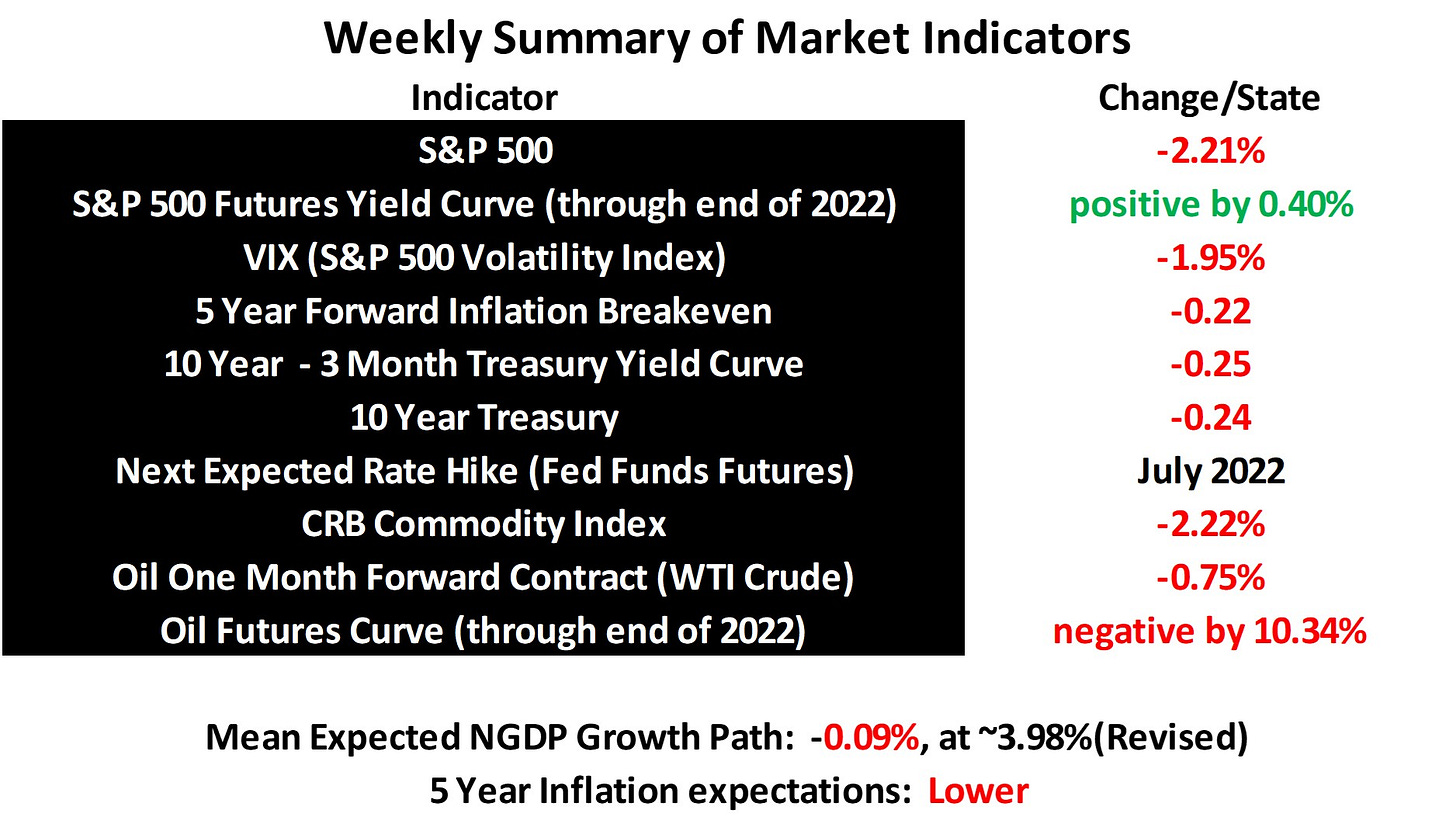

Last week was good if you like the fact that inflation expectations fell precipitously, painful though the sight of more red in the investment portfolio may be. The mean expected NGDP growth path has now fallen more than 1.02% since the tightening cycle began on January 3rd, while 5 year inflation expectations have fallen 45 basis points. So, much of the pain is in fact real.

Not much has changed outlook-wise since last week. We’re still likely in or near a recession, though we won’t know for sure until we start to see unemployment rise. The U3 unemployment rate has been flat at 3.6% since March. The number for June will be released at 8:30 AM EST this Friday, July 8th. Markets could obviously move signficantly on news of an increase.

Until supply-side issues start to improve, it would not surprise me to see the S&P 500 fall another 10% or so, though perhaps the Fed will have some mercy on the economy if it is shown to be in recession soon.

I still think that sustained productivity growth will surprise on the upside in the coming years, and after adjustment to what will likely be a return to Fed policies that are somewhat tight.

Special Note: I discovered a slight error in a previous calculation that put the estimated mean NGDP growth path off by about .13%, due to a typo on my spreadsheet. I apologize for the error.

Usual Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data