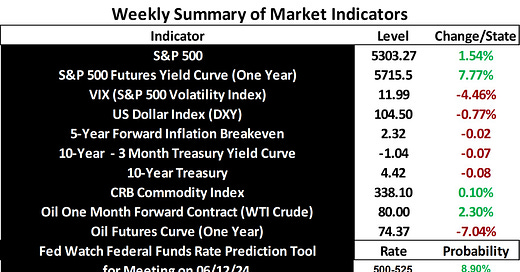

Stock prices and the mean expected NGDP growth rate again rose sharply last week, while long-term interest rates and inflation expectations fell. This positive real shock was largely spurred by the softer-than-feared CPI report for April, which indicated that the year-over-year gentle deceleration trend continued.

The 5-year inflation breakeven remains near the Fed’s mean 2% target, in core PCE terms, so we should still expect stock prices to remain relatively flat without some additional real shocks.

As I’ve been pointing out rececently, the inflation expectations have reflected the Fed’s regained credibility in respecting its inflation target, which is not only good news for monetary policy, but for predicting the upper limits of stock market gains at a given time.

Note again the obvious pattern of two spikes of the 5-year breakeven above the Fed’s target, which is roughly 2.35%, in core PCE terms, in association with the declines in the S&P 500, as I’ve been pointing out recently.

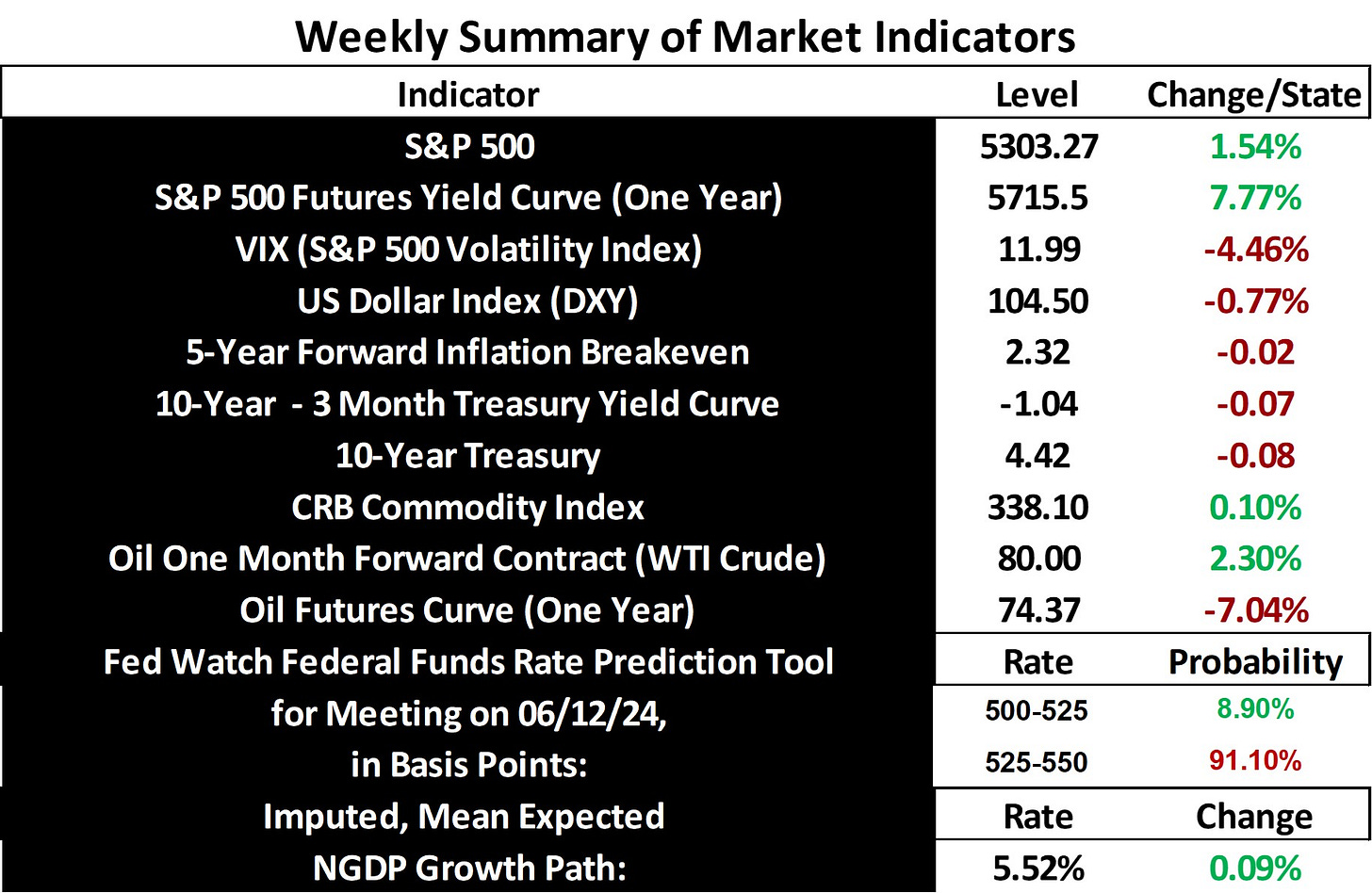

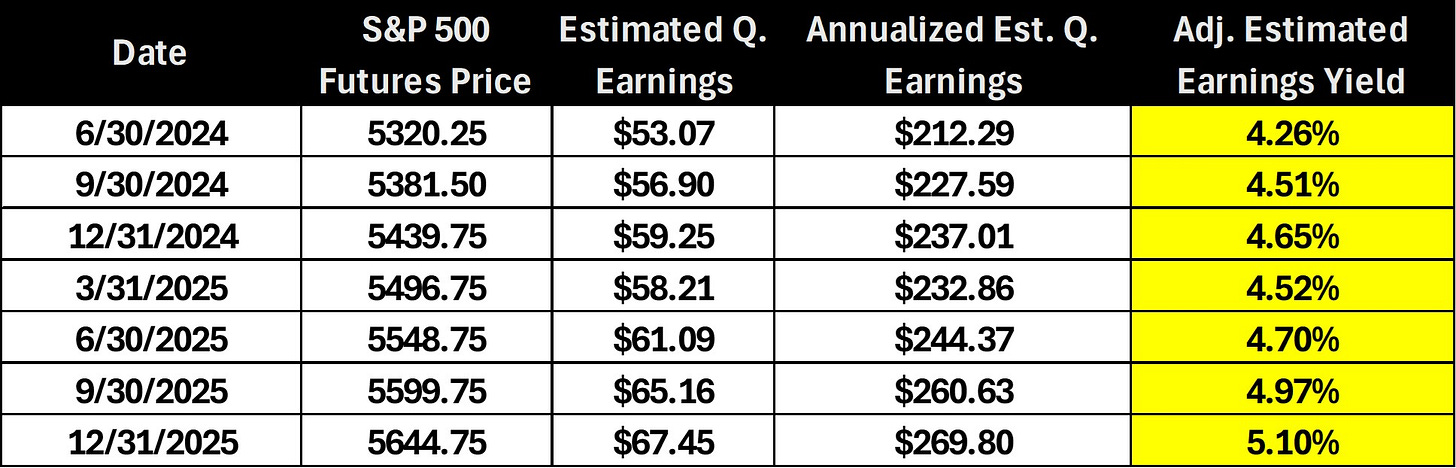

Looking ahead, you can refer to the weekly summary of indicators above to see that the current mean expected NGDP growth rate is estimated at 5.52%, which is well-above expected S&P 500 earnings yields, which are based upon consensus earnings estimates and S&P 500 futures prices.

Hence, while inflation and NGDP growth are trending down, the latter is expected to exceed expected earnings yields through 2025, indicating a positive output gap. NGDP growth is too high and is expected to remain so for at least another 18 months, predicted to reach equlibrium in mid-2026 (refer to the Fed Funds futures market).

This will be fine if the economy does in fact continue to glide gently down toward equilibrium as markets predict, but as I’ve stated repeatedly, such a gradual rate of adjustment is inherently risky, given the potential for negative real shocks. On the other hand, given the Fed’s history in managing soft landings, this might be the best we can hope for.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data: