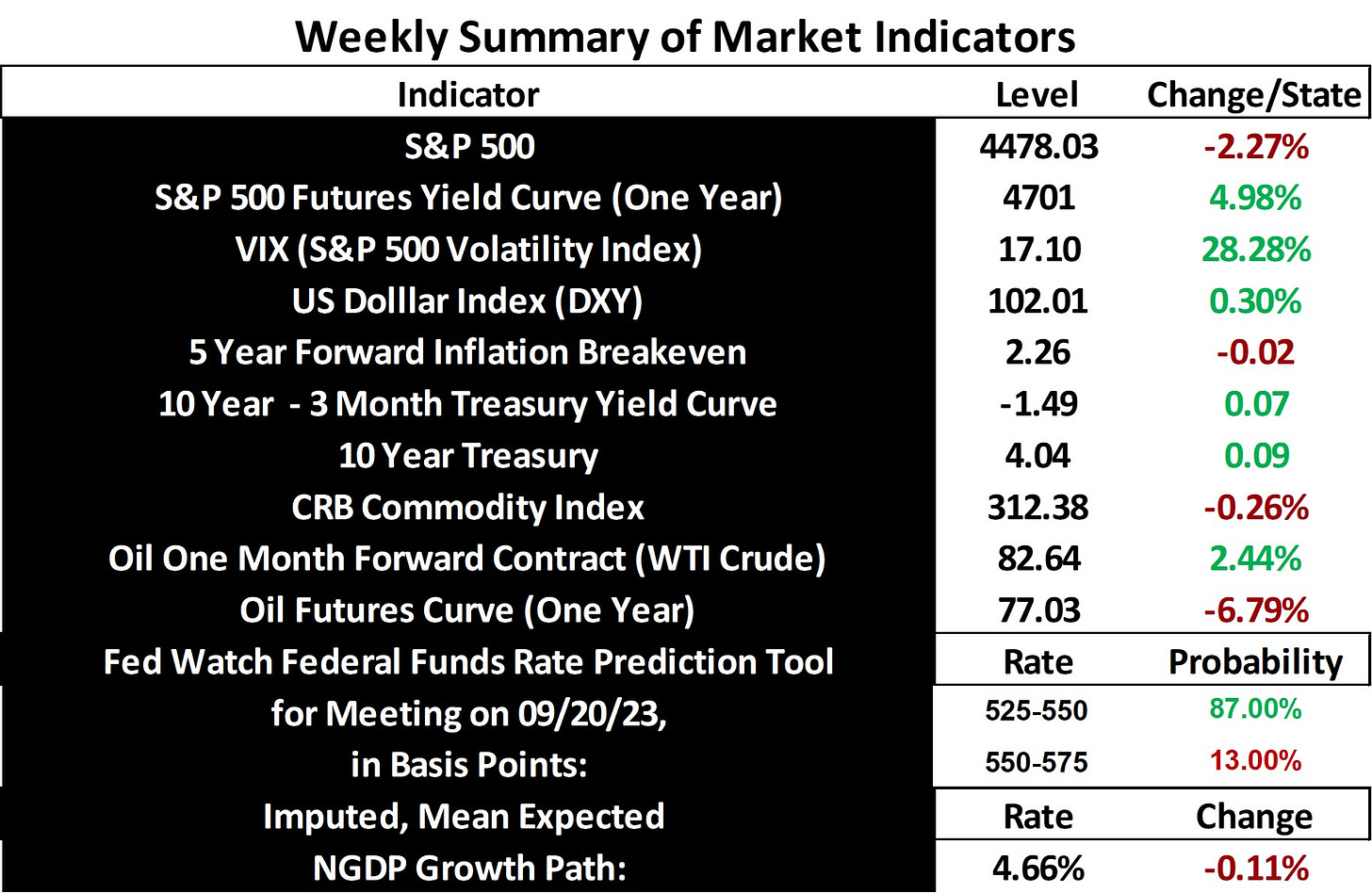

Last week saw a rare setback this year for stocks and expected economic growth, as both the S&P 500 and the mean expected NGDP growth rate lost ground. This was in the context of the aftermath of a Fitch downgrade in the US credit rating, some disppointing earnings results or forecasts, and a weaker-than-expected jobs report, the latter of which was initially associated with a gain for stocks. More important than the weaker-than-expected jobs number, perhaps, was the stronger-than-expected rise in hourly earnings, which could raise inflation expectations, absent expected Fed offset. Such an expected offset is perhaps largely responsible for the rise in Treasury yields this week, as inflation expectations sagged a bit. Also, theMay and June jobs numbers were revised down to 281,000 and 185,000, respectively. These are, of course, still very strong jobs numbers, and very consistent with very strong economic growth. This is rreflected in the Fed’s current GDPNow growth rate, now approaching 4%.

Now I want to turn to a prediction for S&P 500 earnings for Q2 of this year, based on the model I’ve been discussing for the past two weeks. I’ll use a simplified form of the equation, e = P x g, given that this is just a back-of-the-envelope calculation. Using S&P 500 price data, and my own mean expected NGDP data, imputed expected annualized earnings began at $169.71 for Q2 of this year, and ended the quarter at $181.63. So, the earnings estimate for last quarter is about $45. This is in-line with some other recent estimates which, presumably aren’t calculated using imputed mean expected NGDP growth rates. This is just an example of how investors can use mean expected NGDP data.

I pulled this mean expected NGDP data from my own website, which is still under construction. I’ve made significant progress, having built the economic indicator dashboard and stock stress-tester, in addition to a demo AI-enabled chatbot to offer auto interpretations of economic indicator data. I would allow those interested to demo the site, but it is still on a development server, which can’t handle much traffic. I look forward to debuting it as soon as possible.

In the meantime, the economy still appears strong, with no apparent recession on the horizon, according to markets.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data: