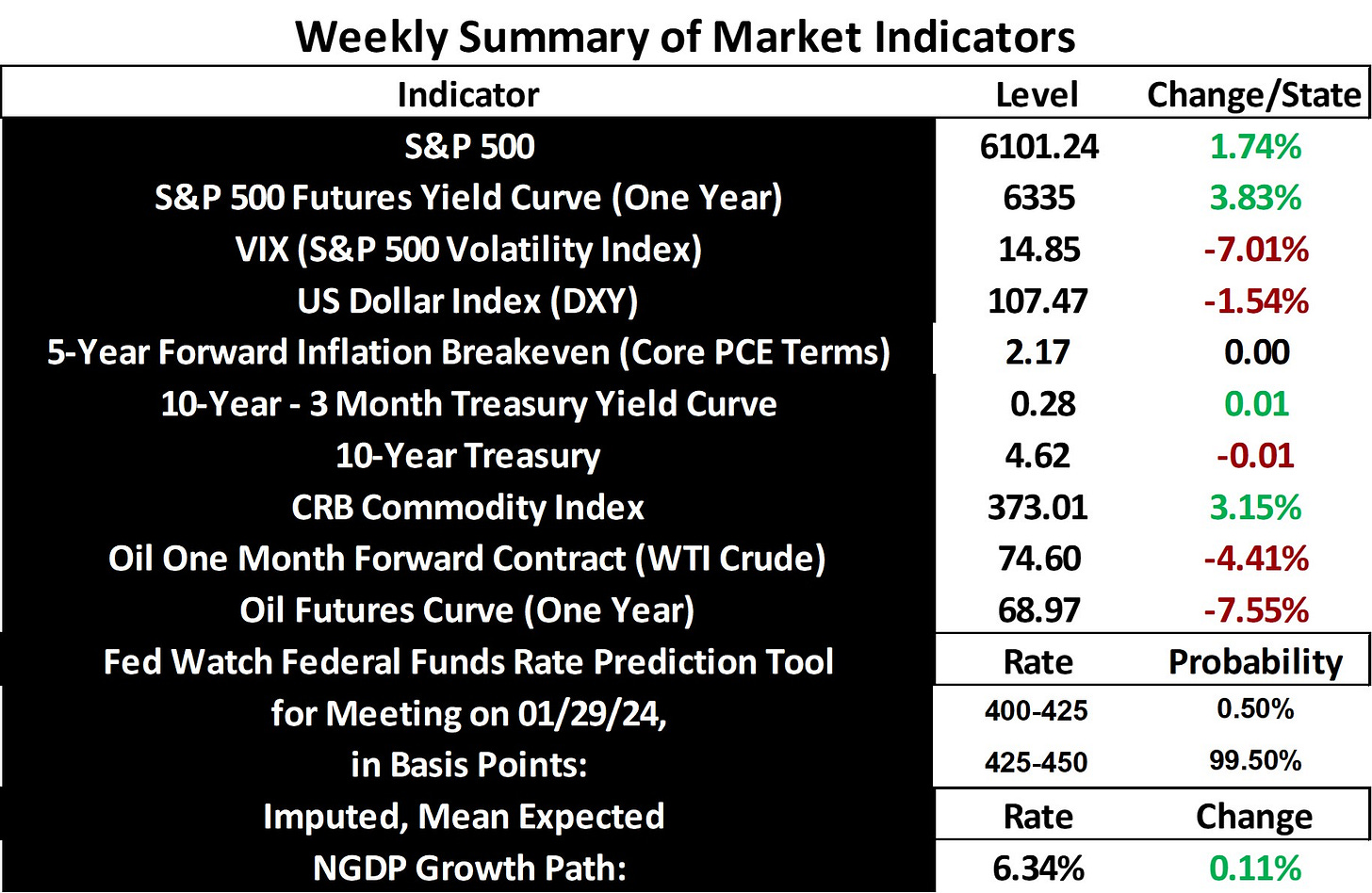

Stock prices and the mean expected NGDP growth rate rose for a second straight week, as the VIX further eased, and inflation expectations were steady. Markets continued to bet that talk from the White House is cheap, as this good week came in the midst of quite a few statements that would be highly concerning if taken seriously.

For example, in a video in which Trump was speaking to attendees at Davos, he said he’ll demand lower interest rates from the Fed. This is despite all indications that the US economy continues to run hot, with the recent inflation and the 5-year inflation breakeven above the Fed’s 2% target and NGDP growth still above long-run trends and reasonable estimates of sustainability. As this week’s updated stock market-based quarterly NGDP forcasts indicate (available to paid subscribers), NGDP growth is expected to remain above the roughly 5% sustainable rate for at least the rest of this year.

And as I point out weekly lately, while the Fed does tend to run the US economy above its sustainable NGDP growth rate at times, it is much less patient with above-target inflation rates, which is why we should continue to see only very limited stock price appreciation until inflation expectations come down. This chart displays the recent history of stock price performance when the 5-year breakeven is above the 2% mean target in core PCI terms:

Markets also ignored new tariff threats from Trump last week, but perhaps they are taking the new tariffs placed on Colombia this weekend more seriously. S&P 500 futures are down about half-a-percent in early Sunday evening trading.

In addtion to warnings about potential policy problems I’ve recently shared from the excellent economists Stephen Kirchner and Lars Christensen, here’s Marcus Nunes on the possible consequences of Trump’s as-stated economic policy inclinations.

So, while markets continue to take Trump actions and comments in stride, I agree with most economists that there is deep reason for concern about related potential negative real and perhaps even nominal shocks. Particularly given the likely limited potential upside for stocks as inflation expectations remain high, there’s not a great case to be made for having a lot of money in stocks at the moment. Even just holding may be a bit too optimistic right now.

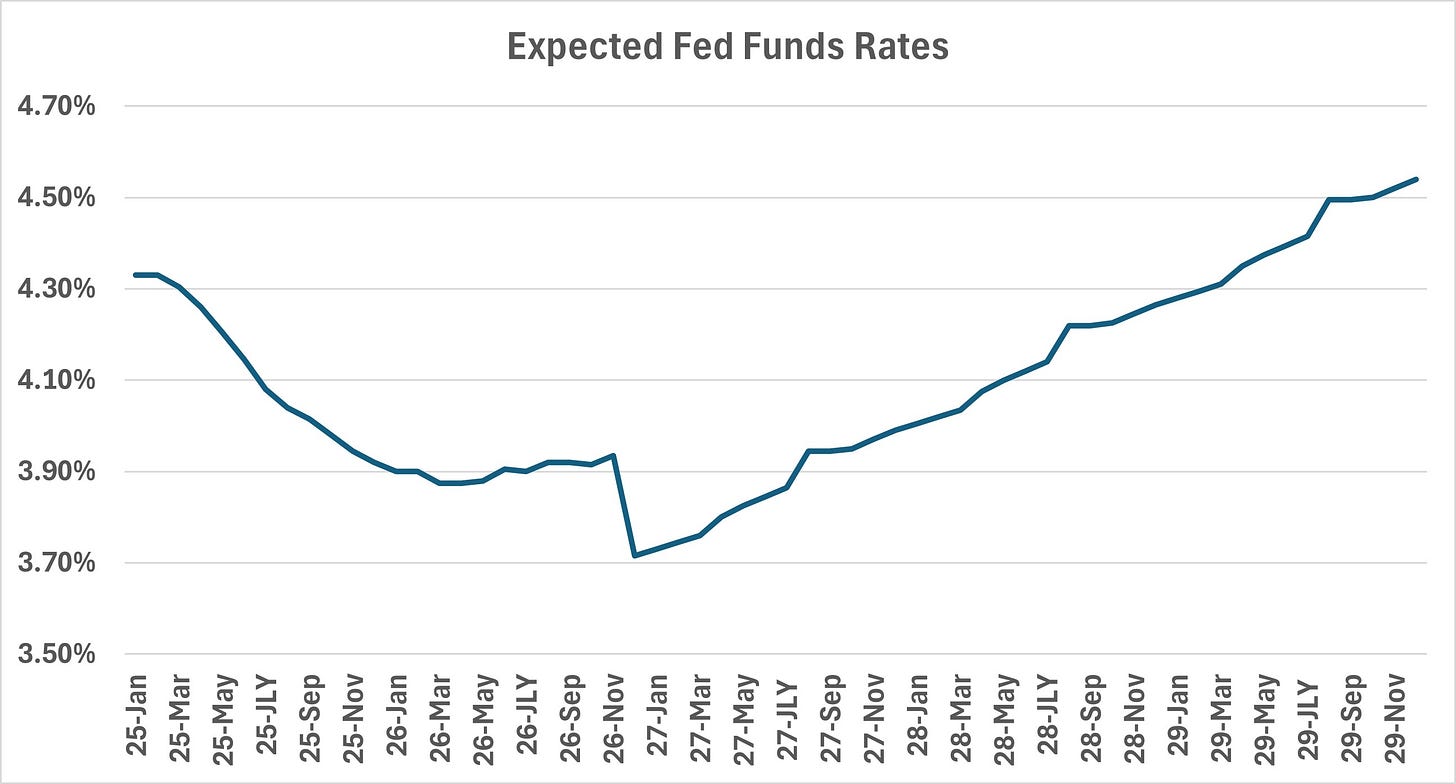

In the somewhat longer run however, the latest expected Fed Funds rates chart is interesting:

First, rates are still expected to decline, for a while, but by not much. Second, and more interestingly, for the first time in a long time, rates are expected to be higher within 5 years than they are now. Does this reflect increased real growth expectations, increased US default concerns, or some combination?

My guess is the former. Perhaps AI development. and even expected continued high rates of immigration “trump” concerns about Washington policy. Yes, Trump says he wants to “stem” immigration, but that certainly doesn’t mean it will happen. When it comes to puns, I can match this era’s shamelessness.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Economic Data Sources:

https://fred.stlouisfed.org/series/SP500

https://www.wsj.com/market-data/stocks/peyields

https://www.barchart.com/futures/quotes/ES*0/futures-prices

https://ycharts.com/indicators/sp_500_earnings_per_share_forward_estimate#:~:text=Basic%20Info-,S&P%20500%20Earnings%20Per%20Share%20Forward%20Estimate%20is%20at%20a,28.27%25%20from%20one%20year%20ago.

https://www.cnbc.com/quotes/.VIX

https://fred.stlouisfed.org/series/DTWEXBGS

https://fred.stlouisfed.org/graph/?g=Ee9i

https://fred.stlouisfed.org/series/T10Y3M#0

https://fred.stlouisfed.org/series/DGS10

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

https://tradingeconomics.com/commodity/crb?user=nunote

https://www.cnbc.com/quotes/@CL.1

https://www.cmegroup.com/trading/en

https://www.spglobal.com/spdji/en/documents/additional-material/sp-500-eps-est.xlsx

https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.quotes.html

Thank you very much, Mike, for sharing for free your macroeconomic analysis and actionable insights!

Is true that a few months ago you started indicating the factors that are affecting stock prices negativity.

Meanwhile the market didn't agree with you today's session might be the start of a pullback in the equity market.

Your Updated Quarterly NGDP Forecasts and NGDP Output Gaps Based on S&P 500 earnings estimates and futures prices are useful and actionable.

Paid subscribers, with a tiny fee, get a more precise picture of very important metrics that influence equity market's trajectory.

Stay blessed.

Ioannis Lazaridis

Helsinki, Finland.