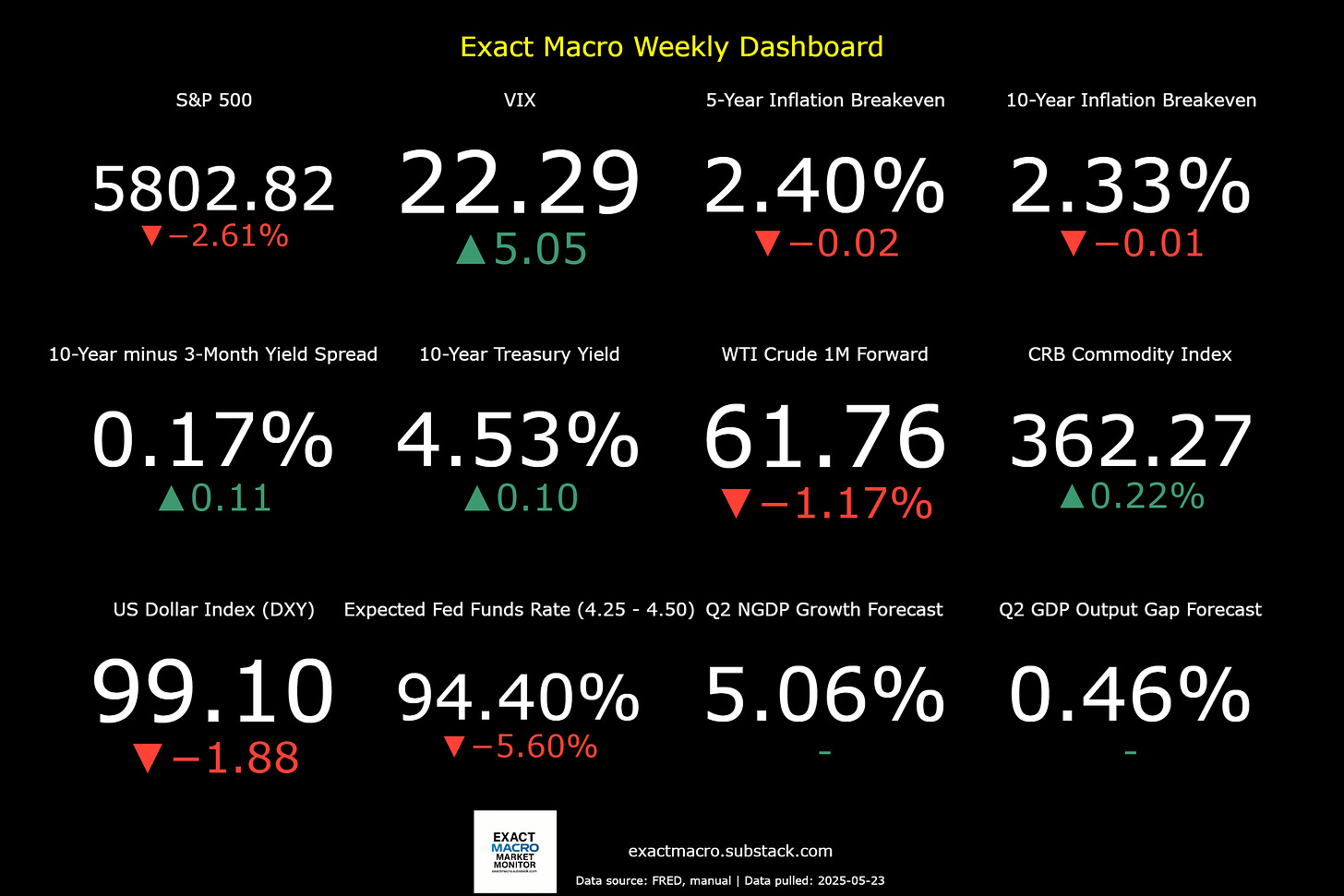

Stock prices and the mean expected NGDP growth rate fell sharply last week, amid concerns about rising long-term interest rates and new tariff threats against the EU, and Apple and rival products. On the bright side, stock prices would have been expected to fall more sharply on such a credible tariff threat, so at least it’s widely considered more bluster than reality. The S&P 500 was only down 0.67% at close after this news Friday. and true-to-form, Trump already announced a delay of these 50% new tariffs on the EU Sunday.

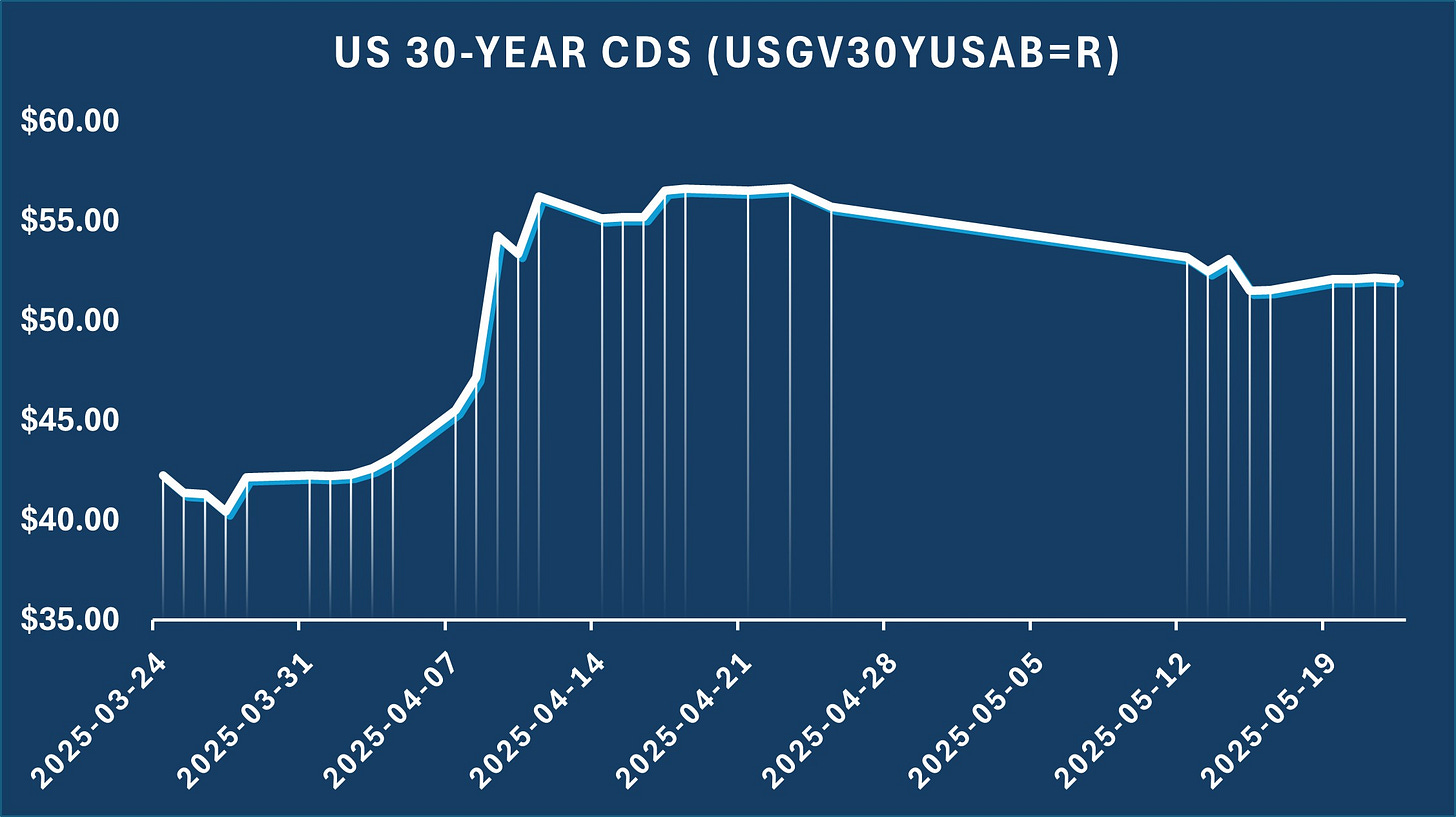

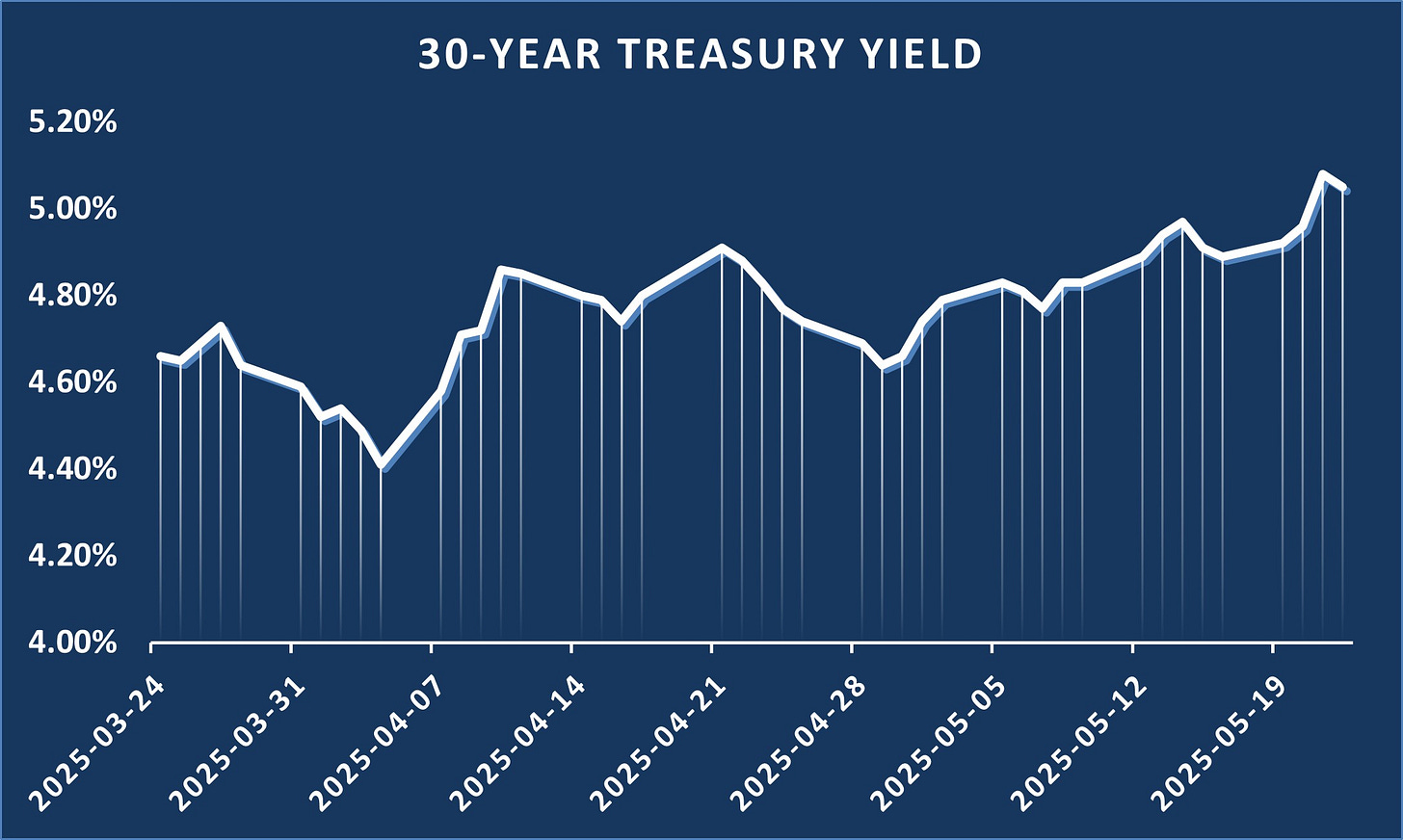

Hence, the real issue here, apart from the continued erratic decision making in Washington, is the rising interest rates, which do not reflect rising expectations of formal default. For example, 30-year CDS prices while elevated, have not moved up with the more recent rise in the 30-year Treasury rate.

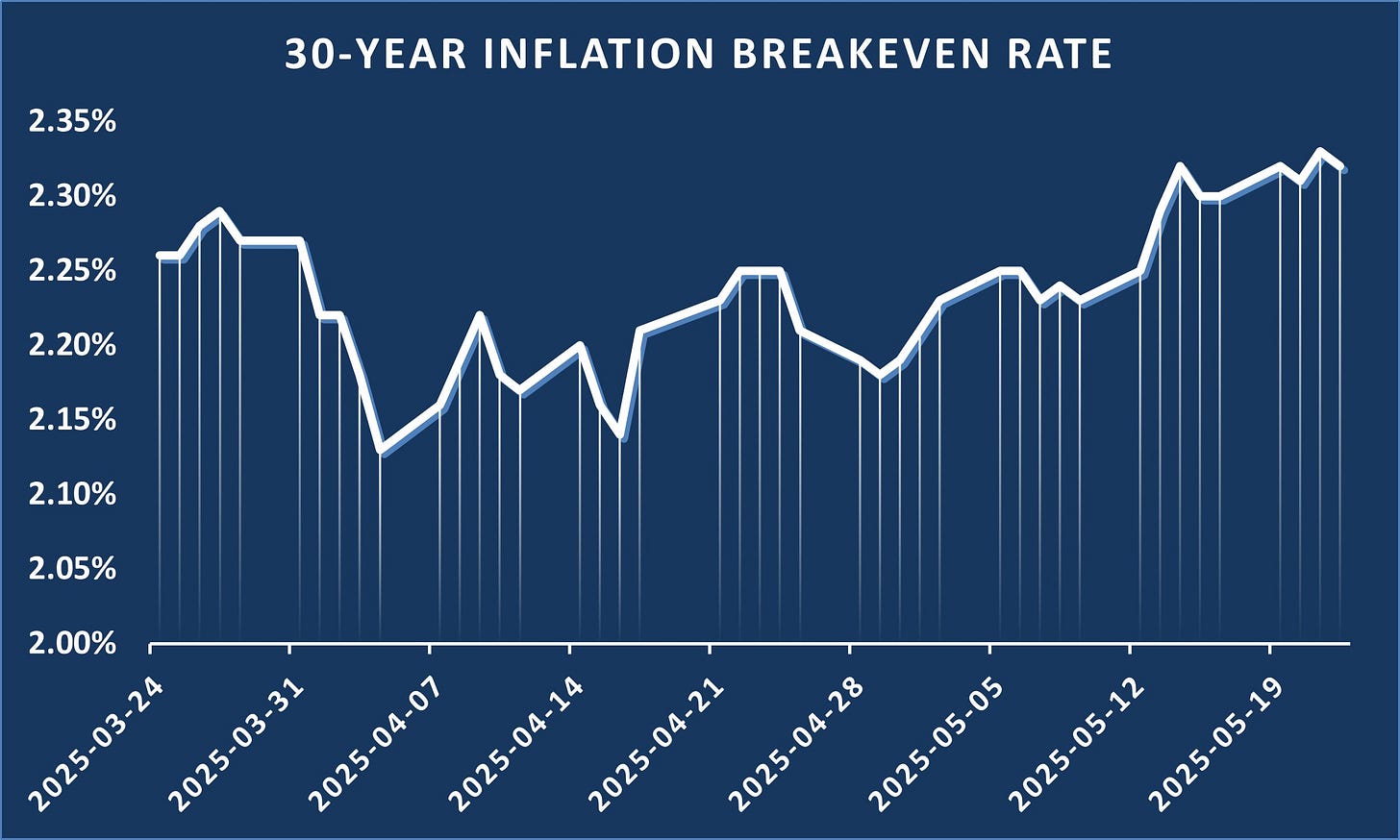

However, the 30-year inflation breakeven rate has been rising concurrently.

And the most recent 30-year expected inflation rates are not even quite at the Fed’s 2% target, in core PCE terms. There’s still no crisis prediected currently.

This is not to underestimate the risks to US credit that the current and possible future fiscal situations present. The shape of the current US budget formulation is not encouraging. Lars Christensen has an excellent recent post on this topic. While the bond vigilantes may not be stirring just yet, they could begin to appear soon. This is not because the US lacks many options for addressing its high debt and deficits, but because confidence could be lost in the long-term rationality of the US political system. The apparent unprecedently rife White House corruption doesn’t add confidence at the moment (see also here), and nor does the general erosion of the rule of law.

So, the outlook for stocks and the economy is not particularly optimistic. We’re very close to the Fed’s preferred limit in terms of inflation expectations and there will not necessarily be a clean end to the tariff drama, nor the potential for other negative real shocks.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data:

Economic Data Sources:

https://fred.stlouisfed.org/series/SP500

https://www.wsj.com/market-data/stocks/peyields

https://www.barchart.com/futures/quotes/ES*0/futures-prices

https://ycharts.com/indicators/sp_500_earnings_per_share_forward_estimate#:~:text=Basic%20Info-,S&P%20500%20Earnings%20Per%20Share%20Forward%20Estimate%20is%20at%20a,28.27%25%20from%20one%20year%20ago.

https://www.cnbc.com/quotes/.VIX

https://fred.stlouisfed.org/series/DTWEXBGS

https://fred.stlouisfed.org/graph/?g=Ee9i

https://fred.stlouisfed.org/series/T10Y3M#0

https://fred.stlouisfed.org/series/DGS10

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

https://tradingeconomics.com/commodity/crb?user=nunote

https://www.cnbc.com/quotes/@CL.1

https://www.cmegroup.com/trading/en

https://www.spglobal.com/spdji/en/documents/additional-material/sp-500-eps-est.xlsx

https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.quotes.html