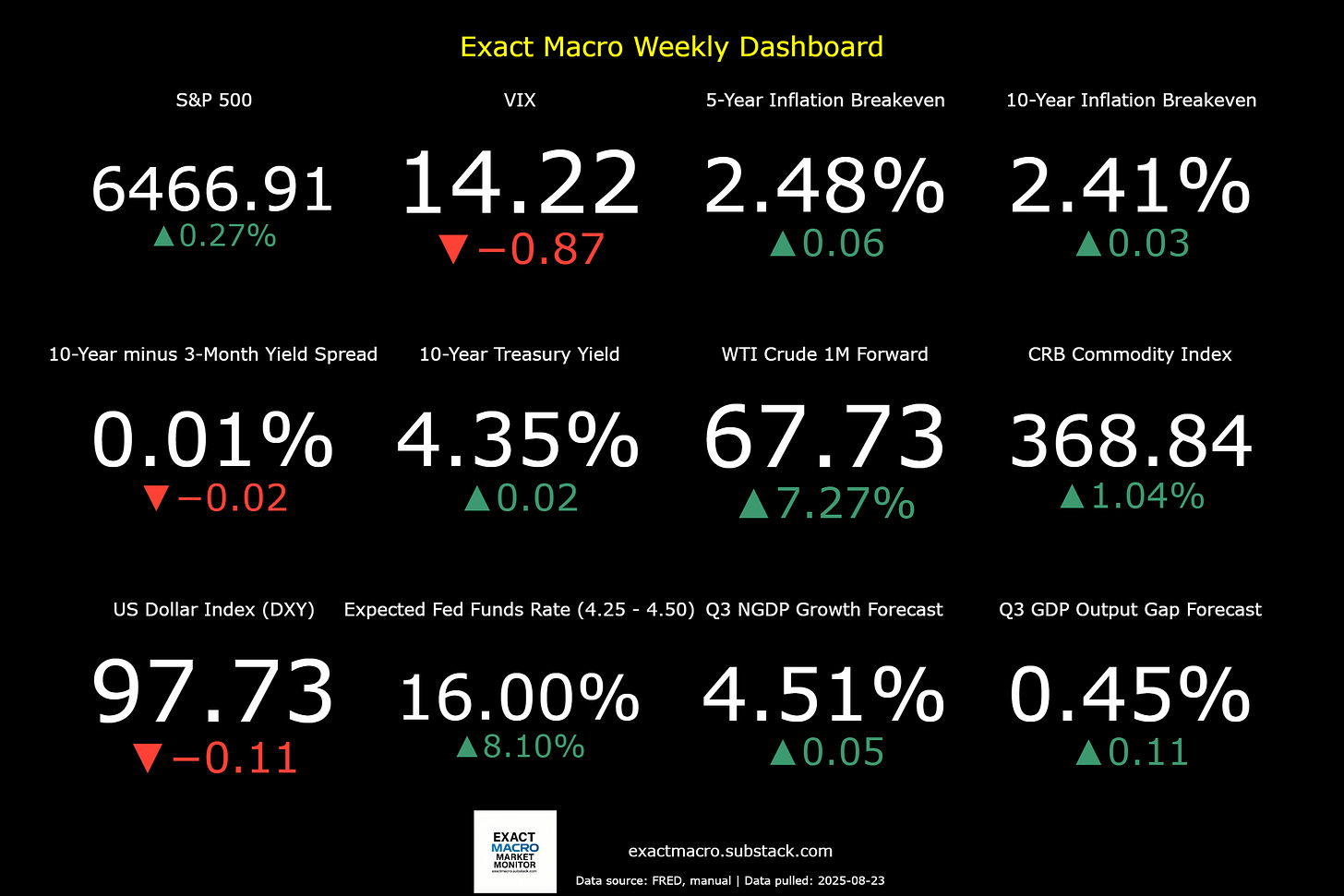

Stock and GDP Outlook, for Week Ending 08/29/2025

Erosion of the Rule of Law and Policy Stability Threatens the US Economy

Stock prices and the mean expected NGDP growth rate rose last week, with a big jump Friday after 5 straight losing sessions. Inflation expectations rose proportionally, confirming that this was a nominal shock.

The Friday spike followed the start of the much anticipated speech by Fed Chairman Powell at Jackson Hole, widely perceived as relatively dovish and more importantly, that provided an update on the result of the Fed’s 5-year monetary policy review. Disappointingly, the Fed retreated from its prior move toward ruled-based level targeting in 2020 and is now back to targeting 2% core PCE inflation over an unspecified “longer-term”. This was quite contrary to the prediction I reaffirned Friday morning, that the Fed would simply progress to a symmetric mean inflation target, with an unspecified time frame. I overestimated the Fed’s rationality. This gives the Fed more flexibility to run a less stable monetary policy.

News during the week about various Trump administration assaults on free markets and rule of law further darkened the longer-term outlook for the US economy. On the former point, the Trump administration announced it “negotiated” a 10% ownership stake in Intel, making the US government the largest shareholder. Is this socialism, or fascist corportism? I think it was once called “national socialism”, which more prominently featured crony-capitalism.

On the latter point, public announcements of an investigation into alleged mortgage fraud by Fed FOMC member Lisa Cook turned up the heat on the Fed to lower rates, regardless of the consquences. Of course, various members of the administration called for her immediate resignation, rather than awaiting any fair determination of guilt. It was long the policy of the Justice Department and other executive branch departments to refrain from commenting on ongoing investigations for a host of practical reasons, including protection of the reputations of the accused who should be presumed innocent, and to avoid the appearance and fact of political bias. It also helped to reduce the chances of the government tainting jury pools and risking the strength of its own cases when indictments were warranted. Even if Ms. Cook is guilty of mortgage fraud, it seems rather convenient that this investigation occurs now, as Trump has been attacking Fed independence. Even if a legitimate crime was uncovered here, if it was the result of a fishing expedition that violated due process, any resulting prosecution is likely undermined. The adminstration’s objectives here seem clear.

There’s a similar situation regarding the FBI’s search of the home of one of Trump’s first term national security advisors, John Bolton. He already had his Secret Service security detail stripped from him months ago for no defensible stated reason and has clearly been a target of Trump for years, presumably due to his very open criticism of Trump as unfit to be President. This is another situation in which the administration is openly gloating about this investigation, after denying Bolton the opportunity to voluntarily return any classified material he may have that Trump, Biden, and former Vice President Mike Pence were given.

This follows the announcment of an independent counsel investigation into Jack Smith a few weeks ago, the former independent counsel who was prosecuting Trump in two federal cases before Trump’s return to the White House. A clear pattern is emerging here. There are plenty of other similar issues I could mention that arose last week, but this is supposed to be a short-form outlook.

These issues, coupled with Trump’s extraordinarily odd and incompetent approach to foreign and trade policy. his general ignorance and seeming dementia- and hatred-fueled rants and revenge plots, along with his capricious general policy daytrading all obviously undermine the stability and future growth of the US economy. Rule of law, strong institutions, and stable policy are critical for healthy economic growth. I don’t think markets are taking these threats seriously enough. At the very least, the tail risks are growing.

There’s still no recession on the horizon, but expect both more bad news and the unexpected.

PS: I’ll soon publish a post on my efforts to develop an NGDP forecasting tool based upon the equilibrium relationship between the 10-year Treasury yield and the NGDP growth rate. I may also write a post with another overview of large language models to reflect my continued learning on the topic.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data:

Economic Data Sources:

https://fred.stlouisfed.org/series/SP500

https://www.wsj.com/market-data/stocks/peyields

https://www.barchart.com/futures/quotes/ES*0/futures-prices

https://ycharts.com/indicators/sp_500_earnings_per_share_forward_estimate#:~:text=Basic%20Info-,S&P%20500%20Earnings%20Per%20Share%20Forward%20Estimate%20is%20at%20a,28.27%25%20from%20one%20year%20ago.

https://www.cnbc.com/quotes/.VIX

https://fred.stlouisfed.org/series/DTWEXBGS

https://fred.stlouisfed.org/graph/?g=Ee9i

https://fred.stlouisfed.org/series/T10Y3M#0

https://fred.stlouisfed.org/series/DGS10

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

https://tradingeconomics.com/commodity/crb?user=nunote

https://www.cnbc.com/quotes/@CL.1

https://www.cmegroup.com/trading/en

https://www.spglobal.com/spdji/en/documents/additional-material/sp-500-eps-est.xlsx

https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.quotes.html