Stock and GDP Outlook, for Week Ending 10/03/2025

Slumping slowly toward disaster?

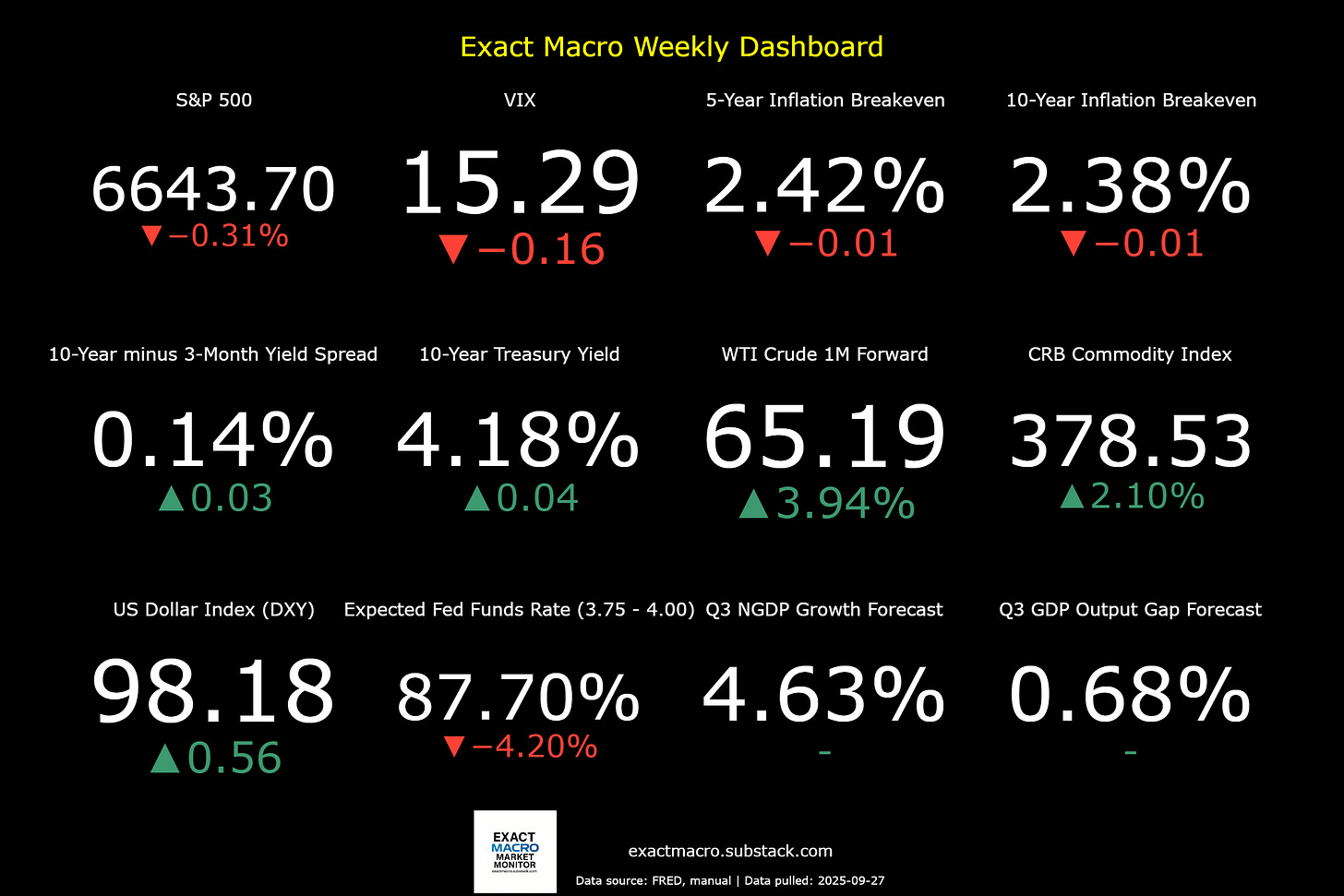

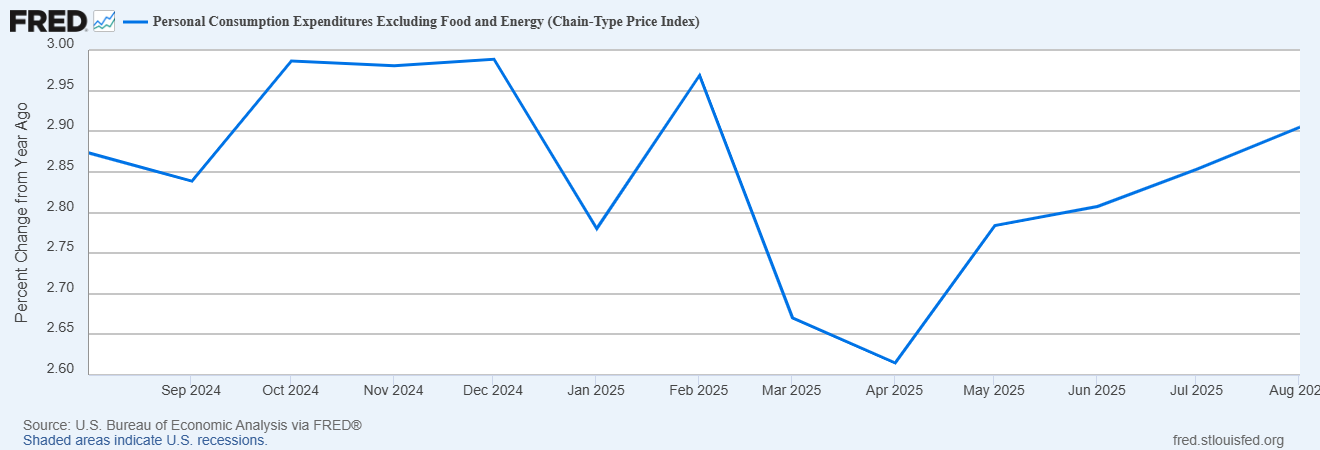

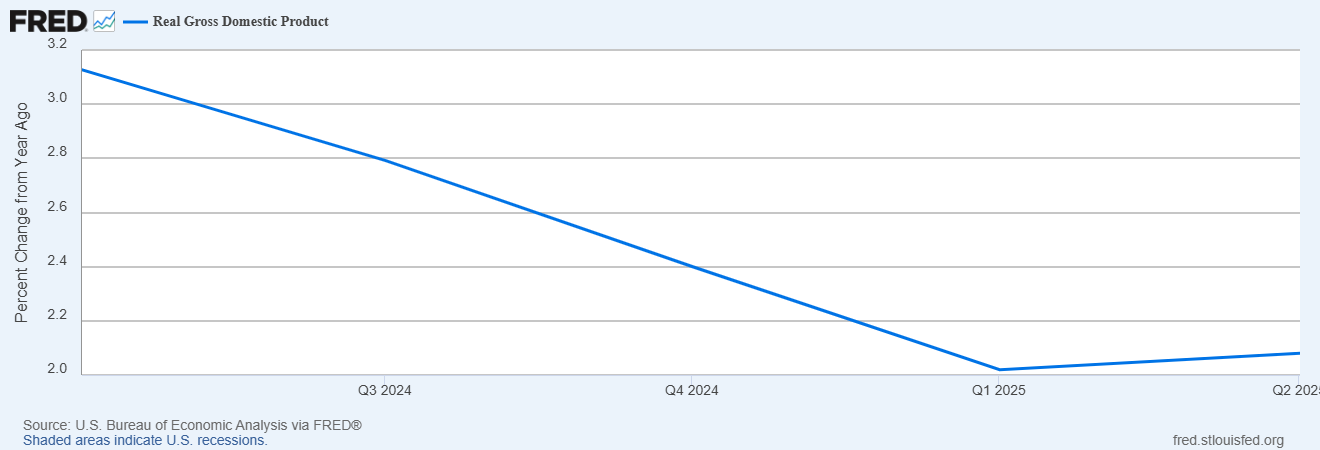

Stock prices and the mean expected NGDP growth rate declined last week, breaking a 3 week streak, with inflation expectations hardly changed. YoY core PCE inflation for August came in at 2.91%, while YoY Q2 real GDP growth was 2.08% after a second revision.

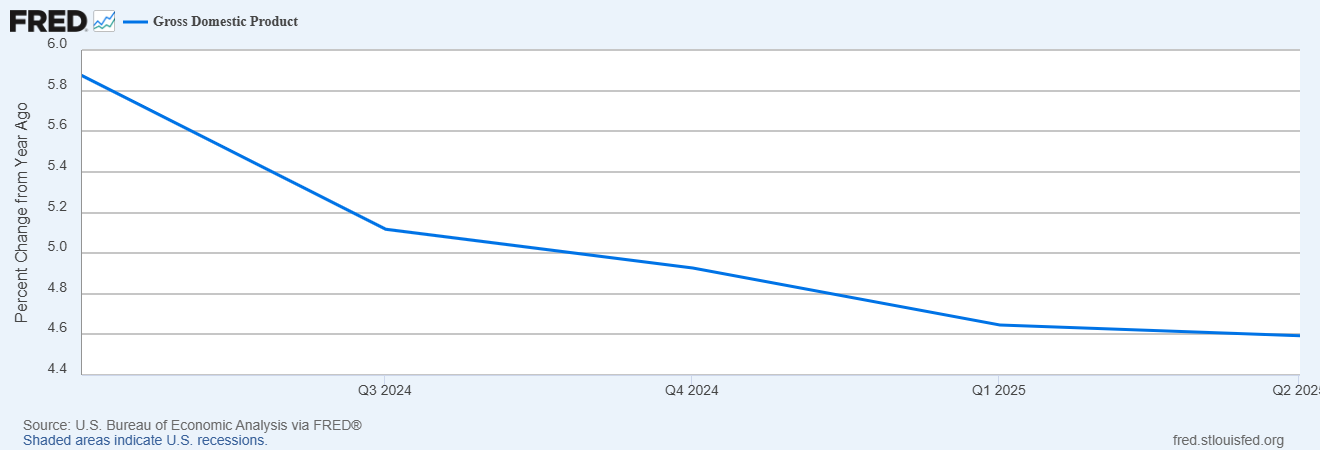

So, while real GDP growth flattened between Q1 and Q2, YoY NGDP growth remained on a steady decline, as predicted by Fed Funds futures yields and the S&P 500 market-based NGDP forecasts.

Moving onto the increasingly negative influence of government on the US economy, the continuing assault on the rule of law was represented by a transparently politically motivated indictment of former FBI director James Comey. It seems obvious to me that the rule of law is critical for long-run economic growth prospects. My guess is that current market reactions are likely muted due to the absurdly transparent nature of the crime committed by the Trump administration here, which will likely lead to summary dismissal of the charges on the bases of lack of evidence and vindictive prosecution.

The Trump administration also announced some minor new tariffs, which are having some big effects on some stocks in the furniture and heavy truck manufacturing industries, though surival of such tariffs are highly questionable given legal challengs, as I’ve pointed out in the past.

Looking ahead, Democrats are threatening to refuse to support a continuing resolution to avoid a government shutdown, without reversals to cuts in healthcare spending and funding for public broadcasting. This game of chicken must begin to be resolved no later than Tuesday, when current funding expires. Given the history of both sides in this, it’s tempting to say that a compromise will be reached, perhaps after a brief shutdown as TACO (Trump Always Chickens Out) is challenged by a Democratic Party that seems at its most natural in panicked retreat. My guess is that Democrats will cave more than Trump, if Trump cavs at all. I suspect the fight the Democrats are pledging is seen as politically expedient rather than any true show of resistance.

On that sour note, the outlook still hasn’t changed much in recent weeks, with mild stagflation, but no recession as the current market-forecasted outcome. However, as I point out so often, obviously tail risks are heightened.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data:

Economic Data Sources:

https://fred.stlouisfed.org/series/SP500

https://www.wsj.com/market-data/stocks/peyields

https://www.barchart.com/futures/quotes/ES*0/futures-prices

https://ycharts.com/indicators/sp_500_earnings_per_share_forward_estimate#:~:text=Basic%20Info-,S&P%20500%20Earnings%20Per%20Share%20Forward%20Estimate%20is%20at%20a,28.27%25%20from%20one%20year%20ago.

https://www.cnbc.com/quotes/.VIX

https://fred.stlouisfed.org/series/DTWEXBGS

https://fred.stlouisfed.org/graph/?g=Ee9i

https://fred.stlouisfed.org/series/T10Y3M#0

https://fred.stlouisfed.org/series/DGS10

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

https://tradingeconomics.com/commodity/crb?user=nunote

https://www.cnbc.com/quotes/@CL.1

https://www.cmegroup.com/trading/en

https://www.spglobal.com/spdji/en/documents/additional-material/sp-500-eps-est.xlsx

https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.quotes.html