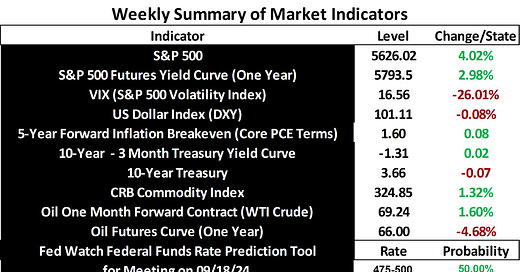

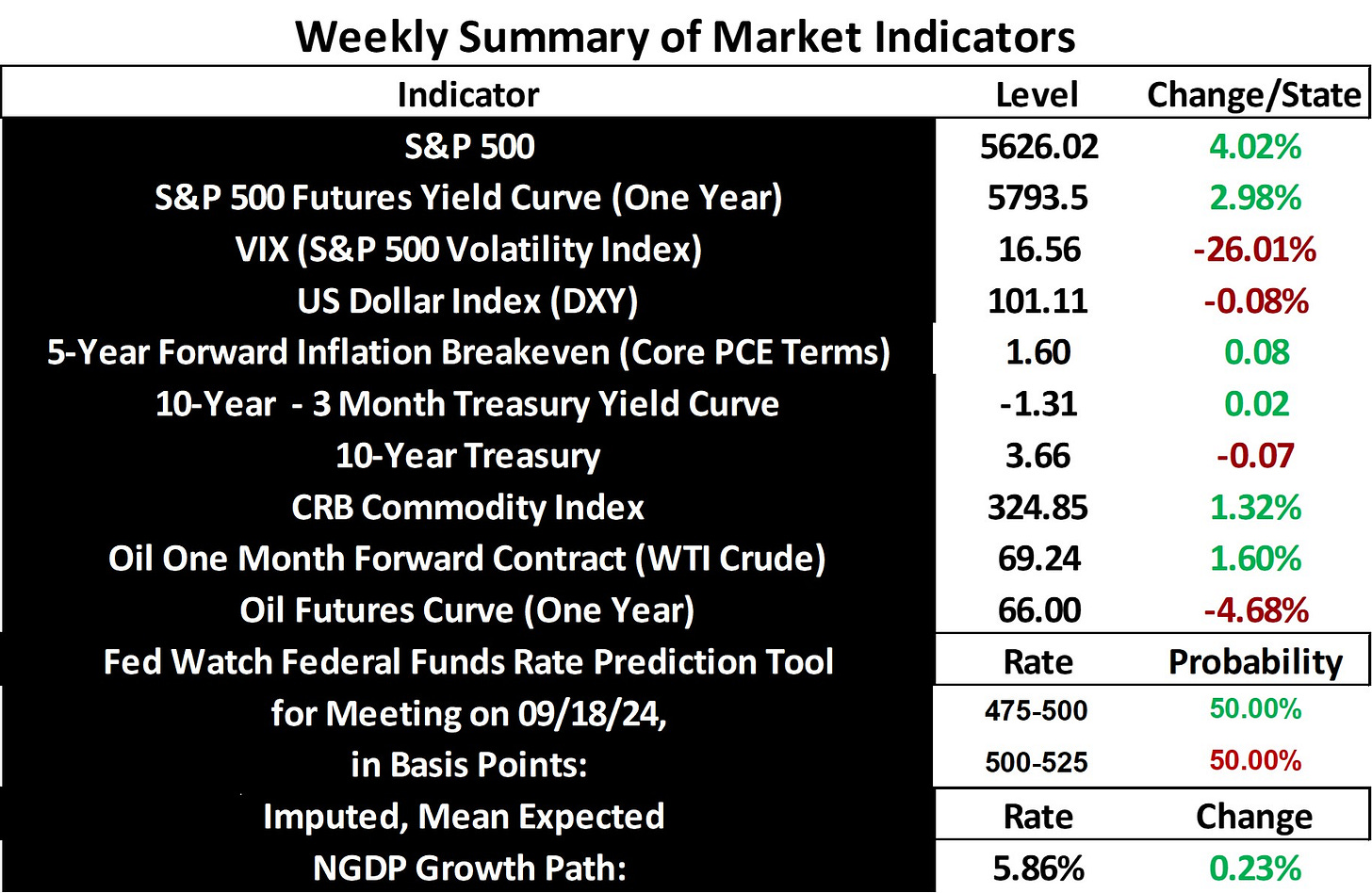

Stock prices and the NGDP growth rate bounced back significantly last week, seemingly bolstered by the new broad CPI measure for August, though YoY core CPI has been flat for a few months.

This was the best week for stocks this year, as the VIX continued moving away from near recession predictions. The Fed Funds futures market now sees an even chance of a 50 basis rate reduction later this month, which is roughly in line with the implied rise in the mean expected NGDP growth rate. Hence, the economy is still on track for a soft landing, though as stated previously, it is not predicted to be as soft as it could be, and markets are increasingly concerned at times about the Fed causing a recession by failing to recognize the rapid rate of the slowdown in expected NGDP growth. See the updated market-based quarterly NGDP forecasts in last week’s post.

Speaking of those quarterly NGDP forecasts, the next update will be behind a paywall. This is for those who want to access these forecasts, as well as an update on the economic outlook from my perspective on continuous basis, along with many other features. Yes, after writing this blog for nearly 4 years, with all information available for free, I will finally offer a premium subscription option.

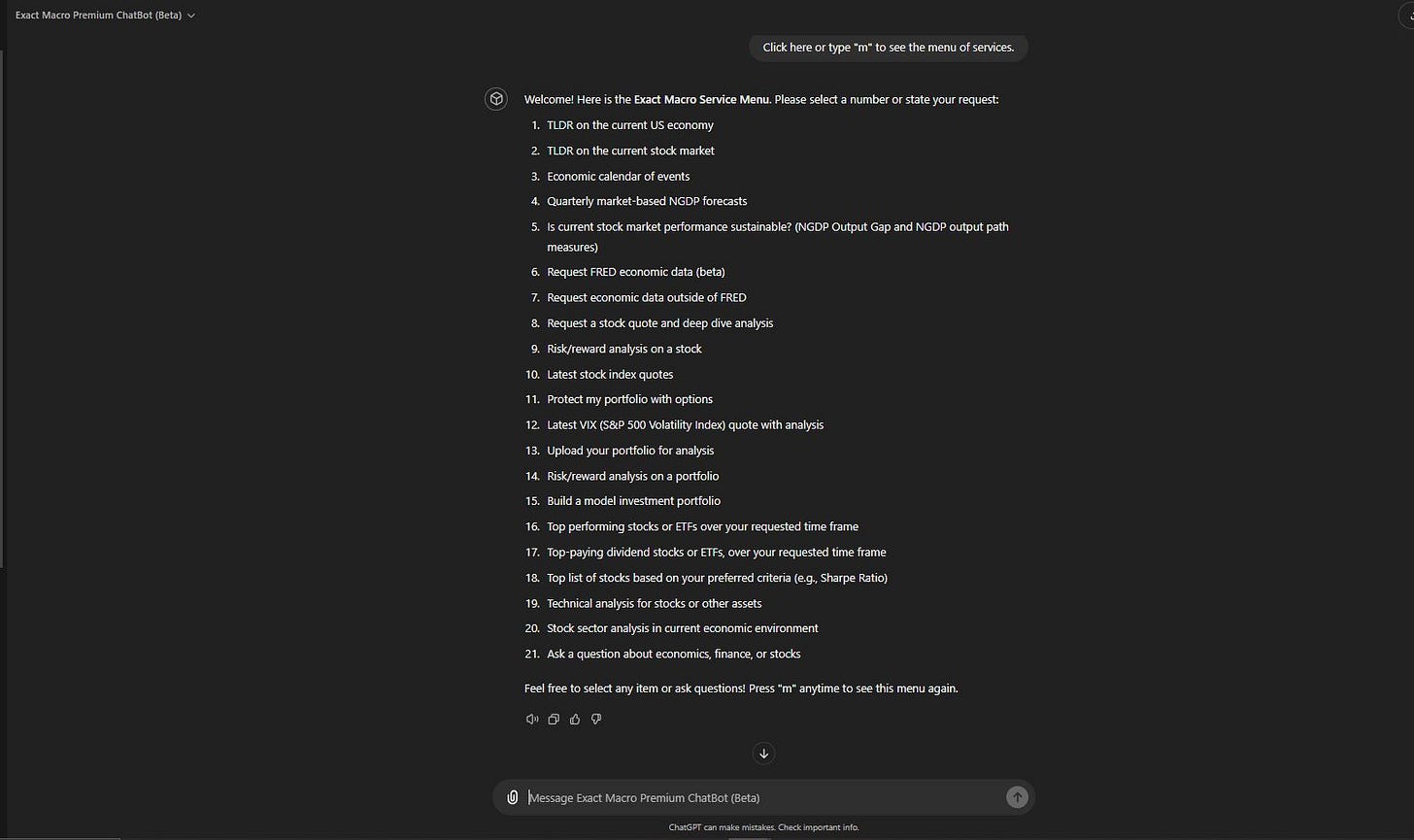

This premium subscription is available for $19.99/month, and offers the market-based quarterly NGDP forecasts, updated every two weeks, along with the NGDP output rate gap chart, and the NGDP versus S&P 500 earnings yield path chart. The latter are updated once each quarter. These will be provided both in expanded premium blog posts and via access to a new OpenAI custom GPT chatbot I’m developing.

The chatbot takes advantage of a recent integration with GPT-4.o, which gave it expanded data gathering capabilities, and enhanced mathematical functionality. This chatbot is different, in that it features an extensive and growing “menu of services” that includes TLDRs on the US economy and stock markets within my framework, along with many features to help analyze stock positions and portfolios, including from risk/reward and stress-testing perspectives. For risk assessments, it relies heavily on implied volatility, both in absolute terms and in terms relative to that of the S&P 500, which puts it into the broader macroeconomic context. This is consistent with the approach in this blog, which is to focus on forward-looking, market-based indicators, whenever possible.

Of course, one may reasonably ask, why pay for access to my chatbot, when one can simply make such requests of ChatGPT-4.o, on one’s own account? The difference here is that this chatbot is prompted to consider analysis within my framework, which is market monetarist with a particular focus on models that are based upon the equilibrium relationship between the S&P 500 earnings yield and the NGDP growth rate. This reflects the classical economic principle that states that such an equlibrium relationship exists between the rate of return on capital and economic growth, more generally. As I’ve stated many times, the mean difference between the US NGDP growth rate and the S&P 500 earnings yield has only been 0.04% since 1990.

The additional benefits in using my chatbot over an unprompted one are in time savings and convenience. Sure, any reader of this blog can create the same charts and request the same calculations via prompts under this framework, but how long would it take and with how much effort? At offered price, it would not take long to exceed that value in terms of time spent trying to duplicate my efforts.

The chatbot is still under development, with significant improvements on the horizon, in addition to improvements that will come simply with continuous upgrades from OpenAI. I’m working on a more nested, compact initial menu, for example, and I’m also working on improving the functionality of a growing list of features. Stay tuned.

The free blog will otherwise remain unchanged. I will offer the same summary of indicators each week and you’ll get the same commentary, absent the explicit quarterly NGDP forecasts and updated NGDP output gaps and NGDP/earnings yield growth path comparisons.

I hope you’ll find the premium features useful. There is a 7-day free trial to try out the chatbot, the link to which is here, and in this blog’s user guide. Note that it may take up to 24-to-48 hours to gain access to the chatbot after beginning a paid subscription.

Any feedback you wish to provide is greatly appreciated, as I want to meet your needs as efficiently as possible.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data: