Stock and GDP Outlook, for Week Ending 10/11/2024

Unsteady She Goes

Stock prices and the mean expected NGDP growth rate eked out tiny gains last week, despite sharply rising oil prices caused by the escalating conflict in the Middle East. This was largely due to the much better-than-expected September jobs report, which saw the unemployment rate fall to 4.1%. This completely eliminated the market odds for a 50 basis point Fed funds rate reduction at the November meeting. However, the VIX spiked with prospects for more oil supply disruptions in the Middle East. Hence, caution is warranted going forward, despite the brightened overall picture.

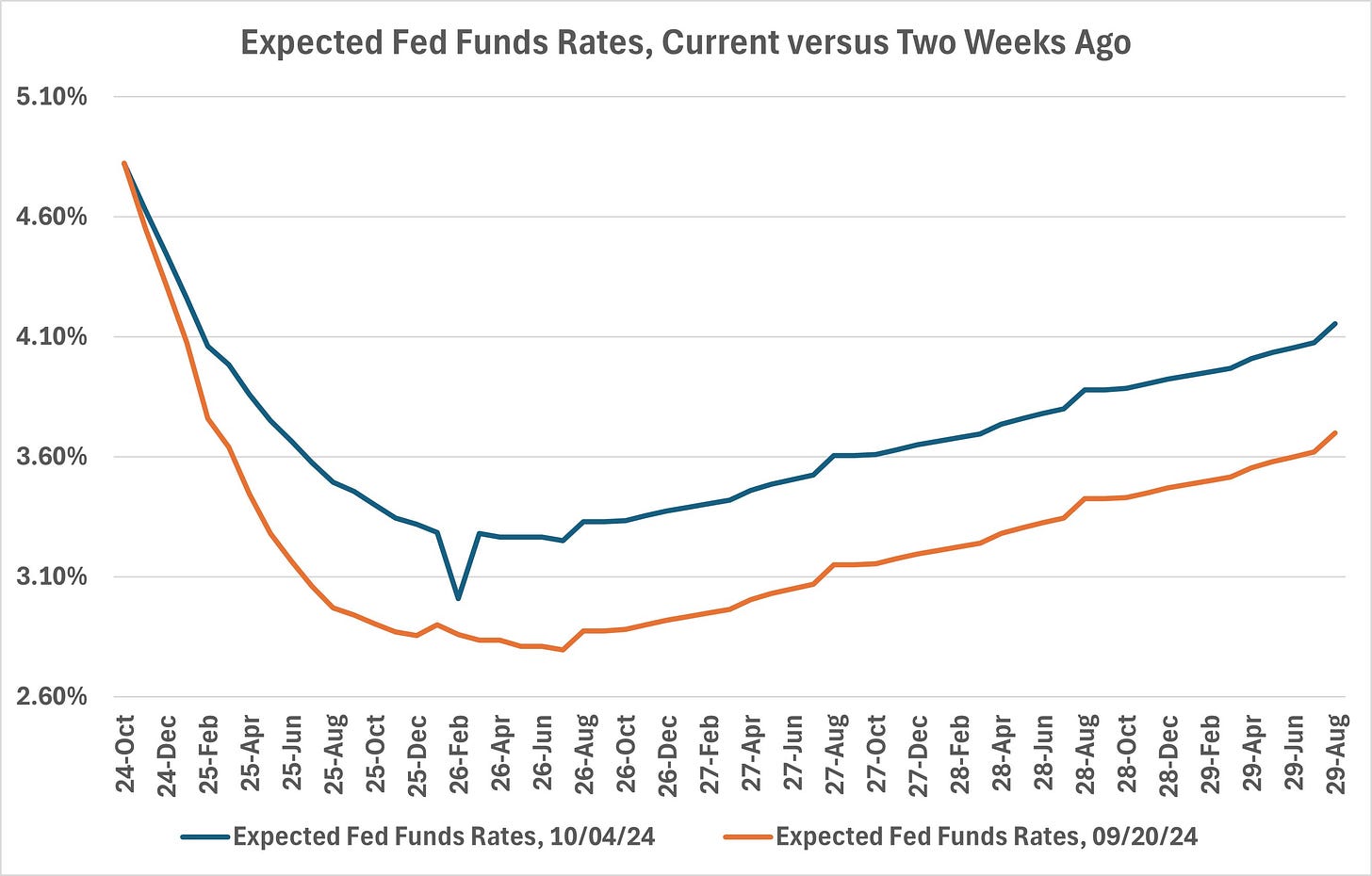

The Fed Funds yield curve reflects just how much economic prospects have improved over the past two weeks. The increase averages over 40 basis points, with a maximum of 50 basis points.

Again, this isn’t all good news, as this market volatility reflects increased risks of both negative real and nominal shocks. In the case of the latter, the inflation expectations are still 20 basis points below the Fed’s mean target. I discussed this conundrum for the Fed in one of my rare mid-week posts last week. They can’t bring down core PCE inflation as quickly as they’d like without risking loosing credibility via their inflation target. Below 2% inflation would likely be healthy for the forseeable future, given the continued boom in real GDP, but letting 5-year mean inflation expectations persist below 2% renders their 2% mean less meaningful, and hence makes predicting Fed actions more difficult. Nonetheless, the soft landing continues to manifest, even if not as smoothly as I’d like.

Now, to shift topics to some housekeeping, the market-based quarterly NGDP forecasts through 2025 were updated this week, with signficiant recent upward revisions. You can now view them, and the latest NGDP output gap measure with a paid subscription. I’ve reduced the price to $5.00-per-month. The subscription includes access to the premium chatbot, which has an increasing number of improving features. The features are not only improving due to refinements on my part, but also due to advances in ChatGPT technology. The features it offers now are largely beta and are doubtlessly modest compared to those to come within the next year or two.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data: