Market Turbulence

Unnecessary Roughness

The S&P 500 was down nearly 1% yesterday as the VIX exceeded 20 at times, closing at 19.26. This suggests expected index price volatility of just over 18% over the next 30 days at 99.9% confidence. That corresponds to an over 1% possible change in the mean expected NGDP growth rate. Of course, the VIX typically rises with fears of losses.

So, why has the VIX been higher since July? While there’ve been some real factors like flair-ups in the Middle East conflict, and there was a short-lived crisis caused by nominal shocks in Japan and South Korea a month ago, the principle problem is the loss of Fed credibility in hitting it’s mean 2% core PCE inflation target. As you can see in the chart below, the inverse relationship between the VIX and the 5-year inflation breakeven is clear. The 5-year breakeven reveals market expectations for mean inflation over the next 5 years.

This is the conundrum inflation targeting represents. Inflation has been too high, and inflation targeting is counter-cyclical, but if the Fed fails to convince markets it will respect its inflation target, then expectations become unanchored and markets begin to fear negative nominal shocks. This obviously makes for markets that are several factors more volatile than necessary.

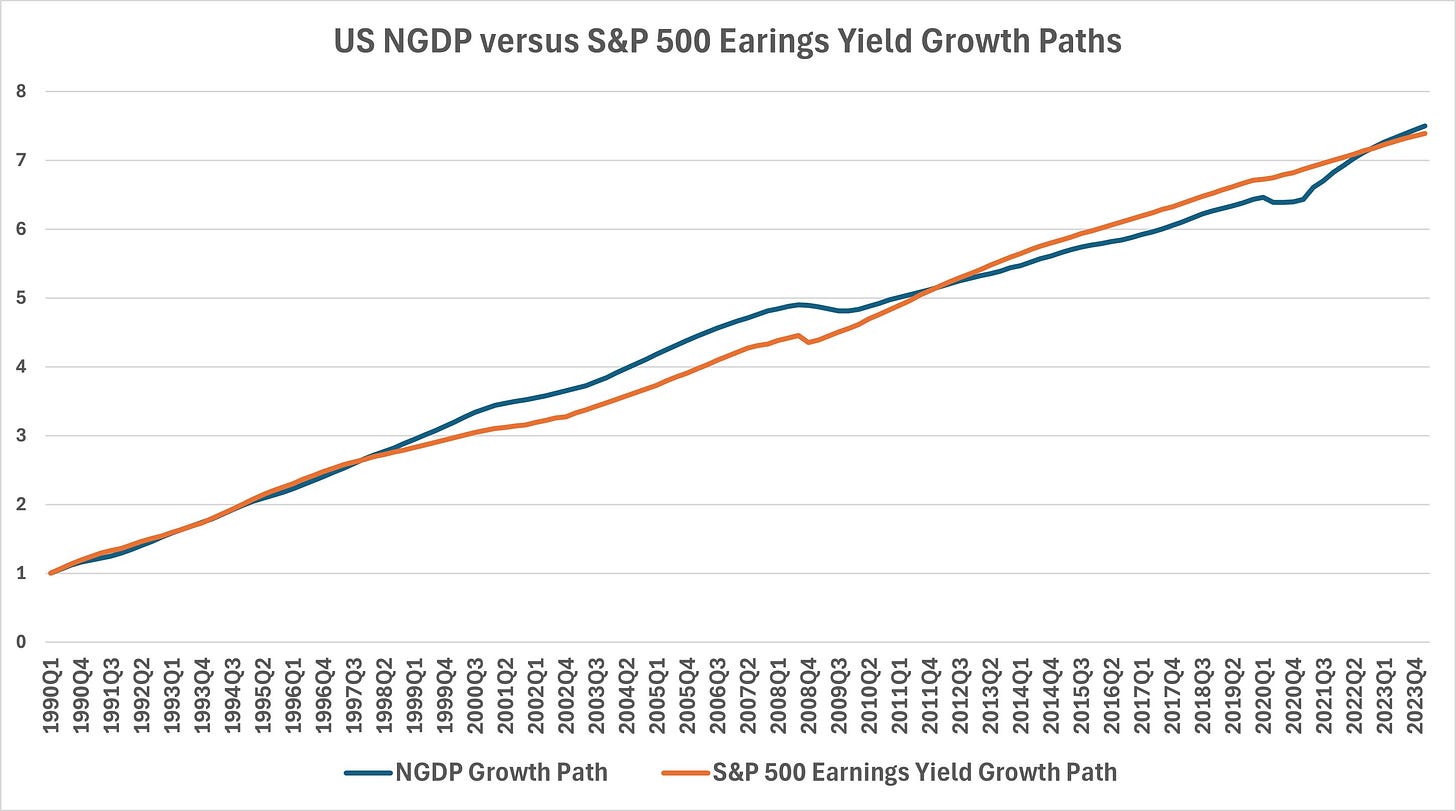

This is why shifting to an NGDP level targeting regime is so important. It can be done in a number of ways, including targeting the S&P 500 earnings yield. Scott Sumner’s idea of the Fed creating a subsidized NGDP futures market is better, more directly addressing the problem, but targeting the S&P 500 earnings yield would lead to far better stabilization policy than has ever existed.

This is because there is an equililbrium relationship between NGDP growth and the S&P 500 earnings yield, with a mean difference of only 0.04% since 1990. This reflects the classical economic principle that there is an equilibrium relationship between the economic growth rate and the rate of return on capital.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Data: FRED was the source of all data for this post.

Enlightening presentation on why the VIX , since late July - early August, remains well above 16.00%.

Stephen Innes , @steveinnes123 , wrote in detail about the Yen carry trade and its impact on US Equities.

The majority of market participants, even high ranking economists in investment companies, believed that the Yen's carry trade is the main factor of volatility during August and early September.

Stephen Innes wrote that the carry trade effect was exhausted most of its potential within the first 5 days after the BoJ's announcement of 0,10% rise of interest rates, which was a continuation of the previous 0.15% rise.

After the end of August, no matter the variety of explanations were given by vatious macro analysts, the VIX above 16.00% remained a mystery.

Thank you, Mike , for the clarification and the additional information about what FED's target should be in the post 1990 economic conditions.

I think that targeting the NGDP is the most acceptable proposal amongst today's economists.