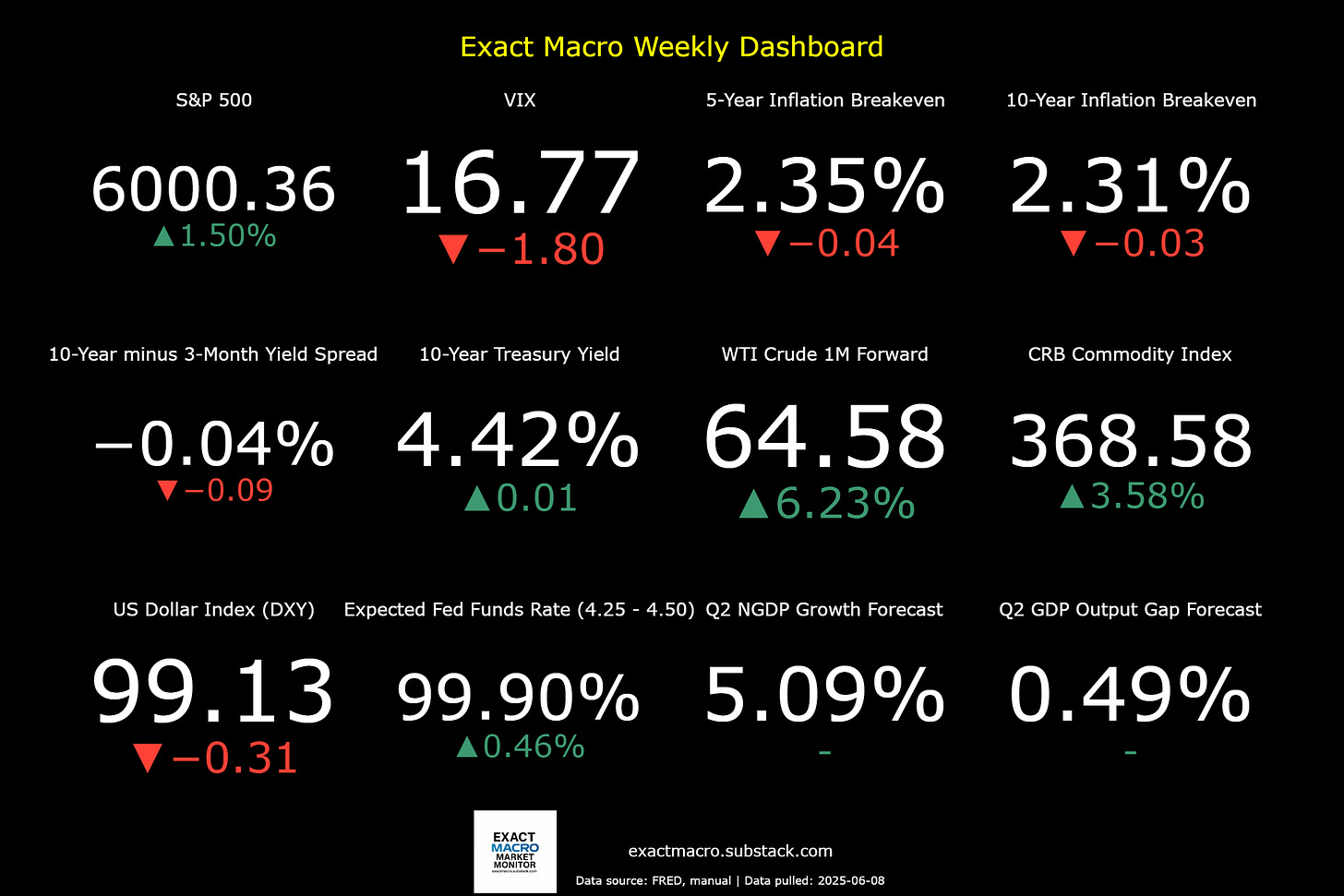

Stock prices and the mean expected NGDP growth rate rose again last week, with the S&P 500 finishing above 6000 for the first time since February. The index is now less than 2% below its all-time high.

Good news for the week included a somewhat better-than-expected May jobs report, with 139,000 jobs added and the unemployment rate remaining steady at 4.2%. However, this was somewhat tempered by a total downward revision of 95,000 jobs for the prior two months.

On the negative side, the ISM Manufacturing PMI came in below forecasts at 48.5, which signals continuation of a 3-month contraction and was slightly below April’s figure of 48.7. The primary cause of this contraction is the tariff situation and related uncertainty.

Overall, the outlook for stocks and the economy remains limited by near-Fed target inflation expectations at least, in the context of considerable US trade policy uncertainty. The Fed Funds Futures market suggests that the current economic slowdown will continue through most of 2026, consistent with my quaterly market-based NGDP forecasts.

While recession is still off-the-table for now, without some positive real shocks, this is obviously unlikely to be a good year for the economy. And that’s before considering the usual elevated risks from erratic policy shifts.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data:

Economic Data Sources:

https://fred.stlouisfed.org/series/SP500

https://www.wsj.com/market-data/stocks/peyields

https://www.barchart.com/futures/quotes/ES*0/futures-prices

https://ycharts.com/indicators/sp_500_earnings_per_share_forward_estimate#:~:text=Basic%20Info-,S&P%20500%20Earnings%20Per%20Share%20Forward%20Estimate%20is%20at%20a,28.27%25%20from%20one%20year%20ago.

https://www.cnbc.com/quotes/.VIX

https://fred.stlouisfed.org/series/DTWEXBGS

https://fred.stlouisfed.org/graph/?g=Ee9i

https://fred.stlouisfed.org/series/T10Y3M#0

https://fred.stlouisfed.org/series/DGS10

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

https://tradingeconomics.com/commodity/crb?user=nunote

https://www.cnbc.com/quotes/@CL.1

https://www.cmegroup.com/trading/en

https://www.spglobal.com/spdji/en/documents/additional-material/sp-500-eps-est.xlsx

https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.quotes.html