Stock and GDP Outlook, for Week Ending 09/05/2025

Trump's Incompetence is His Greatest Strength

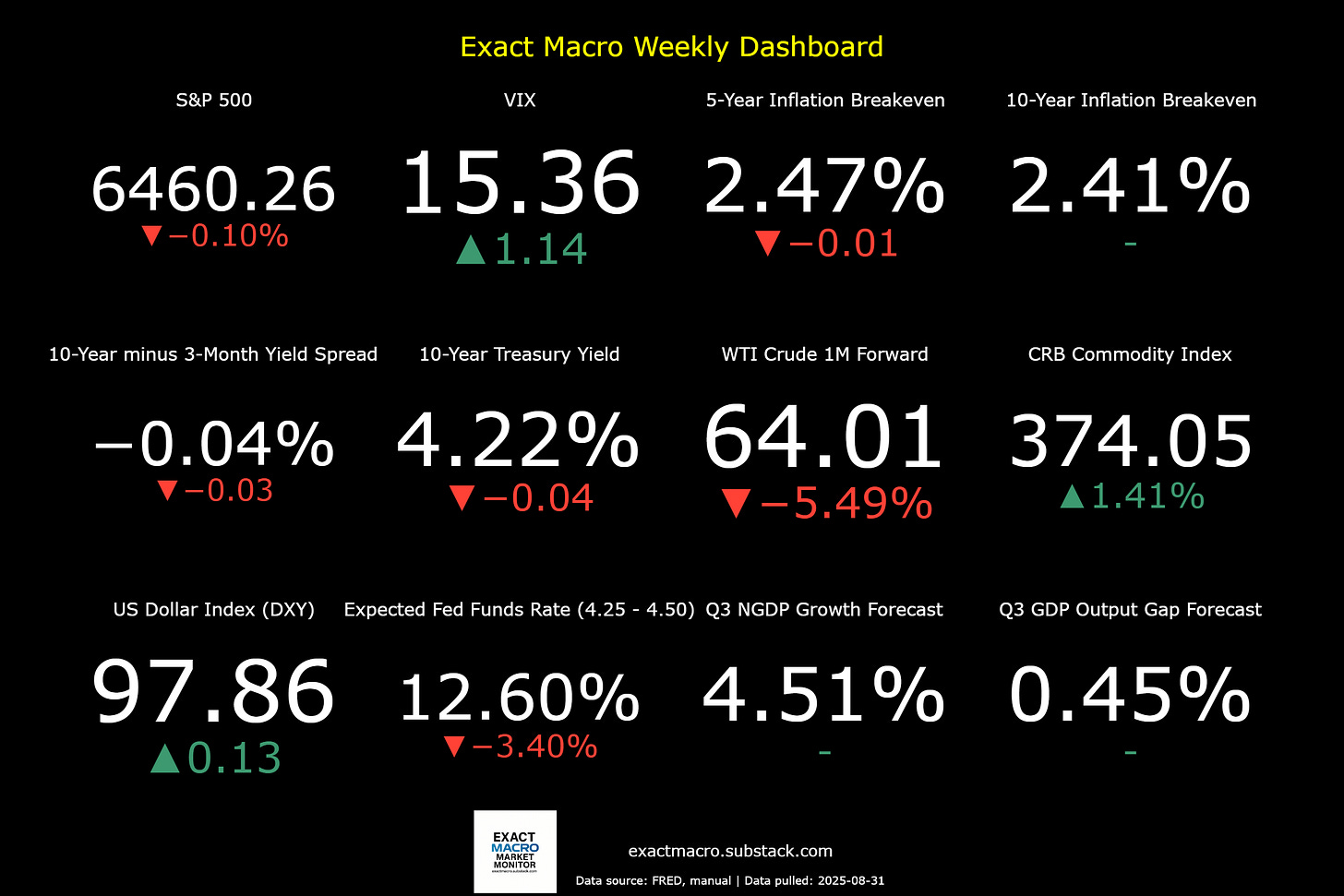

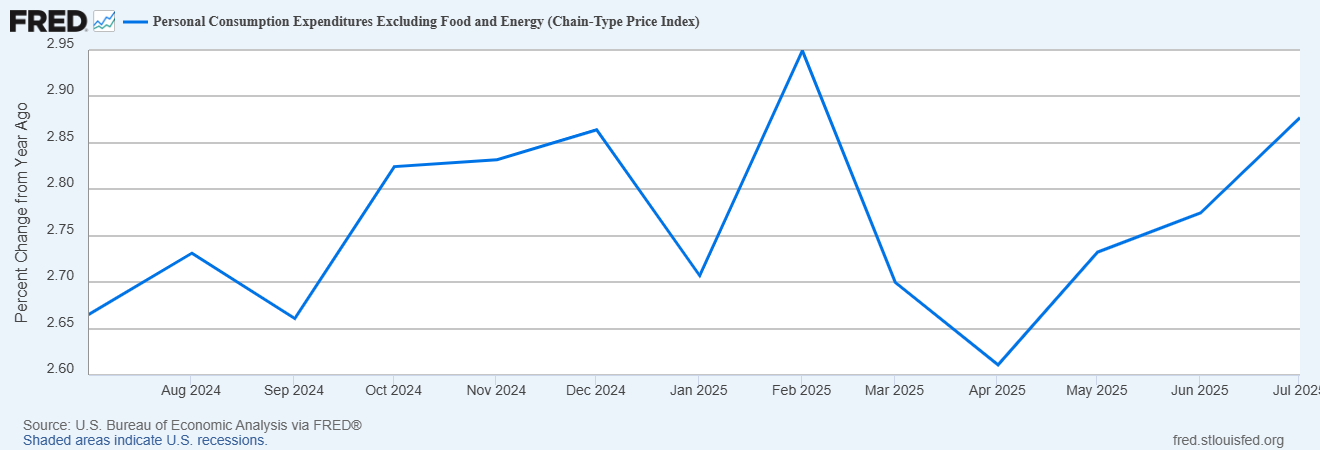

Stock prices and the mean expected NGDP growth rate fell slightly for the week, as year-over-year core PCE inflation increased for the third straight month.

Inflation expectations however, were largely unchanged.

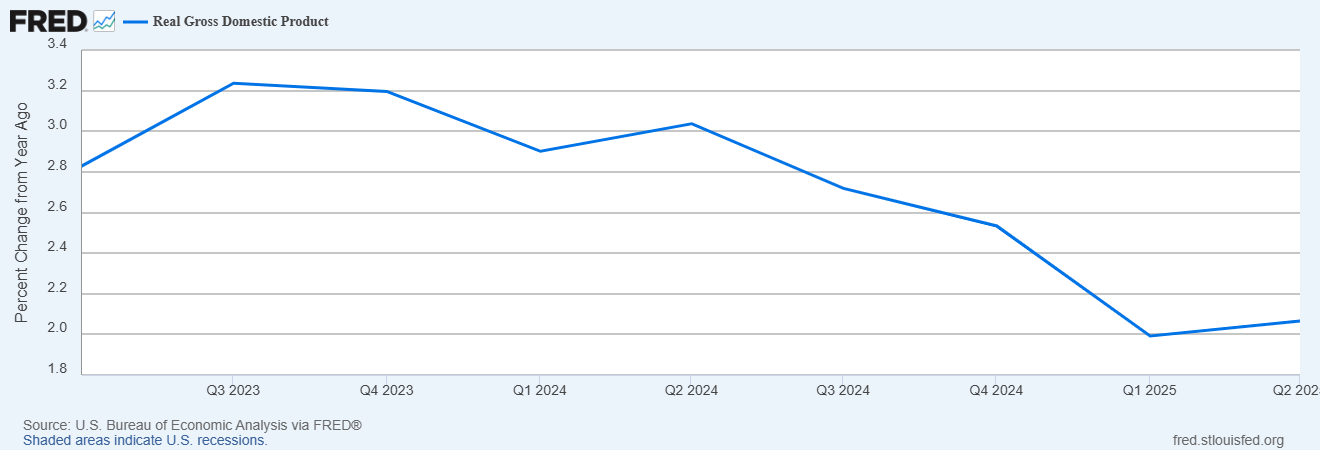

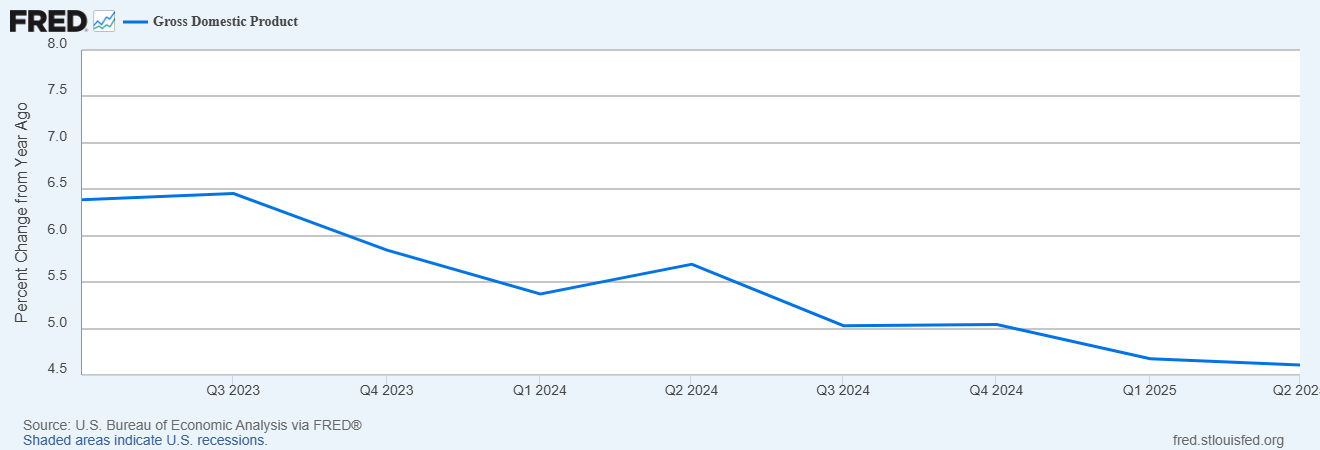

This was coupled with an upward revision to Q2 real GDP growth, which grew at a year-over-year rate of just over 2% with NGDP growth at 4.61%, respectively.

This assumes the numbers are trustworthy.

Markets might seem surprisingly calm, considering the weight of new tariffs and attacks on Fed independence, but as I’ve written recently, they likely do not believe the tariffs will be upheld, or that the Fed’s independence is in much danger. An appeals court ruling this week supports the former notion, while the latter is consistent with some information in betting markets, which show low probabilities for a successful removal of Governor Cook.

The current US administration is extremely dangerous however, despite their thoughtless incompetence, but markets do not yet anticipate significant lasting economic damage. I can’t say I agree, as I continue to be concerned with the longer-term effects of the undermining of respect for the rule of law and tail risks.

For now though, while short-term growth is continuing to slow and stock price gains are restricted by near-target inflation expectations, we’re still no where near markets predicting a recession.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data:

Economic Data Sources:

https://fred.stlouisfed.org/series/SP500

https://www.wsj.com/market-data/stocks/peyields

https://www.barchart.com/futures/quotes/ES*0/futures-prices

https://ycharts.com/indicators/sp_500_earnings_per_share_forward_estimate#:~:text=Basic%20Info-,S&P%20500%20Earnings%20Per%20Share%20Forward%20Estimate%20is%20at%20a,28.27%25%20from%20one%20year%20ago.

https://www.cnbc.com/quotes/.VIX

https://fred.stlouisfed.org/series/DTWEXBGS

https://fred.stlouisfed.org/graph/?g=Ee9i

https://fred.stlouisfed.org/series/T10Y3M#0

https://fred.stlouisfed.org/series/DGS10

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

https://tradingeconomics.com/commodity/crb?user=nunote

https://www.cnbc.com/quotes/@CL.1

https://www.cmegroup.com/trading/en

https://www.spglobal.com/spdji/en/documents/additional-material/sp-500-eps-est.xlsx

https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.quotes.html