Stock and GDP Outlook, for Week Ending 07/19/2024

Another week, another real shock.

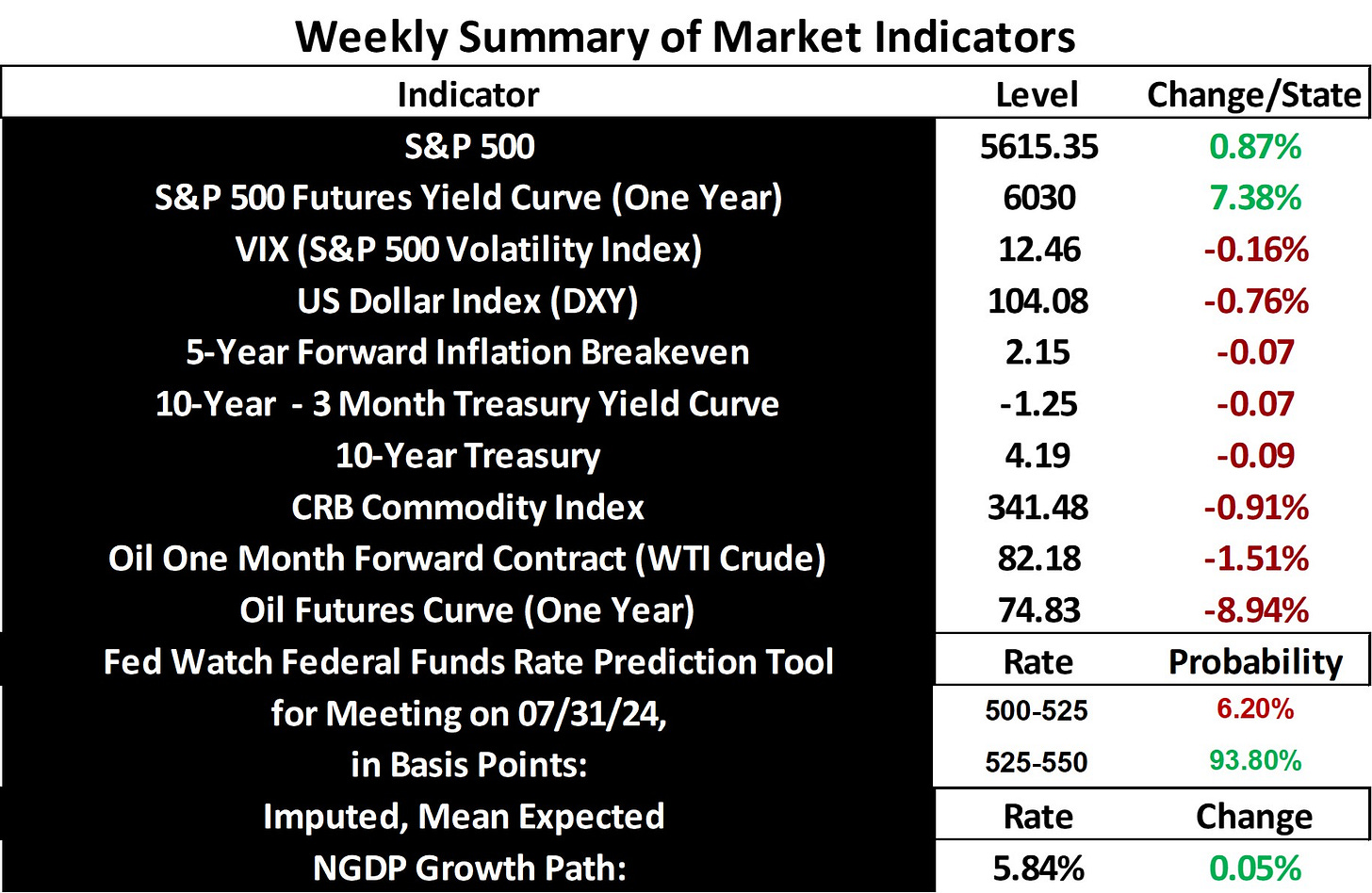

Stock prices and the mean expected NGDP growth rate rose sharply again last week, as inflation expectations again fell. This is just the latest in a long string of net real shocks, going back to at least the debut of ChatGPT-3.5 in late 2022.

This trend might easily make some believe the economy is no longer running hot, but that would be an incorrect conclusion. As I’ve been saying for sometime, the economy continues to run hot by every metric of which I’m aware, though its been consistently cooling and is expected to continue doing so. Exactly when it will be in equilibrium again is a question that often occupies me.

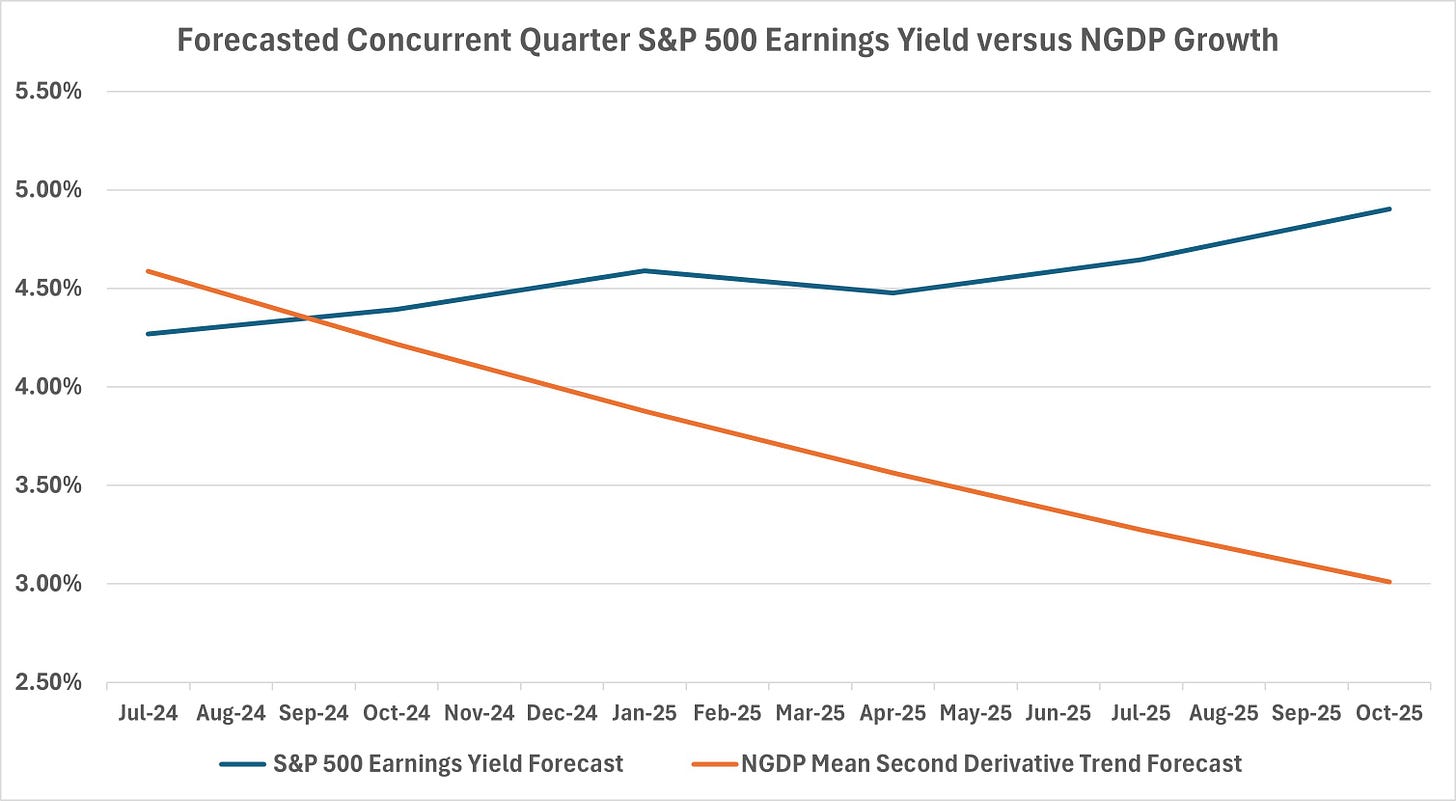

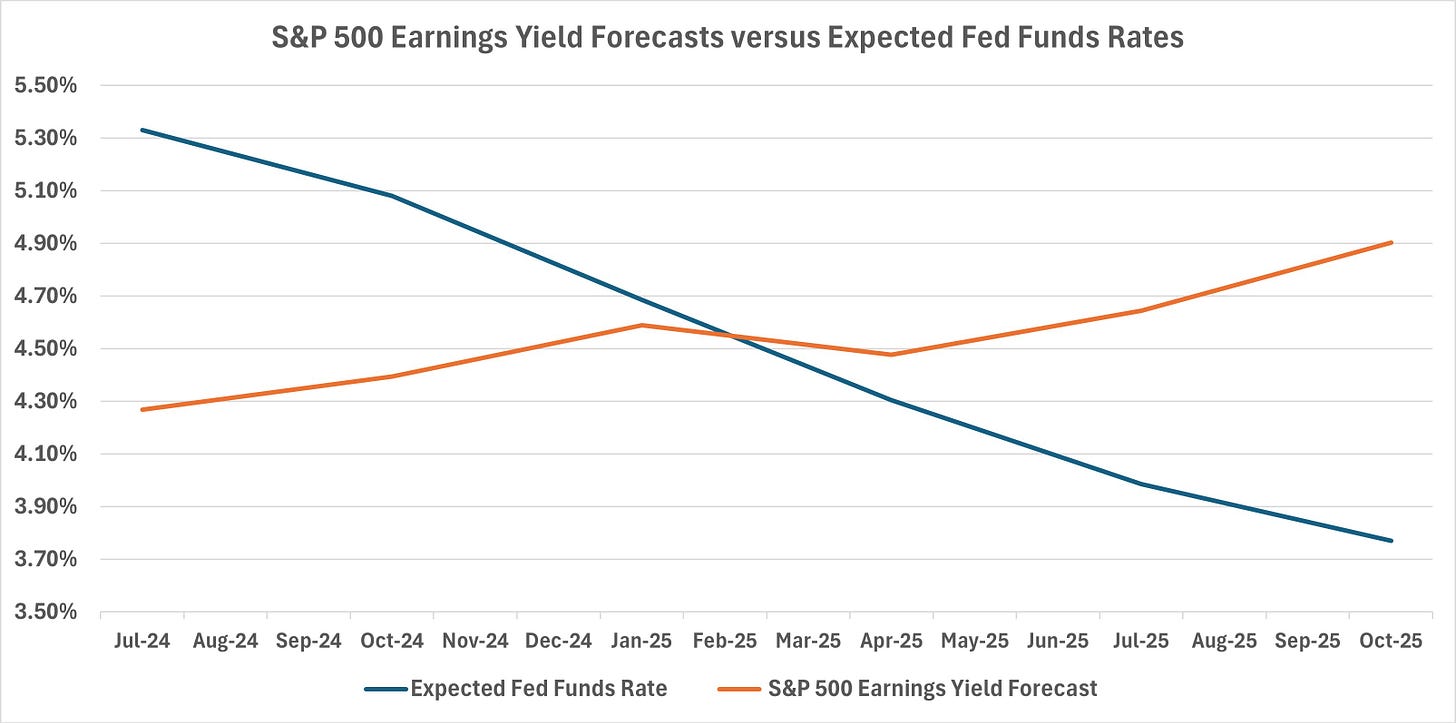

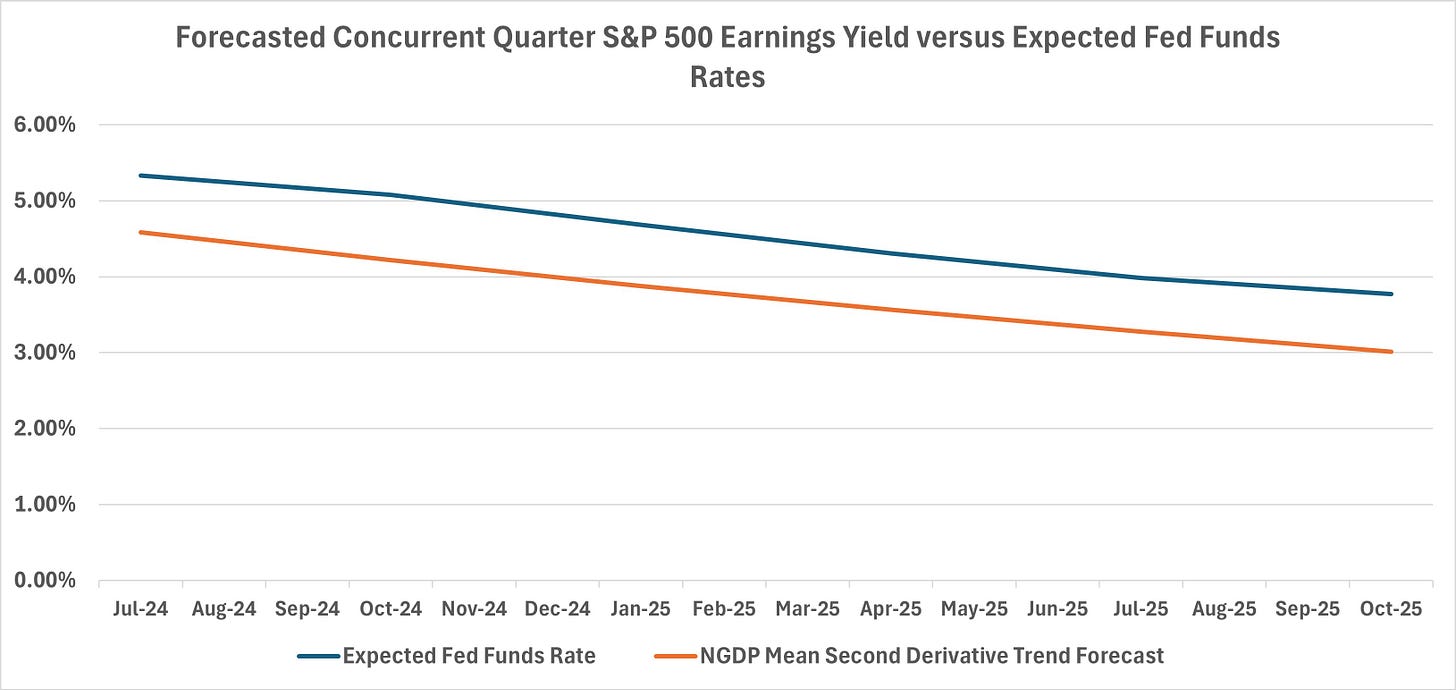

I do have a back of the envelope answer. Looking at the latest earnings estimates for the S&P 500, and combining them with the increasingly steep S&P 500 futures curve, I have forecasts for the S&P 500 earnings yield. I combine these with a simple NGDP growth forecast that relies on the mean change in NGDP growth since the beginning of 2022. This constitutes an NGDP output gap forecast.

These forecasts suggest the economy could be roughly back into equilibrium by the end of the year, but only briefly, as the Fed will allow too much slowing of the economy thereafter. This is consistent with expectations for the timing of Fed Funds rate cuts, with the trend continuing until mid-2026, the date of which is obviously beyond the dates in the chart, but is evident in the complete data.

As a note, the slopes of my simple NGDP trend forecast and the earnings yield curve are very similar.

Consistent with my perspective throughout this pandemic recovery, these forecasts are not predicting recession. If I extend the simple NGDP forecast to mid-2026, when the Fed Funds rate is expected to bottom, the forecasted NGDP growth rate is around 2%. This expectations for a very temporary slowdown, but not a recession, is consistent with the increasingly booming stock market, generally.

Of course, all economic forecasts are conditional, so the usual caveats about the potential for negative real, or even nominal shocks apply. Increasingly volatile political and geopolitical situations may not continue to be so easily shrugged off.

That said, there’s quite a bit of room for optimism about the long-term prospects for the US stocks and the economy as the AI boom continues. Hopefully, the markets are correct about the magnitude of the next Fed mistake.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data: