Stock and GDP Outlook, for Week Ending 10/18/2024

Danger rises as the US election approaches.

Stock prices and the mean expected NGDP growth rate increased for the fifth straight week, despite rising concerns about escalation of the conflict between Israel and Iran. Hence, the VIX increased substantially, as oil prices spiked a bit, while 5-year core PCE inflation expectations continued their strong recovery toward the Fed’s 2% target. So, at least the Fed’s conundrum concerning failing to meet its inflation target is closer to solved, for now. There was also a positive real shock in the form of stronger-than-expected bank earnings reports, helping to send 10-year treasury rates further above 4%, continuing the flattening of the negative yield curve.

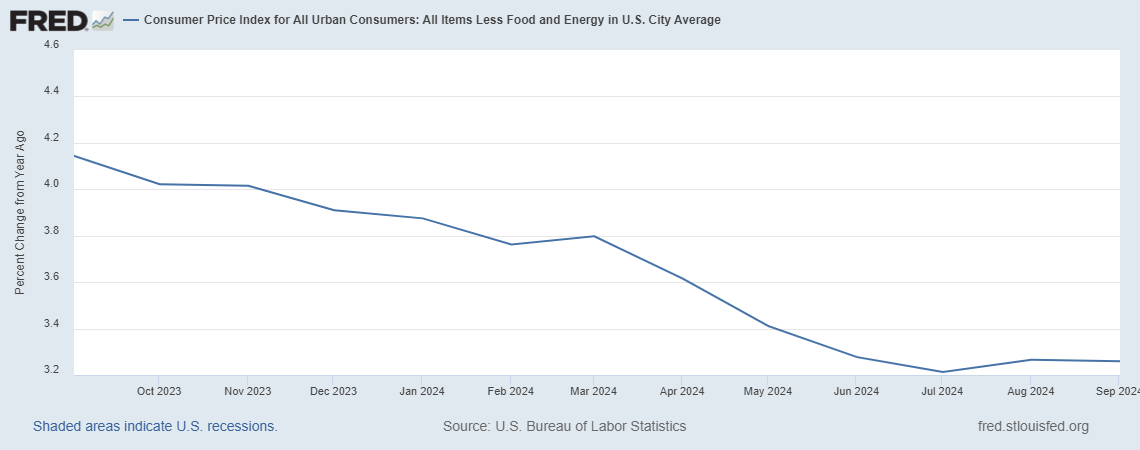

While the release of the CPI numbers for September were received somewhat negatively by markets, year-over-year core CPI was essentially flat versus the prior few months.

Core inflation seems to have bottomed out at a level that’s still well-above the Fed’s target in core PCE terms, so the Fed will not see its job here as done. However, the Fed is also paying close attention to the labor market and has expressed sensitivity lately to the unemployment rate.

The Fed funds yield curve suggests that the current rate cutting cycle will end in the early second half of next year, as the the forward S&P 500 yield curve-based NGDP forecasts suggest that YoY quarterly NGDP growth will fall below 5% by the end of 2025. Metrics such as the NGDP output gaps, based upon the equilibrium relationship between NGDP growth and the S&P 500 earnings yield imply a sustainable NGDP growth rate of roughly 5%, though that could obviously increase with permanent increases in productivity growth, due to AI for example. Currently, I see no evidence of a permanent increase in productivity growth.

So, signals for a soft landing continue to dominate, with the understanding that the growing political and geopolitical risks are also pushing the VIX back toward levels consistent with recession fears. How much markets fear Fed policy mistakes in responding to potential negative real shocks, versus potential real shocks being significant in both magnitude and duration is unknown. Obviously, much unrest could come with the US Presidential election early next month, regardless of the winner, and geopolitical actors may try to influence the election prior to then, and perhaps try to take advantage of the situation immediately thereafter, should opportunities allow. Extreme caution is hence warranted.

Note: This post, as is the case with all my posts, should not be construed as offering investment advice. Such advice should be tailored to the individual investor by qualified professionals who, ideally, are fiduciaries.

Links to Data: