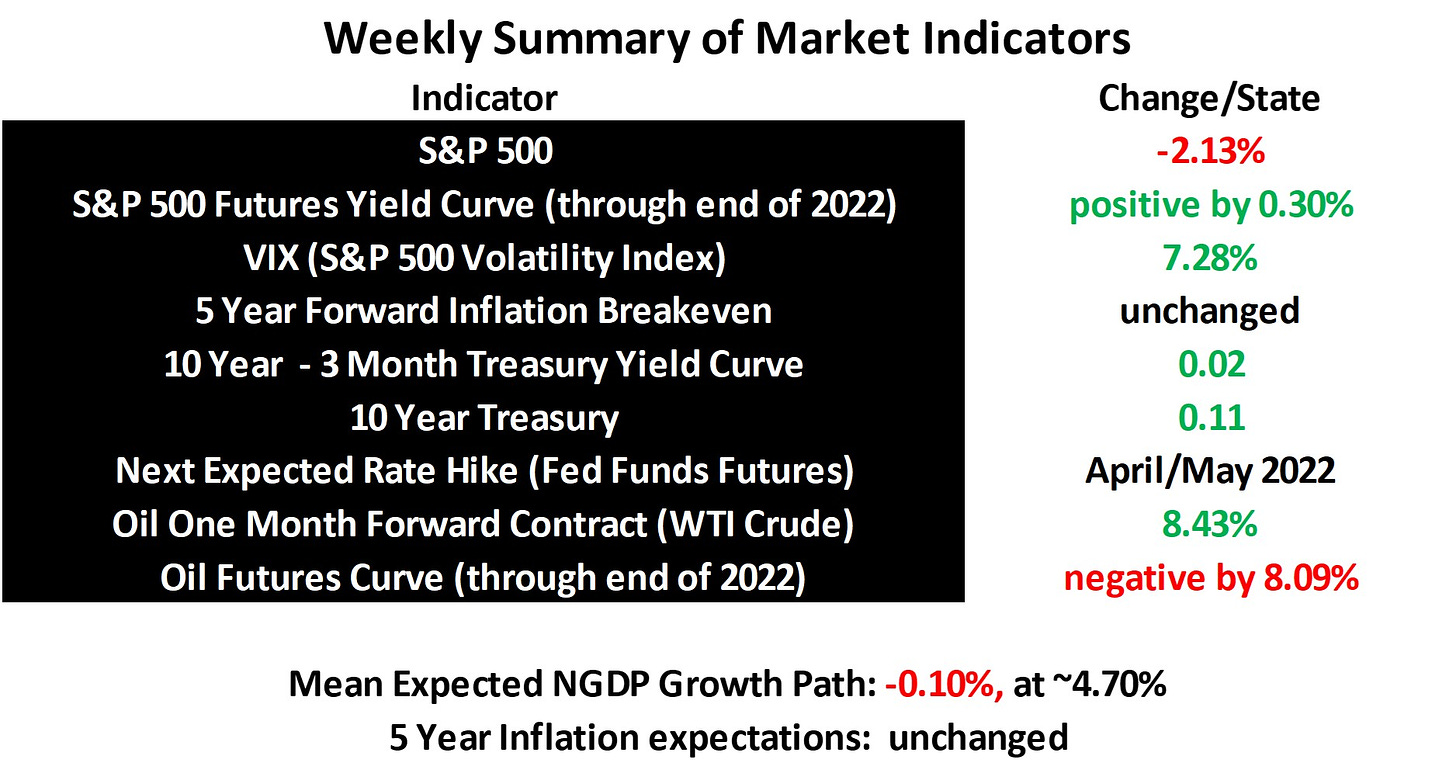

The mean expected nominal economic growth path fell last week, though inflation expectations were flat. Hence, real growth expectations now stand at about 1.7%, while inflation is expected to be about 3%, 5 years from now.

The S&P 500 will fall another roughly 15% to 3734 if the expected mean NGDP growth path falls to match the pre-pandemic realized average of roughly 4%. That assumes the absence of positive real shocks. The Fed obviously still has a ways to go in catching up with market inflation expectations. The 10 year rate should probably be at over 350 basis points to achieve this goal.

For those who haven’t noticed, I did set up a crude, alpha website where the imputed, market-based forward NGDP growth path can be observed in real time. I hope to add features in the not too distant future, including perhaps offering such forecasts for other countries. Your feedback here or through that website is greatly appreciated. What, if anything, would you like to see feature-wise?

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data