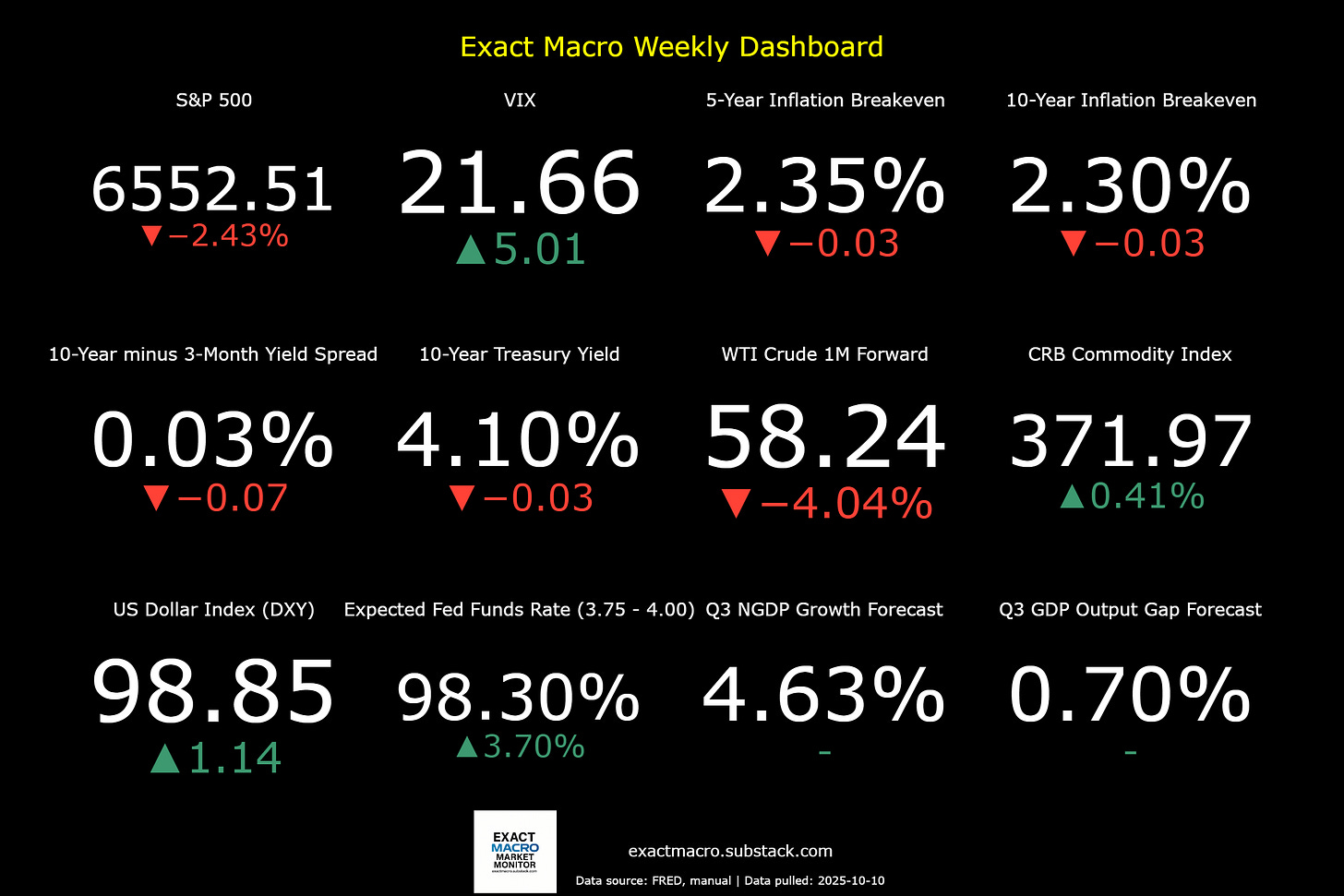

Stock prices and the mean expected NGDP growth rate fell sharply last week, as the VIX spiked after a sizeable Friday sell-off that followed announcments of 100% tariff increases on China and export restrictions on software. This was in retaliation for China’s announced new export controls on rare earth minerals.

However, S&P 500 futures prices are up more than 1% as I write this just before 8:30 PM EST, after Trump seemed to try to ease concerns over a deepening trade rifts on his social media platform. This goes to illustrate what was already obvious and that I point out nearly every week, which is that we live in an era uniquely heightened tail risks.

Otherwise, the outlook for stocks and the economy didn’t change much after last week. The Fed is still trying to execute a soft landing amid much unnecessary turbulance, with the drain on economic growth due to immigration restrictions and tariffs being somewhat offset by the generative AI boom. Official government statistical reporting is still suspended during the continuing federal government shutdown, leading market participants to lean more heavily on private sources.

Speaking of private sources, I’ve been studying a new possible expected NGDP growth indicator. Tests are ongoing and I hope to have an update soon.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data:

Economic Data Sources:

https://fred.stlouisfed.org/series/SP500

https://www.wsj.com/market-data/stocks/peyields

https://www.barchart.com/futures/quotes/ES*0/futures-prices

https://ycharts.com/indicators/sp_500_earnings_per_share_forward_estimate#:~:text=Basic%20Info-,S&P%20500%20Earnings%20Per%20Share%20Forward%20Estimate%20is%20at%20a,28.27%25%20from%20one%20year%20ago.

https://www.cnbc.com/quotes/.VIX

https://fred.stlouisfed.org/series/DTWEXBGS

https://fred.stlouisfed.org/graph/?g=Ee9i

https://fred.stlouisfed.org/series/T10Y3M#0

https://fred.stlouisfed.org/series/DGS10

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

https://tradingeconomics.com/commodity/crb?user=nunote

https://www.cnbc.com/quotes/@CL.1

https://www.cmegroup.com/trading/en

https://www.spglobal.com/spdji/en/documents/additional-material/sp-500-eps-est.xlsx

https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.quotes.html