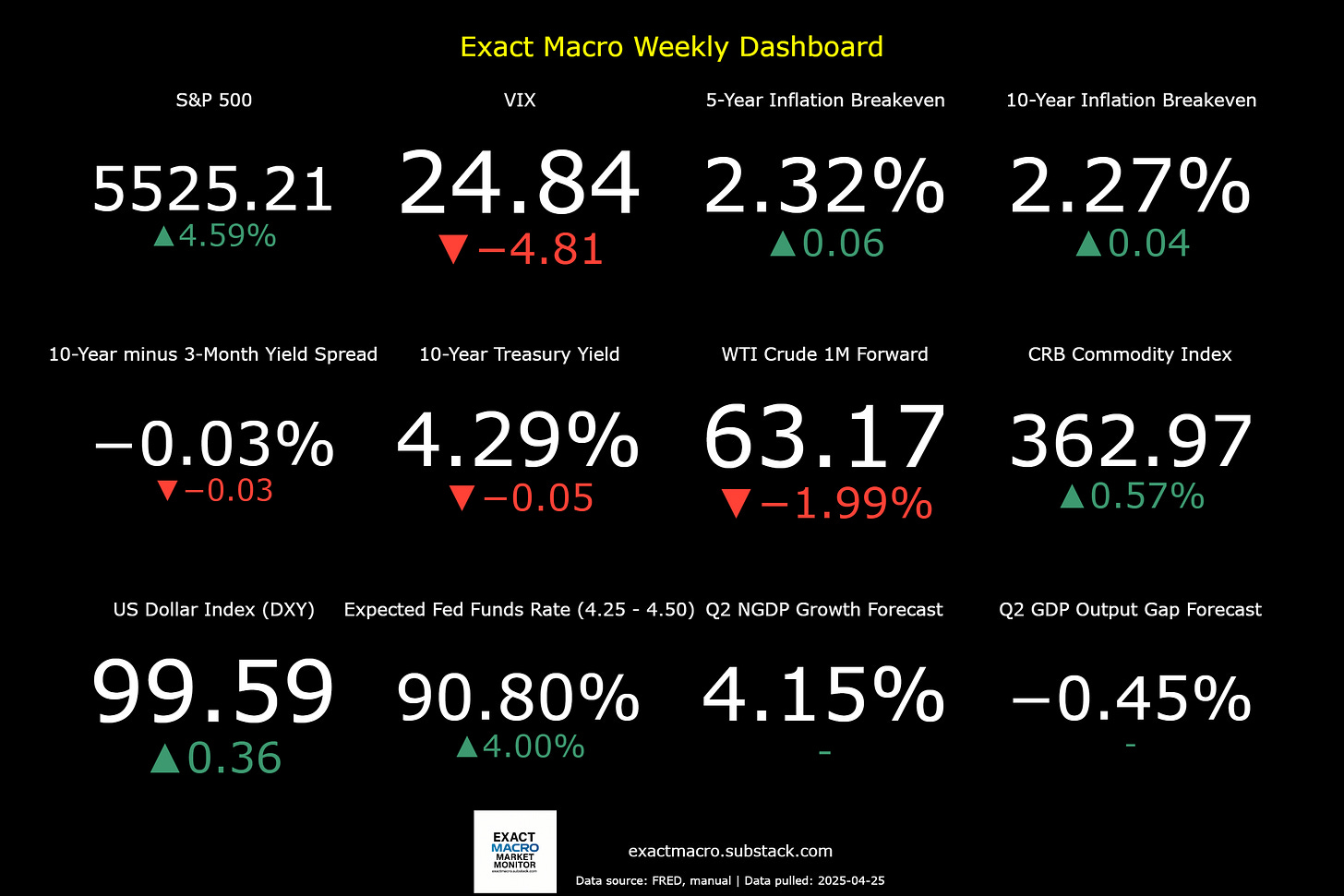

Stock prices and the mean expected NGDP growth rate sharply recovered last week, amid a continued backing-off of the tariff rhetoric that sent the S&P 500 down more than 20% recently. The VIX also fell sharply toward non-crisis levels, though the 5-year inflation breakeven crept up near the Fed’s preferred mean limit. The 10-year breakeven isn’t far behind.

Hence, while there’s now some some reason for relief, the unpredictable nature of the Trump administration and some lasting loss of credibility for economic stability will likely limit stock price growth for the foreseeable future.

That doesn’t mean that a sizable continued recovery isn’t possible though, or even likely. While long-run inflation breakevens currently suggest limited opportunity for growth, that could change with an additional retreat from the trade wars. Also, Trump has seemed to reverse himself on replacing Fed Chairman Jay Powell, at least for now.

In the meantime, signficant supply chain disruptions abound, likely leading to a combination of higher prices and limited availabilty for some goods in the near future. Also, tourism is way down in the US now. Unfortunately, there’s simply no reason to believe that Trump won’t return to his scattershot attacks on trading partners, the Fed, and immigrants, so rough waters are still ahead.

At least he seems to respect market sentiment, which as I’ve written before, is his only apparent virtue. Perhaps that will serve as an ultimate guardrail, though his respect for markets does obviously have limits. Also, he’s not exactly rational, as this recent interview with Time magazine underlines.

So, while some optimism has returned, it’s not clear how long it will last. Though markets are no longer conditionally predicting recession, Trump, as always, is a continual likely source of negative real shocks. I would love nothing more than to go back to discussing the AI boom more.

Good luck.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data:

Studies on Immigration:

https://www.hoover.org/research/economic-effect-immigration

https://www.hoover.org/research/immigration-innovation-and-growth

https://www.epi.org/publication/u-s-benefits-from-immigration/

https://www.nationalacademies.org/news/2016/09/new-report-assesses-the-economic-and-fiscal-consequences-of-immigration

https://www.cbo.gov/publication/60165

https://www.dallasfed.org/research/economics/2024/0702

https://link.springer.com/article/10.1007/s41996-023-00135-x?utm_source=chatgpt.com

https://ideas.repec.org/p/cpm/docweb/2202.html?utm_source=chatgpt.com

Economic Data Sources:

https://fred.stlouisfed.org/series/SP500

https://www.wsj.com/market-data/stocks/peyields

https://www.barchart.com/futures/quotes/ES*0/futures-prices

https://ycharts.com/indicators/sp_500_earnings_per_share_forward_estimate#:~:text=Basic%20Info-,S&P%20500%20Earnings%20Per%20Share%20Forward%20Estimate%20is%20at%20a,28.27%25%20from%20one%20year%20ago.

https://www.cnbc.com/quotes/.VIX

https://fred.stlouisfed.org/series/DTWEXBGS

https://fred.stlouisfed.org/graph/?g=Ee9i

https://fred.stlouisfed.org/series/T10Y3M#0

https://fred.stlouisfed.org/series/DGS10

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

https://tradingeconomics.com/commodity/crb?user=nunote

https://www.cnbc.com/quotes/@CL.1

https://www.cmegroup.com/trading/en

https://www.spglobal.com/spdji/en/documents/additional-material/sp-500-eps-est.xlsx

https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.quotes.html