Stock and GDP Outlook, for Week Ending 11/01/2024

A New Short-Term Ceiling for Stock Prices

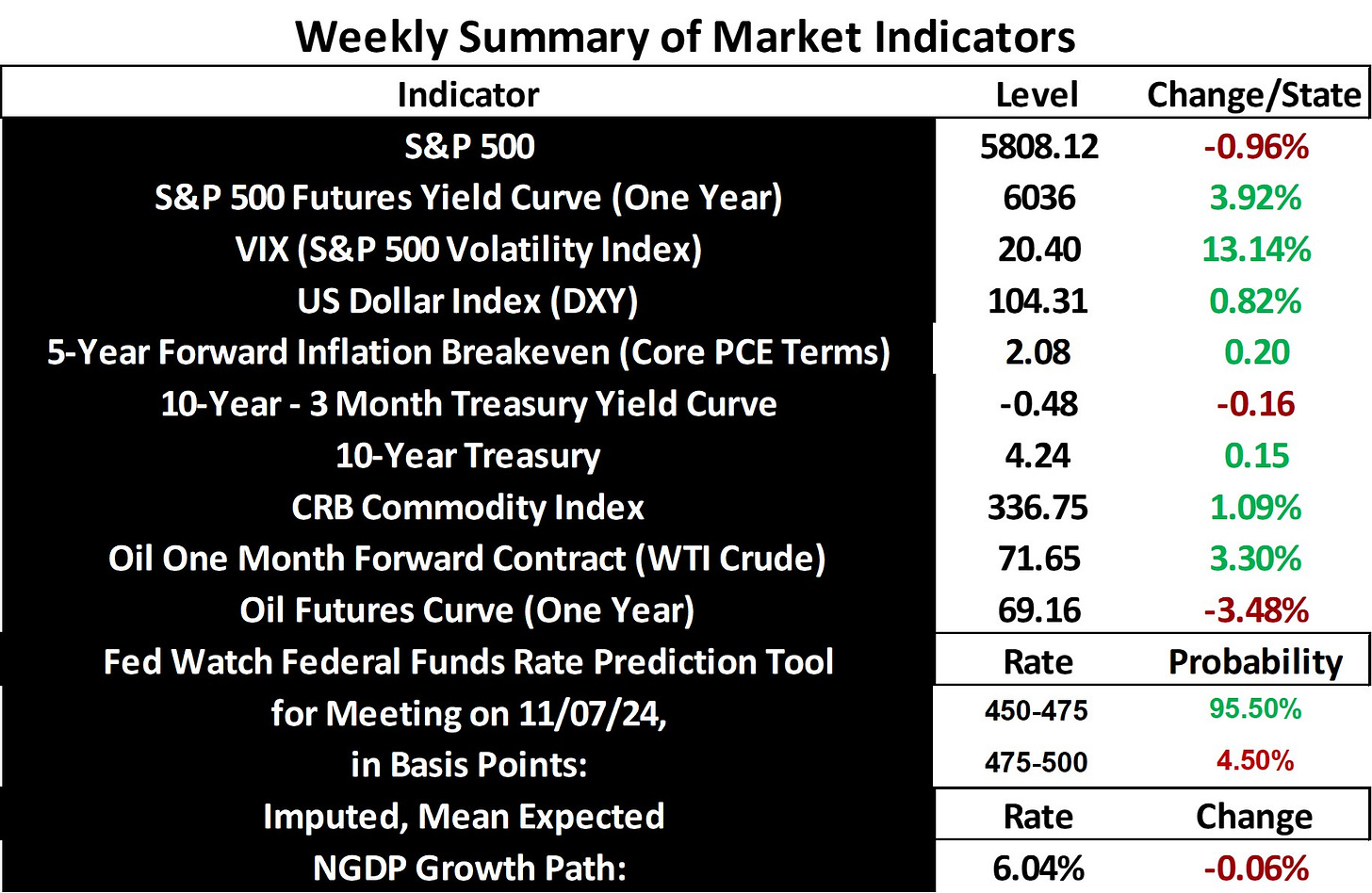

Stock prices and the mean expected NGDP growth rate finally saw setbacks last week, breaking a 6 week streak of gains. This was seemingly largely due to a rise in concerns over rising stakes in the Middle East conflict, which also drove up the VIX and oil prices. Nonetheless, the Nasdaq managed to eke out a meager gain for the week, as the AI-fueled boom continues to boost tech earnings expectations.

Also, notably, the 5-year inflation breakeven rose above the Fed’s preferred 2% mean target in core PCE terms. Hence, to the degree inflation expectations remain above target, growth in stock prices should be limited. Coupled with the elevated VIX, increased caution with regard to stock price declines is warranted.

Looking into next week, the first GDP estimate for Q3 will be released Wednesday, the 30th. My latest S&P 500 market-based forecast for YoY Q3 NGDP growth is at 5.81%, which would not be much different than that of Q2. Future quarter forecasts through 2025 are available to paid subscribers. They are updated every other week. Also, the BLS will release the October non-farm payrolls report Friday, November 1st.

Lastly, to address a high profile pessimistic forecast of 3% S&P 500 growth for the next 10 years issued by Goldman Sachs, I’ll say that I don’t think the cyclically-adjusted price-earnings (CAPE) ratio is very useful. I focus much more on the equilibrium relationship between the concurrent earnings yield and the mean NGDP growth rate. Right now, the the NGDP growth path is only a bit above its sustainable level, a situation which markets predict will be corrected by the end of 2026. More fundamentally, market forecasts reign supreme with me, and for the next 5 years, the S&P 500 futures market predicts mean annual index growth of a bit under 3.3%, so the controversial Goldman forecast may not be too far off the mark for the next 5 years. However, this includes a slowdown in NGDP growth due to a tightening cycle. The 5 years following could see more robust average NGDP growth.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data: