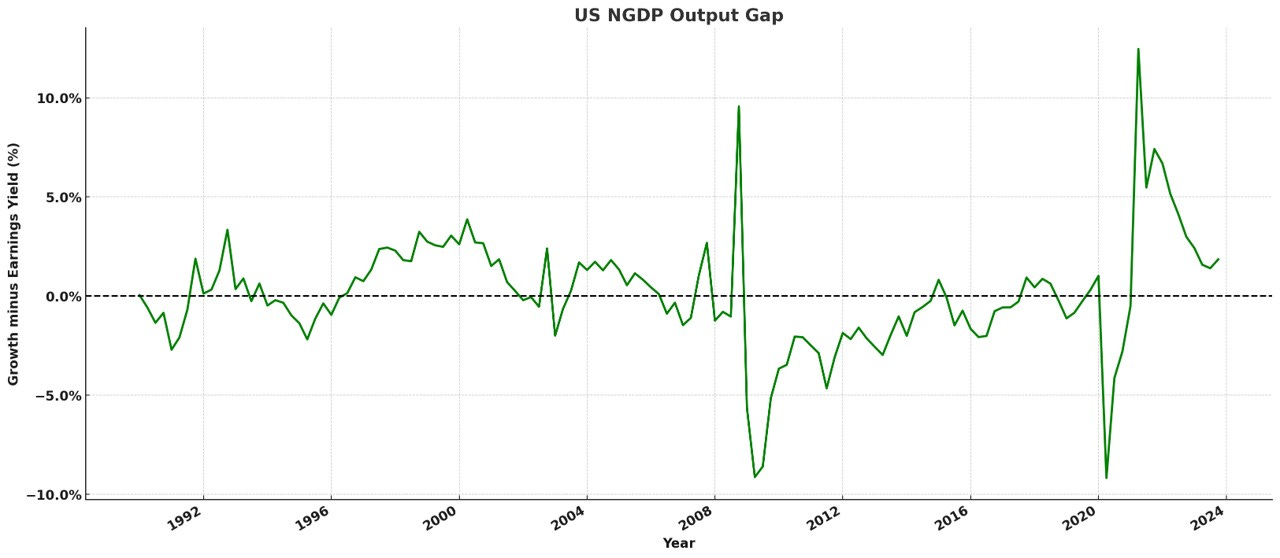

Understanding the NGDP Output Gap: A Market-Driven Approach

Introduction: In the dynamic interplay of economic growth and market returns, the NGDP (Nominal Gross Domestic Product) output gap emerges as a pivotal measure, offering insights that traditional economic indicators may overlook. This unique approach, grounded in neoclassical economic theory, posits a theoretical equilibrium between NGDP growth rates and the rate of return on capital, as reflected in market measures like the S&P 500 earnings yield.

Theoretical Rationale: Neoclassical economics suggests that in an efficient market, the growth rate of the economy (measured by NGDP) and the rate of return on capital should converge towards an equilibrium. This relationship is predicated on the idea that capital flows into sectors and investments where it is most efficiently used, equating the return on investment with the overall economic growth rate. By examining the gap between NGDP growth and the S&P 500 earnings yield, this measure assesses the alignment or divergence from this theoretical equilibrium.

Definition and Importance: The NGDP output gap is defined as the difference between the actual quarterly growth rate of NGDP and the annualized earnings yield of the S&P 500 for the same quarter. This gap indicates whether the actual economic output is overperforming or underperforming relative to the returns expected by the market.

A critical aspect of this measure is its ability to provide a more integrated view of economic health, combining macroeconomic output with market expectations. It serves as an essential tool for investors and policymakers to gauge the underlying pressures in the economy that might not be apparent through traditional analysis.

Calculation Method:

Obtain NGDP Growth Rate: This is the percentage increase in NGDP, year-over-year, available from economic data sources like the Bureau of Economic Analysis (BEA).

Determine S&P 500 Earnings Yield: Calculate this by taking the inverse of the price-to-earnings ratio of the S&P 500, representing the expected rate of return on investments in the stock market.

Compute the Gap: The NGDP output gap is then calculated as NGDP growth rate minus the S&P 500 earnings yield. A positive gap suggests that the economy is growing faster than market returns would suggest, potentially signaling overheating. Conversely, a negative gap indicates underperformance, which might call for stimulative economic policies.

Implications:

Positive NGDP Output Gap: May indicate potential inflationary pressures, suggesting that the economy might be running hotter than what would be ideal based on market returns.

Negative NGDP Output Gap: Suggests that there is slack in the economy, potentially warranting measures to stimulate growth and align NGDP growth with market expectations.

Historical Application: Using this measure in periods of economic uncertainty or transition can reveal significant insights. For instance, during the recovery from the 2008 financial crisis or in the recent volatile economic climate influenced by global events, the NGDP output gap can highlight discrepancies between economic output and market expectations, guiding more nuanced policy responses.

This market-driven approach to analyzing economic performance through the NGDP output gap provides a comprehensive perspective that aligns macroeconomic indicators with financial market dynamics, offering a robust framework for economic analysis and decision-making.

Justifying Use of the S&P 500 Index as a Proxy for the Broad Rate of Return on Capital

Market Coverage and Capital Representation: The S&P 500 index includes 500 of the largest companies listed on stock exchanges in the United States, covering about 80% of the available market capitalization. This broad coverage makes it a representative sample of the overall market and a reasonable proxy for the economic activity generated by large capital investments across diverse sectors. Additionally, because these companies are generally among the largest and their markets are often saturated, they predominantly depend on NGDP growth for earnings growth. This dependence makes the S&P 500 earnings yield particularly reflective of the broader economic conditions, reinforcing its role as a proxy for the rate of return on capital.

Earnings Yield as a Return Indicator: The earnings yield (inverse of the price-to-earnings ratio) of the S&P 500 is a direct measure of the income (earnings) generated per unit of price (investment). It serves as an indicator of the profitability of companies from an investor's perspective, approximating the return on capital that investors expect from the market. Higher earnings yields suggest higher returns relative to the prices paid for stocks, reflecting investor expectations about future profitability.

Liquidity and Market Efficiency: The S&P 500 is highly liquid, meaning it is frequently traded, which ensures that its price reflects up-to-date information about the underlying companies and the overall economy. This efficiency supports the argument that the earnings yield can be a timely and effective proxy for the return on capital, as it embodies the collective market sentiment and expectations about future economic conditions.

Economic Influence and Sentiment: The companies in the S&P 500 are not just large in terms of capitalization; they also wield considerable influence over the economy. Their performance can impact economic policy and investor sentiment broadly, making their aggregated earnings yield a significant indicator of economic trends.

Historical Correlation with Economic Cycles: Historical data often shows a correlation between the performance of the S&P 500 and broader economic cycles. During periods of economic growth, the earnings yield may decrease as stock prices rise on optimism and expected future earnings growth, reflecting the decreased cost of capital. Conversely, during economic downturns, the earnings yield might increase as prices fall, indicating higher returns on lower-priced stocks and a more cautious economic outlook.

Comparative Analysis: By comparing the NGDP growth rate with the S&P 500 earnings yield, you can assess whether the real economy is growing at a pace justified by the returns expected by the capital markets. This can provide insight into whether current market valuations are supported by economic fundamentals or if discrepancies might indicate an overheating or under-stimulation of the economy.

These points collectively justify the use of the S&P 500 earnings yield as a proxy for the rate of return on capital, making it a useful tool in economic analysis to gauge the alignment or misalignment of market valuations with actual economic performance.