Stock and GDP Outlook, for Week Ending 09/27/2024

Turbulent soft landing

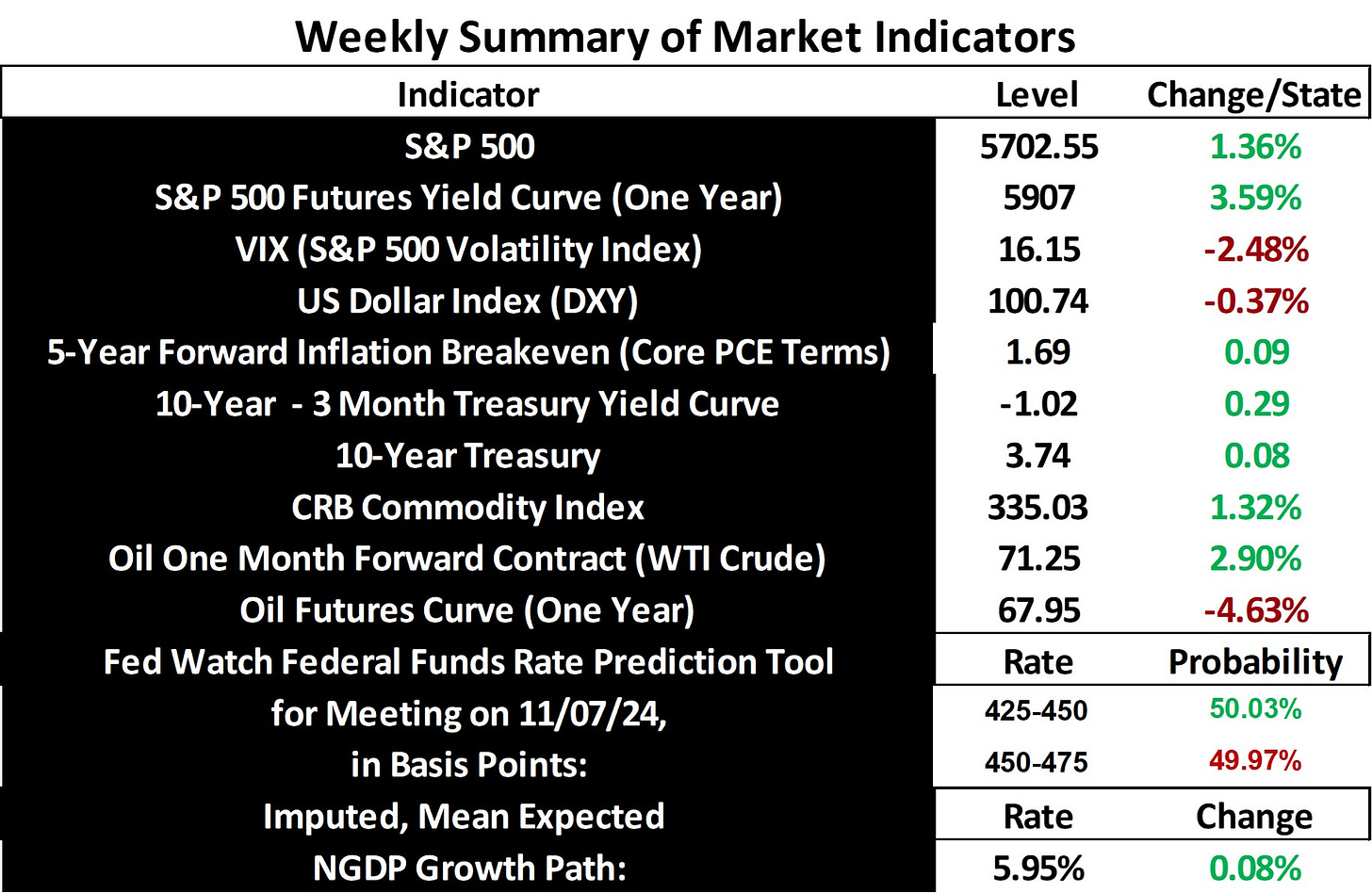

Stock prices and the mean expected NGDP growth rate rose for the second straight week, as the Fed slightly surprised with its 50 basis point Fed Funds rate decrease, resulting in a net positive nominal shock. Market odds are now roughly even for a 25 versus a 50 basis point decrease at the next meeting in November. The expected Fed Funds rate yield curve was otherwise not much changed.

Inflation expectations rebounded with the mean expected NGDP growth rate, but still run under the Fed’s mean target. continuing to threaten to undermine the Fed’s credibility concerning its inflation anchor. Targeting mean inflation at 2% is not ideal policy, as inflation targets are procyclical, but failing to respect the target can be even more destabilizing for NGDP growth, and hence stock price appreciation. Hence, the instability may continue, as reflected in reduced but still elevated VIX levels. However, while still elevated, VIX levels are now pretty far from predicting recession over the next 30 days, so markets are continuing to move further away from crisis levels of concerns over negative nominal shocks. Expectations for a soft landing are still on, though the ride is expected to be rockier than necessary.

PS: Quarter-specific market-based NGDP forecasts and will be updated every two weeks and available to paid subscribers, with quarterly updates to market-based sustainable growth measures and many other features available via the premium chatbot.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data: