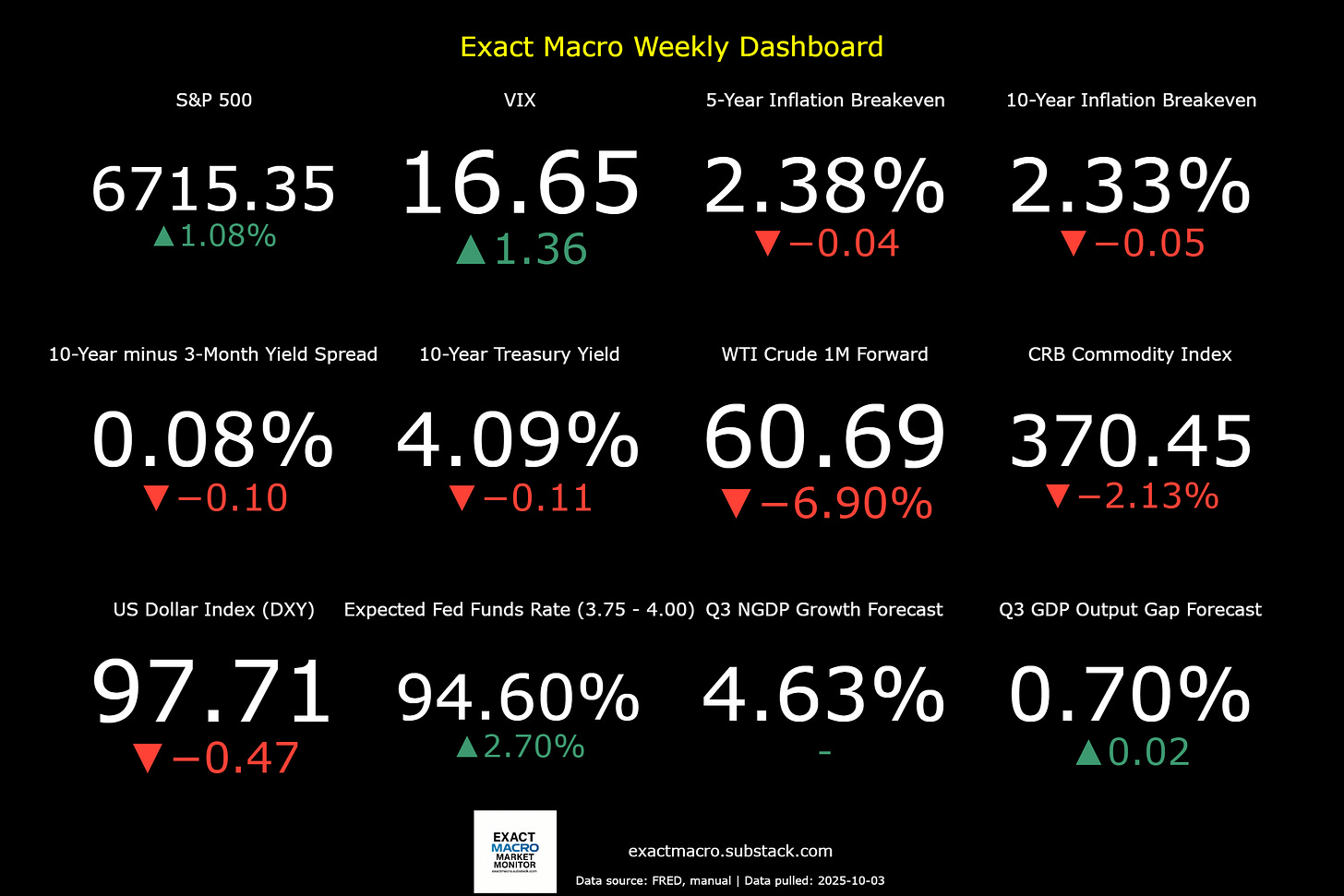

Stock prices and the mean expected NGDP grow rate rose sharply last week, as inflation expectations fell, signalling a positive real shock. The ADP employment report revealed a loss of 32k private jobs, while the BLS September jobs report was delayed by the shutdown. The federal government shutdown obviously did not seem to weigh much on the markets, which were pumped up again by the continuing generative AI boom.

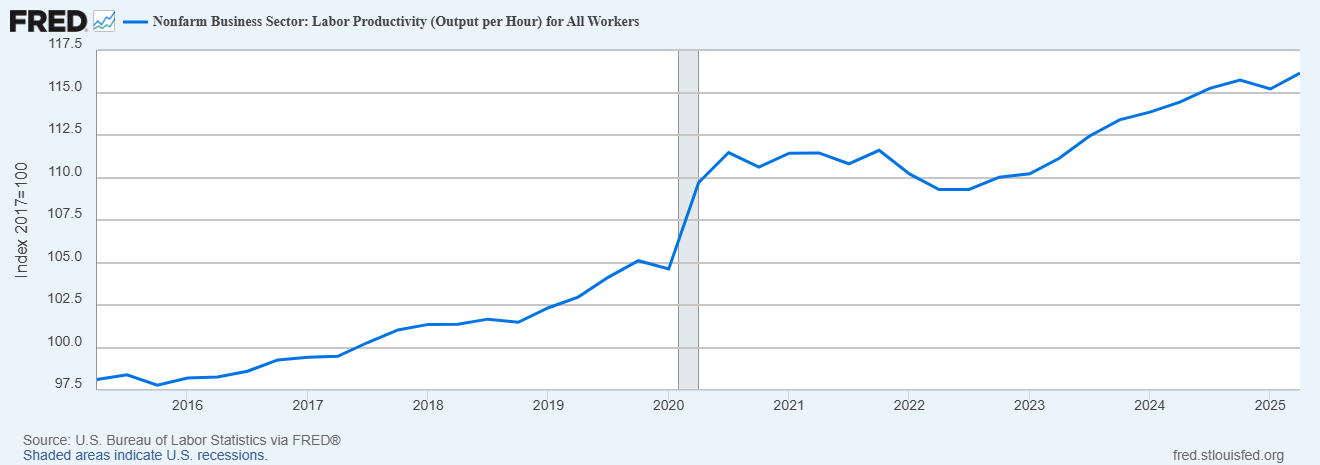

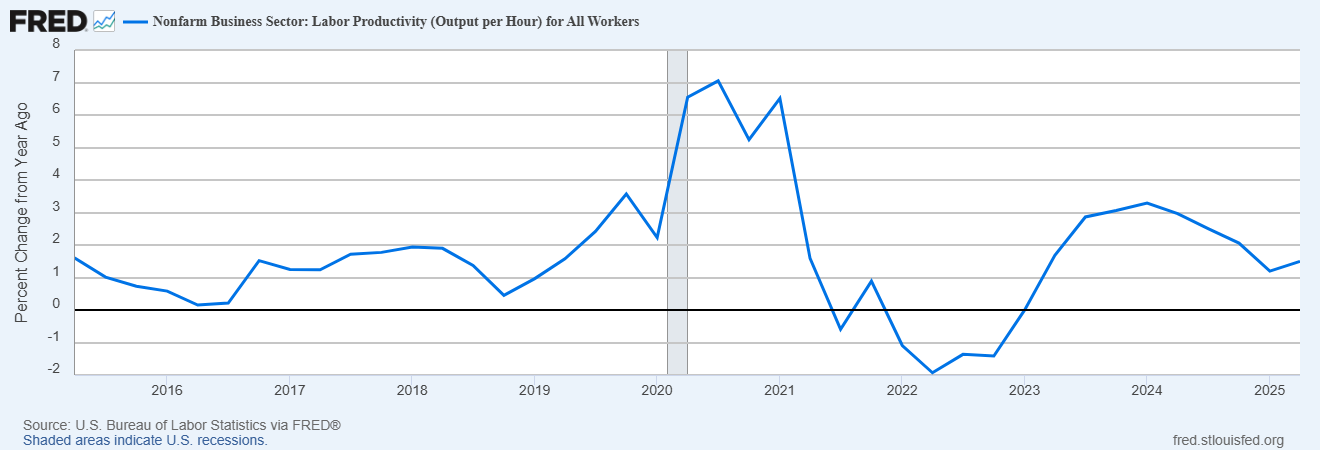

On that generative AI boom, I did recently point out some correlations between the launch of the first ChatGPT product in late 2022 and the pickup in real GDP growth and stock prices since. There’s a similar correlation with labor productivity growth.

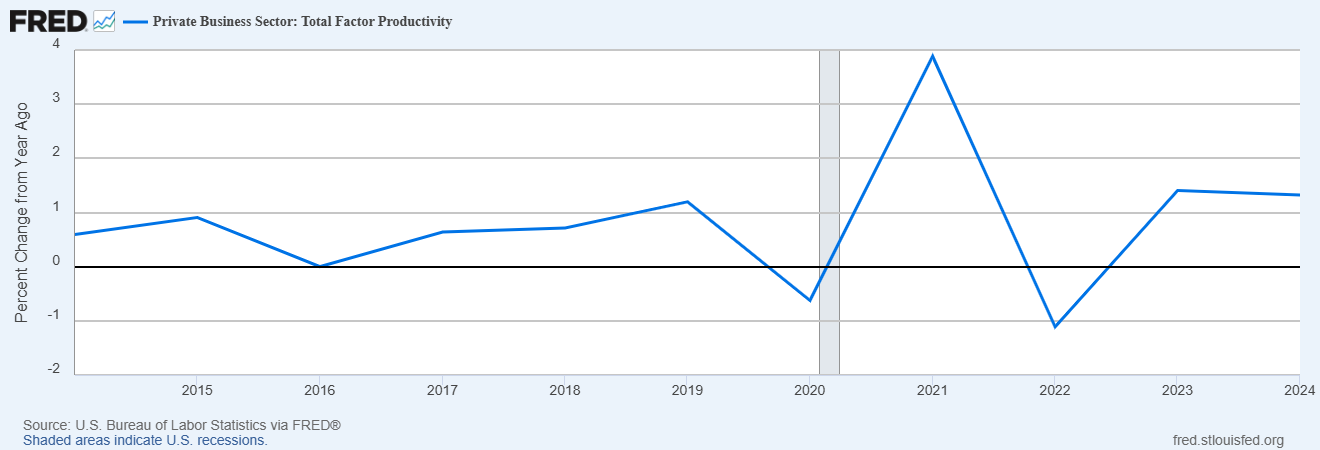

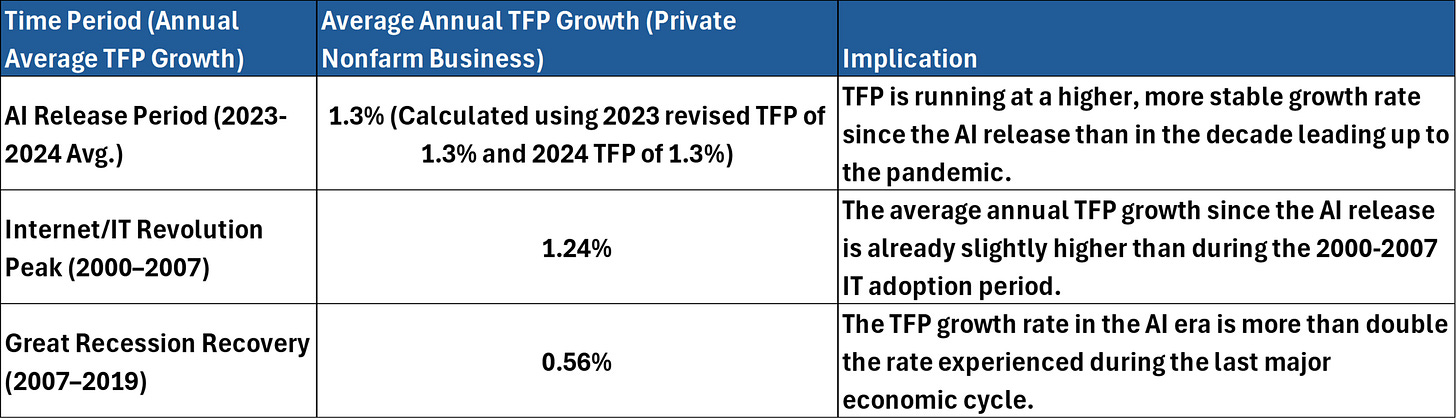

However, total factor productivity numbers don’t as clearly reflect the boom, at least yet, but obviously the data is limited so far. TFP has been higher since ChatGPT’s release than during the Great Recession recovery, with the spike during the pandemic recovery likely being idiosyncratic.

Anecdotally, I can tell you that many data analytic tasks are much easier than prior, with productivity greatly increased. Also, vibe coding platforms which automate coding, such as Replit and Google AI Studio, are improving at rates that are difficult to believe. The technology is advancing very rapidly.

In my own experimentation, I’ve found that the Gemini 2.5 APIs produce deterministic output when not web search-grounded. This was quite a pleasant surprise, and I haven’t seen Google advertise this critical fact. It obviously makes engineering solutions with this generative AI product much more reliable, meaning it can be used for medical, financial, and other high stakes development that requires precision data processing.

Hence, we have the dual prospects of riding a historic productivity boom that may never end, with the highest tail risks for negative real shocks that have existed in my lifetime, and perhaps ever in American history. Technology is exploding as American rule of law seems to be imploding. Hopefully, more fundamental breakthroughs in AI technology will keep the boom going, as Americans regain their senses and recommit to democratic republican government and freer markets.

Enjoy the ride, but be careful! Weighing the prospects of large returns versus the tail risks associated with extreme shocks has perhaps never been more critical.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data:

Economic Data Sources:

https://fred.stlouisfed.org/series/SP500

https://www.wsj.com/market-data/stocks/peyields

https://www.barchart.com/futures/quotes/ES*0/futures-prices

https://ycharts.com/indicators/sp_500_earnings_per_share_forward_estimate#:~:text=Basic%20Info-,S&P%20500%20Earnings%20Per%20Share%20Forward%20Estimate%20is%20at%20a,28.27%25%20from%20one%20year%20ago.

https://www.cnbc.com/quotes/.VIX

https://fred.stlouisfed.org/series/DTWEXBGS

https://fred.stlouisfed.org/graph/?g=Ee9i

https://fred.stlouisfed.org/series/T10Y3M#0

https://fred.stlouisfed.org/series/DGS10

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

https://tradingeconomics.com/commodity/crb?user=nunote

https://www.cnbc.com/quotes/@CL.1

https://www.cmegroup.com/trading/en

https://www.spglobal.com/spdji/en/documents/additional-material/sp-500-eps-est.xlsx

https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.quotes.html