Stock and GDP Outlook, for Week Ending 09/19/2025

More stagflation ahead.

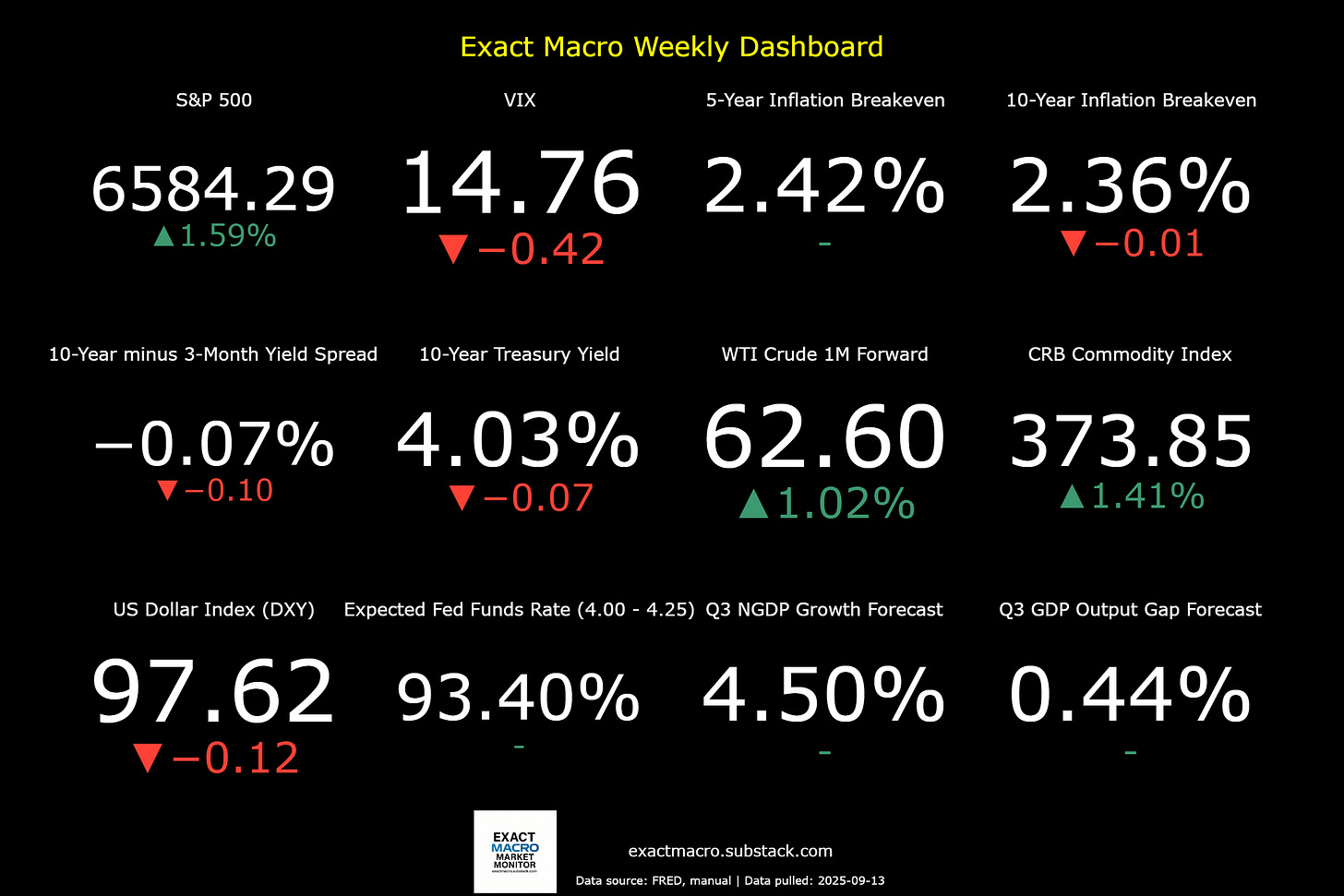

Stock prices and the mean expected NGDP growth rate rose again last week, in what was likely a net real positive shock, given the lack of change in inflation expectations. YoY core CPI inflation for August was reported at 3.4%.

Fundamentally, the outlook hasn’t changed since last week, with mild stagflation expected to continue as NGDP falls for the next year-and-a-half or so, before a partial growth recovery occurs. There’s still no recession expected, but the risk for real and nominal shocks that could cause a recession are unusally high given the conduct of the current US administration and geopolitical context. Tail risks are particularly higher than usual. Caution is warranted.

Apart from the outlook, I will address my efforts to create a forecasting model based on the equilibrium relationship between the 10-Year Treasury yield and 10 year NGDP growth. So far, the effort has failed, due primarily to the effects of Fed policy on the yield curve. Obviously Treasury yields are affected by more than just the expected Fed Funds rates and NGDP growth. The liquidity effect is real, for example. I will continue to try to develop a robust model that will allow for a more straightforward, continuous real-time NGDP forecast tool.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data:

Economic Data Sources:

https://fred.stlouisfed.org/series/SP500

https://www.wsj.com/market-data/stocks/peyields

https://www.barchart.com/futures/quotes/ES*0/futures-prices

https://ycharts.com/indicators/sp_500_earnings_per_share_forward_estimate#:~:text=Basic%20Info-,S&P%20500%20Earnings%20Per%20Share%20Forward%20Estimate%20is%20at%20a,28.27%25%20from%20one%20year%20ago.

https://www.cnbc.com/quotes/.VIX

https://fred.stlouisfed.org/series/DTWEXBGS

https://fred.stlouisfed.org/graph/?g=Ee9i

https://fred.stlouisfed.org/series/T10Y3M#0

https://fred.stlouisfed.org/series/DGS10

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

https://tradingeconomics.com/commodity/crb?user=nunote

https://www.cnbc.com/quotes/@CL.1

https://www.cmegroup.com/trading/en

https://www.spglobal.com/spdji/en/documents/additional-material/sp-500-eps-est.xlsx

https://www.cmegroup.com/markets/interest-rates/stirs/30-day-federal-fund.quotes.html