Stock and GDP Outlook, for Week Ending 03/17/2023

Bank Runs, and Return to Work

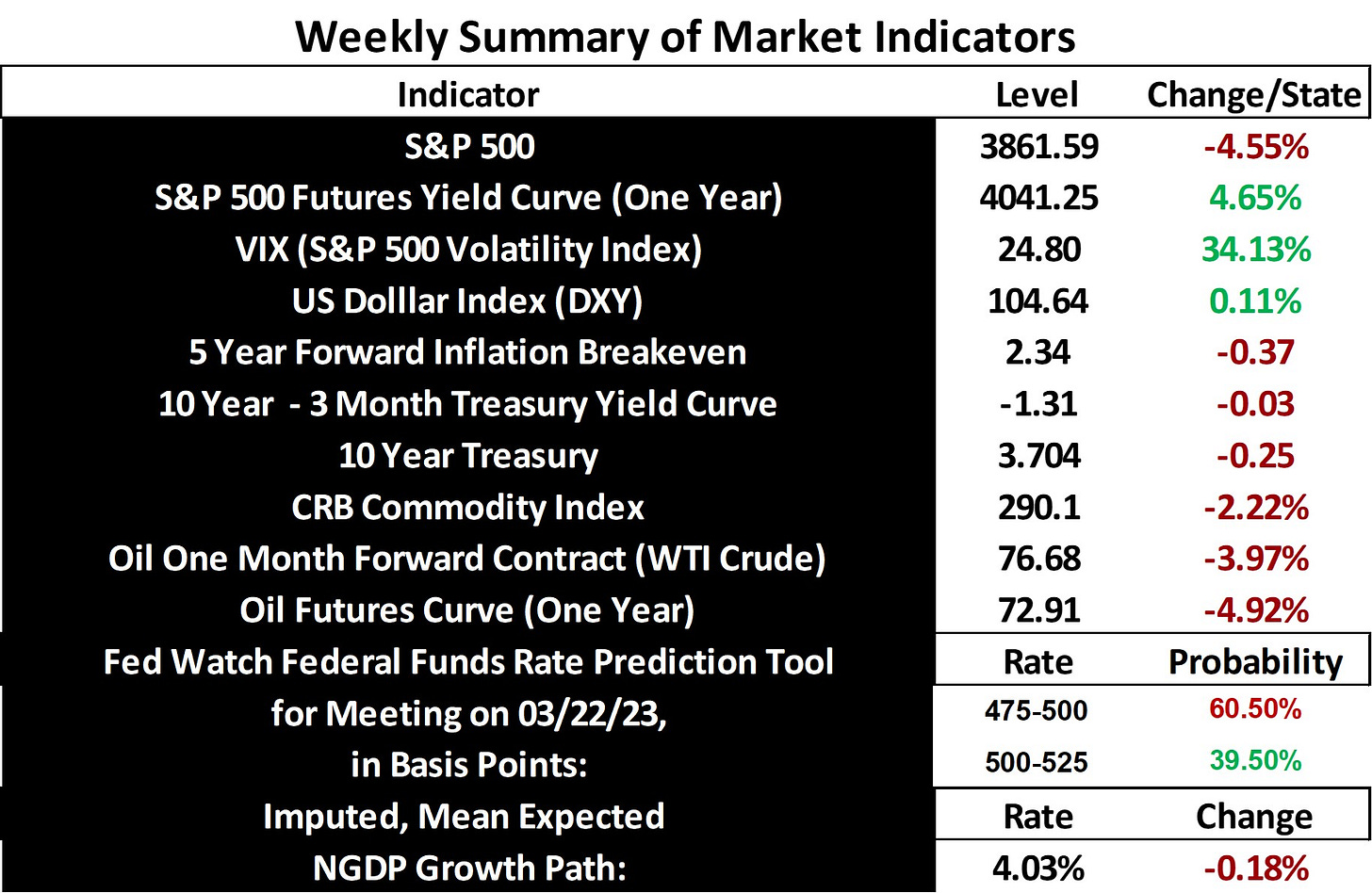

Stock prices and the mean expected NGDP growth rate declined sharply last week amid a very strong jobs report and the failure of Silvergate and Silicon Valley banks. The latter is the largest bank to fail since the Great Financial Crisis and helped drag down stock prices Friday. This left many wondering about the scope of contagion effects, and the general health of the banking system. Additionally, it was announced today that Signature Bank was shutdown by New York state regulators. Silvergate and Signature focused on serving crypto markets.

While there were some seemingly scary looking price declines for some other banks Friday, including Charles Schwab, in the banking sector overall there didn’t seem to be evidence for much of a spread or an acceleration of a general banking crisis. For example, the Vanguard Financials ETF (VFH) and the KBW Bank Index (BKX) were only down about 3% and 4% respectively, though that was in the context of much larger declines of more than 12% and nearly 20% versus highs of this year. Also, the the Treasury Department’s Office of Financial Research Financial Stress Index didn’t exactly represent a flashing light on the dashboard.

And then today, the Treasury Department announced that Silicon Valley and Signature Bank depositors would be made whole, beyond the FDIC’s $250k insurance limit, which could calm markets. Also, the Fed announced it is considering easing access to its discount window and will make additional funding available to meet potential depositor withdraw demands. As I write this, S&P 500 futures are up more than 1%.

Hence, while this is obviously a situation worth watching, it doesn’t seem, at this point, that a broad banking crisis should be expected in the near future. Of course, that doesn’t mean that additional moral hazard due to depositor bailouts won’t help lead to more bank failures in the long-run.

However, that is not the end of concerns to consider in this context. It remains to be seen how the recent fragility of some banks could affect future Fed rate hike decisions. Can the Fed continue to raise rates while they manage impacts on the banking system, in concert with the Treasury Department?

The big current problems for some banks is that the rapid rise in interest rates since last year has greatly impaired the values of some bond portfolios, while creating a large spread between bond and deposit yields. The latter problem is due to the Fed’s program that pays interest on bank reserves, the rate of which is currently at 4.65%. This is versus 12 month CD rates of 1.36% just last month for example, and savings and checking deposit rates that are also often deeply negative in real terms.

Despite these problems, I suspect the Fed can continue to hike rates while avoiding a financial crisis, but that doesn’t mean its interventions will be good for the financial sector in the long-run. I’ve complained previously about some unintended conequences of the Fed’s Rube Goldberg approaches to monetary policy, which help lead to occasional liquidity crises in the Treasury market for example, and their approach to bank regulation isn’t much better. If I’m wrong about the US economy being closer to sustainable growth rates than the Fed seems to think, interest rates could go higher than I’d expect, and then the question of whether the Fed can manage to avoid a financial crisis while controlling inflation may need to be revisited.

Moving on to discuss the jobs report, it was obviously very strong with over 300k jobs added last month. The most interesting thing to me, however, was that the unemployment rate also ticked up 0.20%. Assuming this number survives any revisions, it could suggest additional workers attempting to enter the laborforce. This supports my view that the supply side of the economy is still healing from the pandemic and other recent negative supply shocks, and that faster, sustainable real growth is possible. The Laborforce Participation Rate is still below it’s pre-pandemic rate, though the Prime Age Laborforce Participation Rate returned to par last month.

It will be interesting to see how the supply side of the economy continues to heal this year, but hopefully not too interesting!

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data: