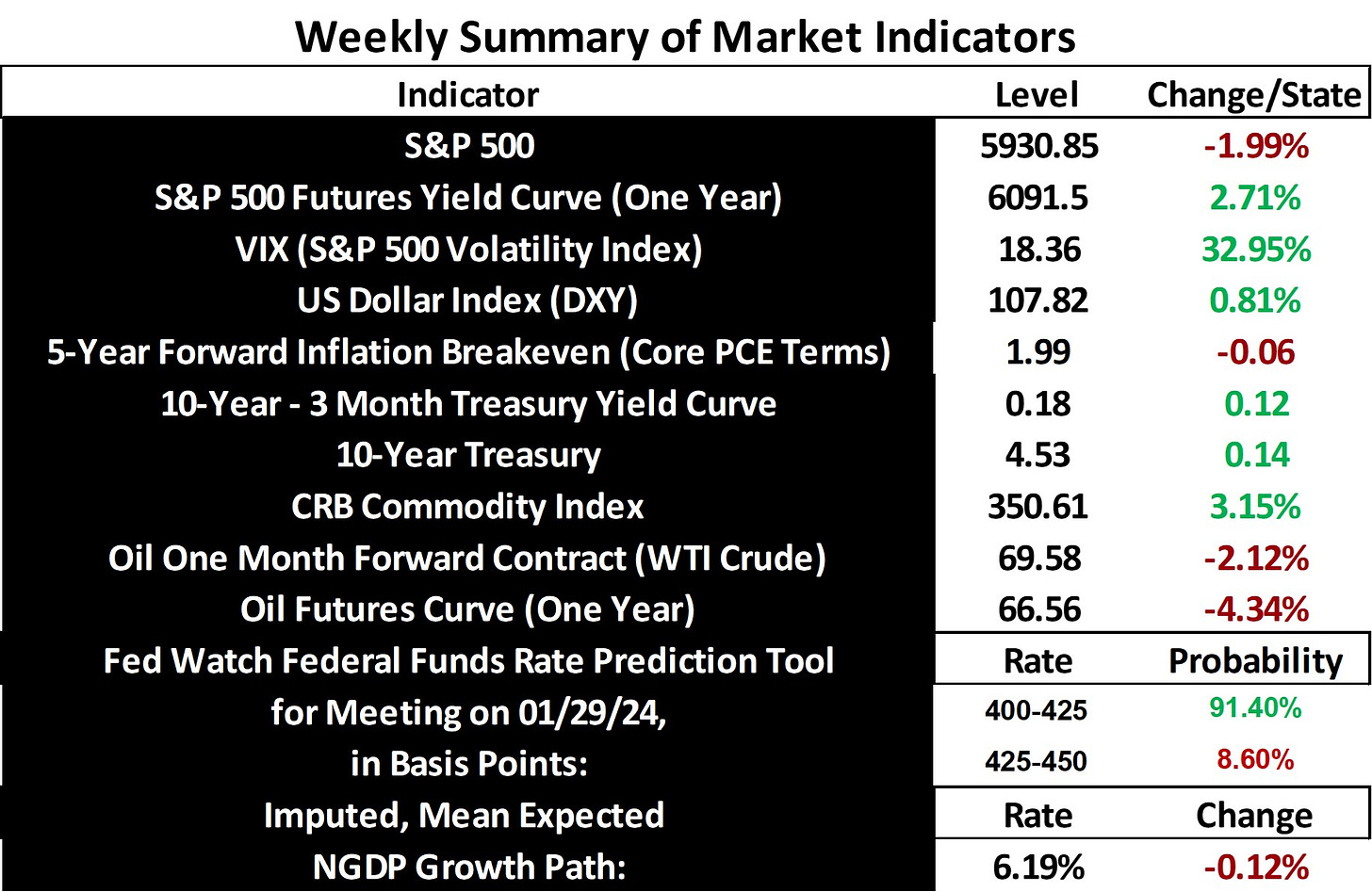

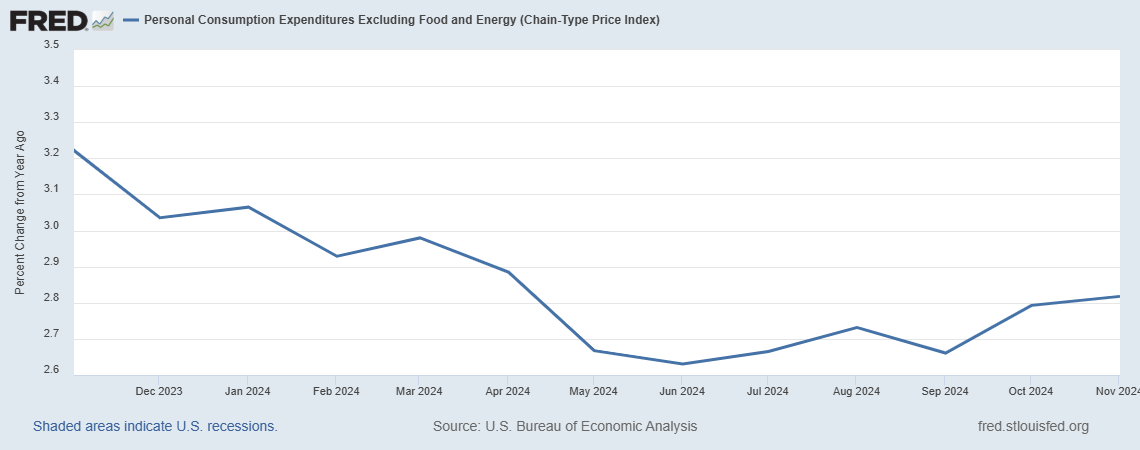

Stock prices and the mean expected NGDP growth rate declined for the second straight week, as volatility spiked. This was caused in part by a hot PCE inflation reading for last month, and by the Fed indicating that there would be fewer rate cuts than previously expected next year.

Just as with YoY core CPI, core PCE inflation has been trending upward since the middle of this year.

Adding fuel to the fire about inflation concerns was the upward revision to RGDP growth for Q3, which now stands at 3.2%.

This is all consistent with rising quarterly S&P 500-based NGDP forecasts, which are available to premium members, and my recent warnings that additional stock market appreciation would be limited by the inflation concerns reflected in the 5-year breakeven being above the Fed’s target. It has now fallen just below the Fed’s target, but it still leaves little room for additional S&P 500 appreciation sans some positive real shocks.

This is a particularly sensitive time for stocks, as potential Fed mistakes in terms of over-tightening monetary policy could lead to significant declines in stock prices, already reflected in the elevated VIX. Hence, caution is warranted. Hopefully, the Fed will merely return the economy to a soft landing trajectory.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Economic Data Sources:

https://fred.stlouisfed.org/series/SP500

https://www.wsj.com/market-data/stocks/peyields

https://www.barchart.com/futures/quotes/ES*0/futures-prices

https://ycharts.com/indicators/sp_500_earnings_per_share_forward_estimate#:~:text=Basic%20Info-,S&P%20500%20Earnings%20Per%20Share%20Forward%20Estimate%20is%20at%20a,28.27%25%20from%20one%20year%20ago.

https://www.cnbc.com/quotes/.VIX

https://fred.stlouisfed.org/series/DTWEXBGS

https://fred.stlouisfed.org/graph/?g=Ee9i

https://fred.stlouisfed.org/series/T10Y3M#0

https://fred.stlouisfed.org/series/DGS10

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

https://tradingeconomics.com/commodity/crb?user=nunote

https://www.cnbc.com/quotes/@CL.1

https://www.cmegroup.com/trading/en

https://www.spglobal.com/spdji/en/documents/additional-material/sp-500-eps-est.xlsx

https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.quotes.html

https://www.worldgovernmentbonds.com/cds-historical-data/united-states/5-years/?utm_source=chatgpt.com