Stock and GDP Outlook, for Week Ending 08/16/2024

A Deeper Dive in Markets

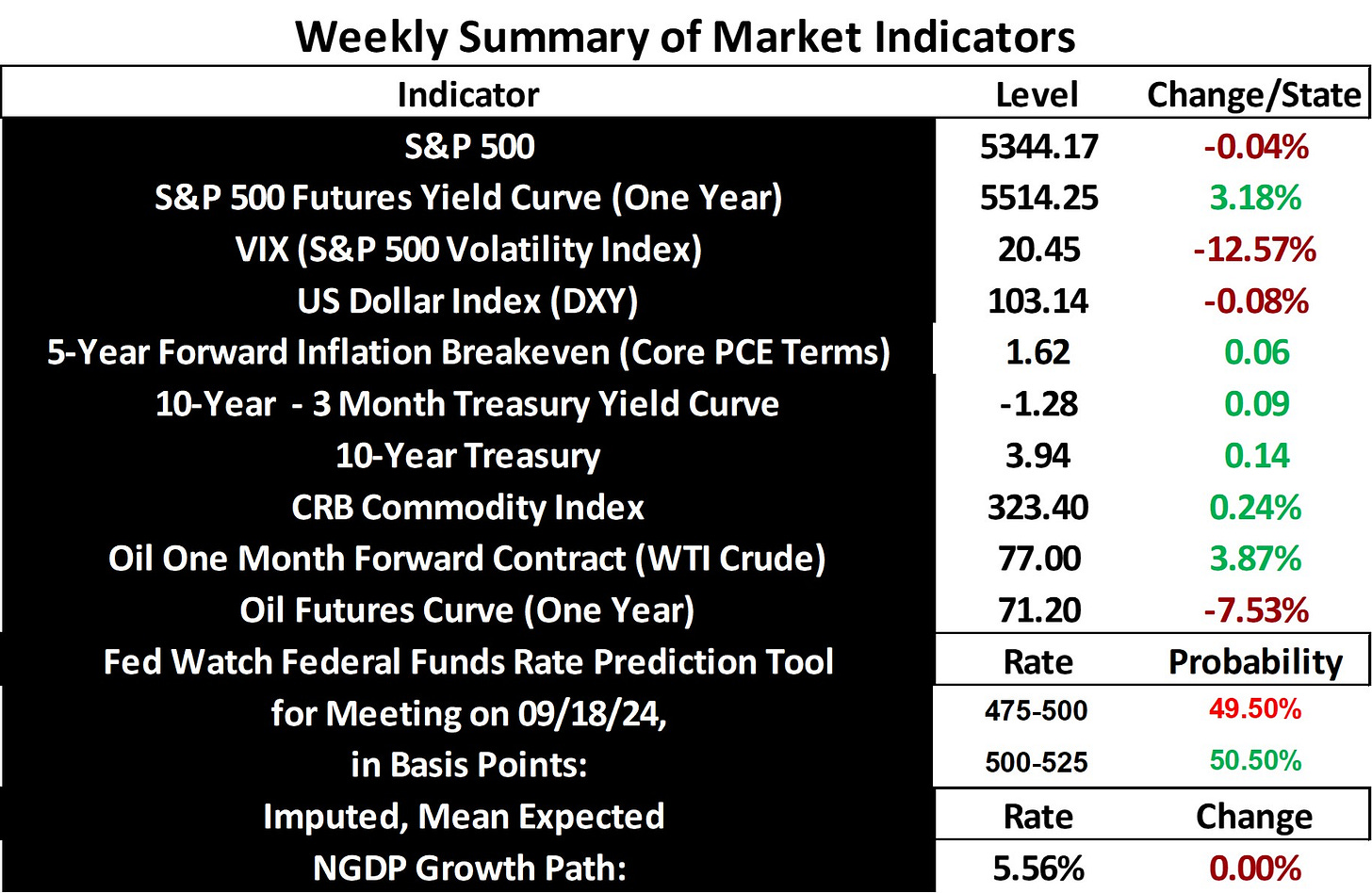

Stock prices and the mean expected NGDP growth rate fell almost imperceptibly last week, after a wild ride on Monday that saw the VIX spike to its highest level since the pandemic-related turbulence in 2020.

The S&P 500 closed down more than 3% that day.

However, as I pointed out then, the trigger for this selloff was not in the US, but in Japan and South Korea, which were tightening monetary policy too quickly, causing recession expectations to begin to emerge in their markets. This was seen in the closing of their leading stock market indexes of 12% and 8% down, respectively. Their markets strongly rebounded the following day, after the beginning of emergency actions by their central banks.

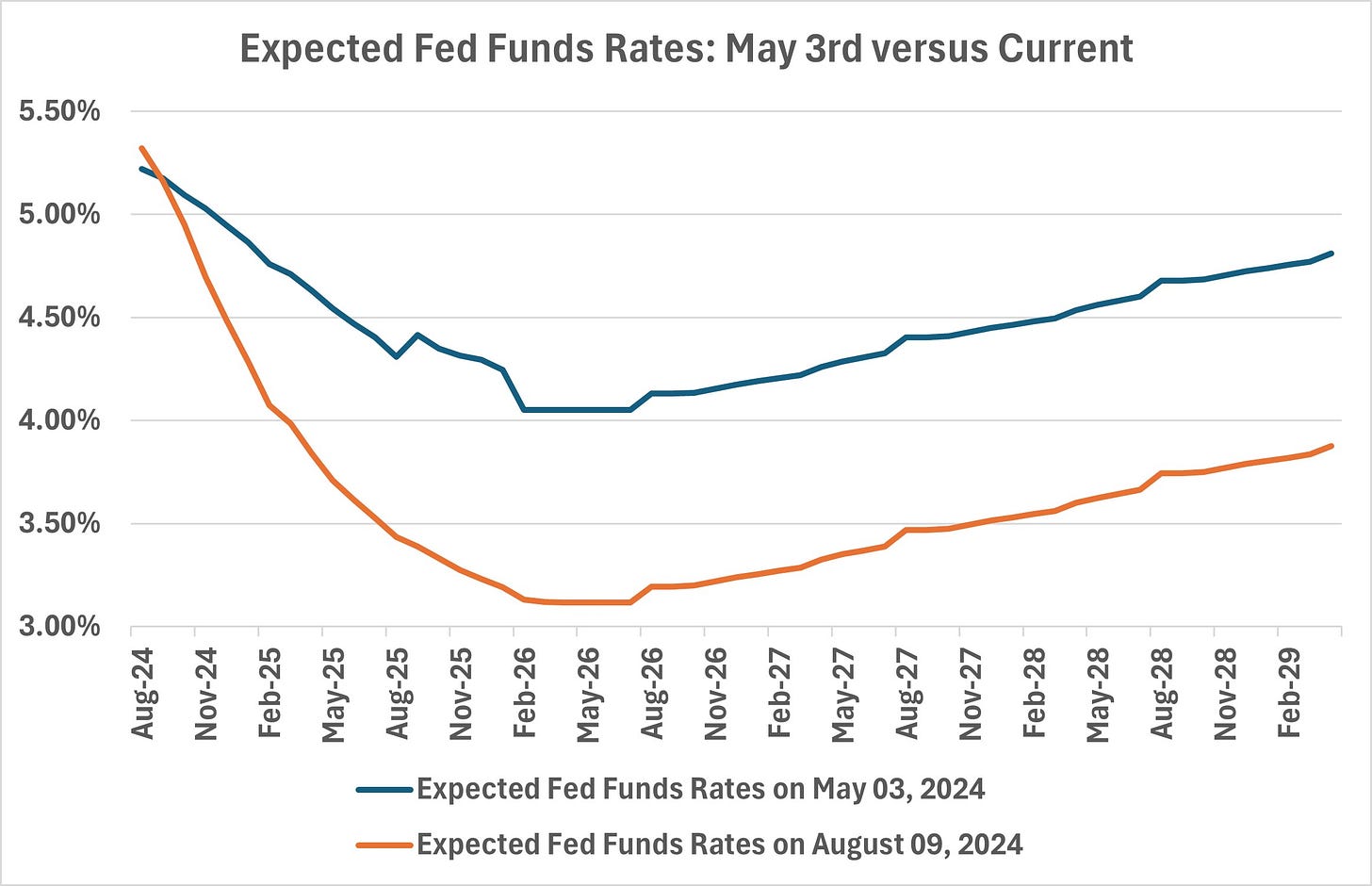

But, while the triggers for the emerging crises were abroad, the US economic outlook has been gradually weakening in recent months, by design, but more quickly lately than markets had expected. For example, consider how far the Fed Funds futures yield curve has fallen since early May.

The expected low is now nearly 100 basis points below the expected rate just a few months ago. While the S&P 500 is down less than 6% since this downturn in stocks began, the elevated index volatility indicates that recession fears are rising.

The markets are still not predicting anything like a meaningful recession, to be clear, but nerves are being frayed. Recession risks are now likely somewhat higher than the 18% average in a typical year, using historical frequency since 1913 as a baseline. However, NGDP growth has been running sufficiently hot that even an extra 1% downturn can be tolerated without a recession, so long as it’s not too rapid.

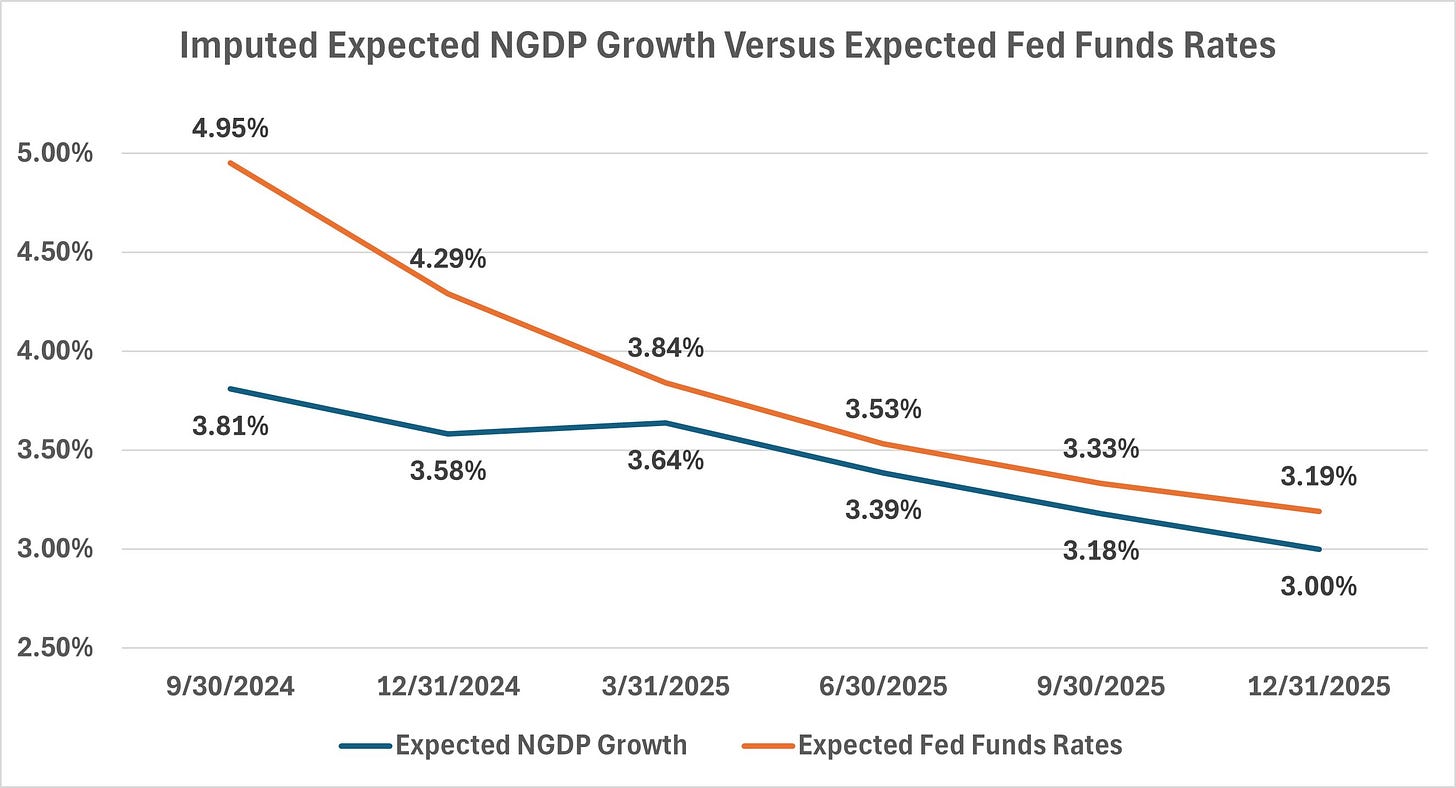

Here are some very back of the envelope estimates of expected NGDP growth through 2025, based on adjusted S&P 500 earnings estimates and S&P 500 futures prices, upon which expected earnings yields are calculated:

I adjust the S&P 500 analyst earnings projections up by 10%, to roughly reflect the underestimation bias demonstrated in recent years. I then impute expected NGDP growth by taking a plausible recent baseline estimate for near-term NGDP growth and adjusting it for changes in the expected S&P 500 earnings yield, with which there is a longer run equilibrium relationship (see NGDP Output Gap). The simple formula for this imputation is Expected NGDP Growth = Baseline Expected NGDP Growth + (Baseline Expected NGDP Growth - Expected S&P 500 Earnings Yield). By “plausible” baseline estimate for near-term NGDP growth, I mean an estimate that will result in expected rates of growth that are below the expected Fed Funds rates, as opposed to the situation in recent quarters. This is what I mean by “very back of the envelope” estimates. Despite the doubtless imprecision of such estimates, the process of thinking that goes into them can prove useful for analysis.

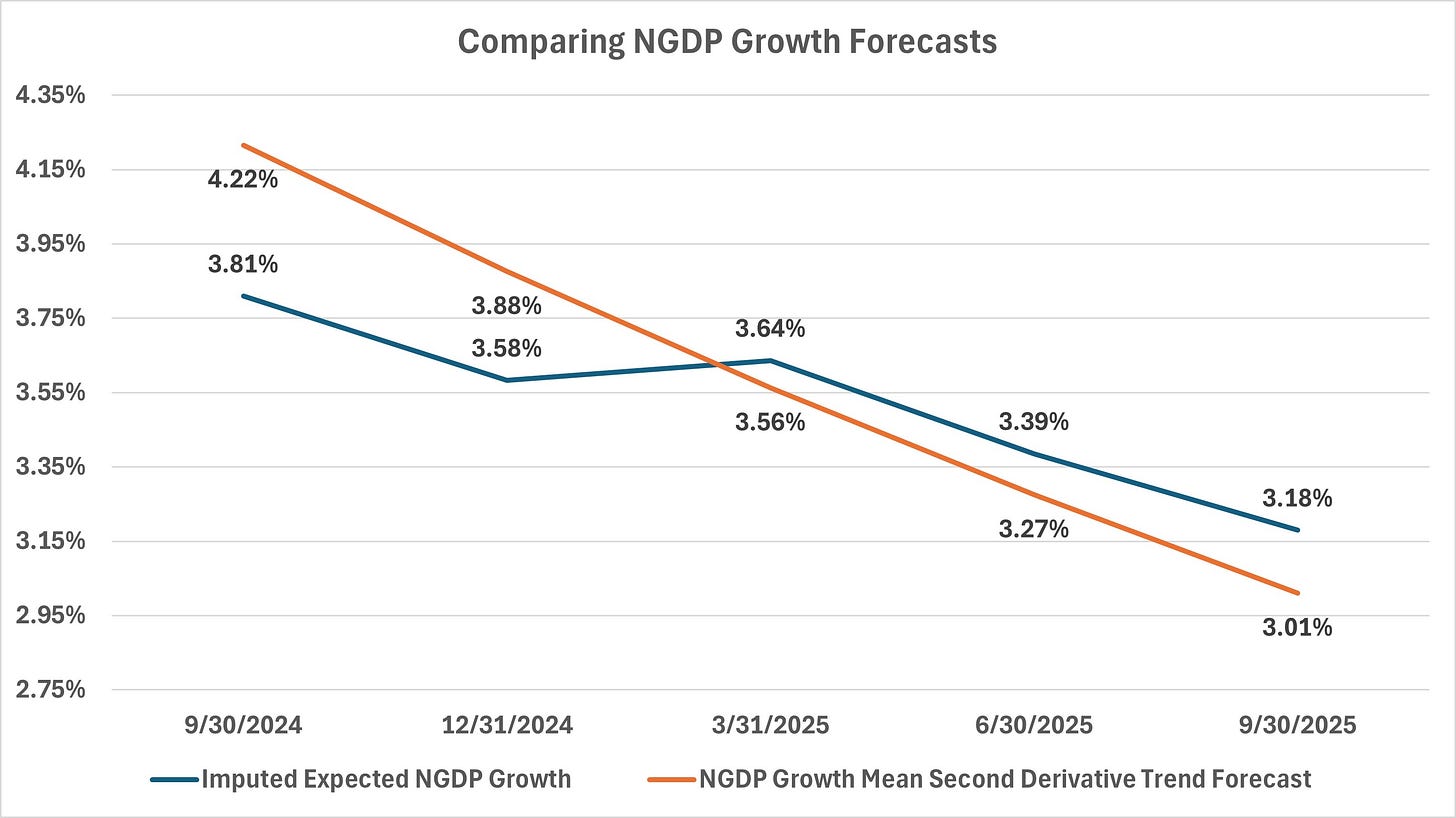

This forecast is pretty comparable to the simple one I offered a few weeks ago, which relied solely on extrapolation based on the downward trend second derivative of NGDP:

So, while NGDP growth expectations are down a bit from last month, markets are still expecting a relatively soft landing, but with a somewhat quicker descent and more turbulence. As I state nearly every week, caution in these very uncertain times globally and domestically is warranted, particularly now that both real and nominal risks to growth are rising, near and abroad.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data: