Stock prices and the mean expected NGDP growth rate rose rather sharply last week, but so did inflation expectations, as the VIX remained steady.

A very gradual slowdown in NGDP growth is expected to begin by next quarter, as reflected in last week’s updated market-based forecasts. Coupled with the higher inflation expectations, a light stagflation is expected to gradually set in over the next couple of years, at least.

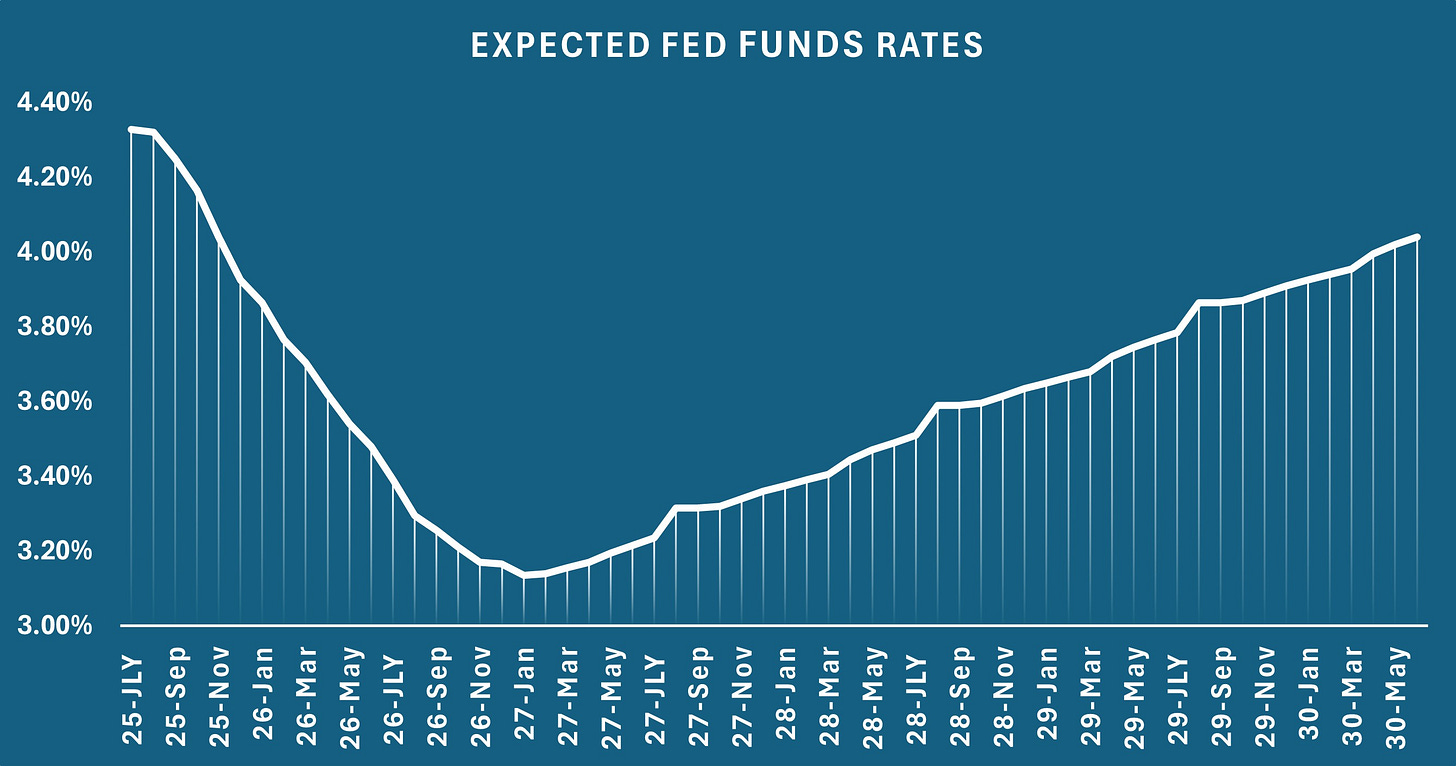

This is consistent with expectations implicit in the Fed Funds futures market. which has rates falling through next year, and then gradually rising. It’s interesting that rates are expected to remain lower than current rates until nearly mid-2030. We seem to be in an era of the most gradual changes in Fed policy in the Fed’s history, with the soft landing so far achieved, apparently to be followed by a soft recovery.

Looking in the rearview mirror, year-over-year core CPI rose last month for the first time this year, likely in part reflecting the delayed consequences of tariffs.

While markets are no longer concerned about anything like the worst case tariff-wise, at least additional marginal shocks are possible. As pointed out last week, Trump fortunately seems constrained by market reactions and perhaps complaints from the business community, while it increasingly appears he’s subject to having his political capital drained by the unfolding Epstein scandal. A diminished Trump is likely good for reducing the tail risks he otherwise presents.

So look for the stock market to begin a period of flat-to-negative performance soon, sans lower inflation expectations. Slower growth with lower risk is certainly preferable to the threats the chaos the first half of this year represented.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data:

Economic Data Sources:

https://fred.stlouisfed.org/series/SP500

https://www.wsj.com/market-data/stocks/peyields

https://www.barchart.com/futures/quotes/ES*0/futures-prices

https://ycharts.com/indicators/sp_500_earnings_per_share_forward_estimate#:~:text=Basic%20Info-,S&P%20500%20Earnings%20Per%20Share%20Forward%20Estimate%20is%20at%20a,28.27%25%20from%20one%20year%20ago.

https://www.cnbc.com/quotes/.VIX

https://fred.stlouisfed.org/series/DTWEXBGS

https://fred.stlouisfed.org/graph/?g=Ee9i

https://fred.stlouisfed.org/series/T10Y3M#0

https://fred.stlouisfed.org/series/DGS10

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

https://tradingeconomics.com/commodity/crb?user=nunote

https://www.cnbc.com/quotes/@CL.1

https://www.cmegroup.com/trading/en

https://www.spglobal.com/spdji/en/documents/additional-material/sp-500-eps-est.xlsx

https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.quotes.html